The Market for Tradable Securities

Warren Buffett's Approach to Investing – A Fundamental Perspective

Seasoned with a Sprinkling of Technical Insights – How I (Anyone can) Make Money in the Market

Warren Buffett told investors of Berkshire Hathaway, a holding company, in his 1987 annual report, the following story, which he got from his mentor Benjamin Graham (author of the definitive book on value investing The Intelligent Investor):

To understand the irrationality of the stock prices, imagine that you and Mr. Market are partners in a private business. Each day without fail, Mr. Market quotes a price at which he is willing to either buy your interest or sell you his. The business that you both own is fortunate to have stable economic characteristics, but Mr. Market's quotes are anything but. For you see, Mr. Market is emotionally unstable. Some days, Mr. Market is cheerful and can only see brighter days ahead. On these days, he quotes a very high price for shares in your business. At other times, Mr. Market is discouraged and seeing nothing but trouble ahead, quotes a very low price for your shares in the business.

Mr. Market has another endearing characteristic, said Graham. He does not mind being snubbed. If Mr. Market's quotes are ignored, he will be back again tomorrow with a new quote. Graham warned his students that it is Mr. Market's pocketbook, not his wisdom, that is useful. If Mr. Market shows up in a foolish mood, you are free to ignore him or take advantage of him, but it will be disastrous if you fall under his influence.

A Deeper Look at Mr. Market's Nature

If you are new to trading and investing, market prices may seem to randomly trade up and down without rhyme or reason. When we take a position in the market, the value of that position goes up and down too, tracking market prices. Therein lies the blessing and the curse. We would all love to see the value of our investment go up and up just after we buy, and down just after we sell (we hate to see prices continue up after we sell). But we don't get to live in that world. Being disappointed when the normal ups and downs of reality happen is, well, just unrealistic. When we buy into Mr. Market (take a position) to earn a highly possible and attractive Market Rate of Return, we face the real risk of a periodic reduction in value along the way. We need to develop an ability to deal with this value drawdown. The Market Rate of Return is on average about 5% for an all bonds index and about 10% for an all stocks index over longer timeframes, compared to much lower rates from traditional bank savings accounts and CDs. The rate of return on specific individual investments will vary and will depend on its growth characteristics, longevity, and the timing of the buy and sell operations. That risk, just like the reward, can be either temporary or permanent, and much of that will depend on us. We cannot control market prices. However, we can study market prices to see if there are any natural tendencies that we can exploit. We can also develop and refine a methodology, an iterative process that plays to our natural abilities and that enables us to profitably exploit the market's natural tendencies. Furthermore, we can control the list of securities that we'll focus our time and money on. That is, we can choose What we buy and sell, and When and How we'll do our buying and selling. It is very important that we develop the ability to focus on a few good investments that can survive volatile markets, that will pay us to hold, and that are likely to see higher prices in the future. Like many professional investors, we can learn how to spot and take advantage of favorable prices when we see them and also learn how to patiently wait for better prices. We must learn how to be okay with normal market volatility, to see it as a blessing, and that will generally take some time and exposure to Mr. Market's nature.

It helps to have a general understanding of what Wall Street Markets are all about. The Market is primarily a mechanism designed to fund economic opportunity, to enable saving for the future, and to diversify risk. It can also be a gambling venue for those with that mindset, which is generally driven by our desire for quick and easy riches (e.g., to be the next super star trader). This approach fosters an adversarial perspective — Thinking thoughts like, "I'm better than average.", "I'm going to beat the market." and "I'm going to take his money." Mr. Market is way too big and powerful to beat or even push around. (Okay, there are some big traders that can push him around a little bit every now and then; but unlike Mr. Market, no one has unlimited trading power, and every manic desire to buy or sell will become spent.) The market is going to go where it wants to go; and all that is driven by our collective feelings about the future as expressed by individual market operations (our individual buying and selling within a broader financial arena of ever changing facts, prices, and opinions). I think this Fast Money Trading mentality is counterproductive and can produce a lot of frustration, savings loss, and maybe even cause some psychological damage given that almost half of all trades will go the wrong way. Market timing is hard, even for the pros. But buying into a few dissimilar investments (at below-average prices) that can survive volatile market forces, that'll pay us to hold, and that are very likely to be worth a whole lot more in time thanks to normal economic growth is a winning formula that can make anybody rich (or a least a lot richer) thanks to the normal compound growth mechanism that is the result of Wall Streets's primary purpose.

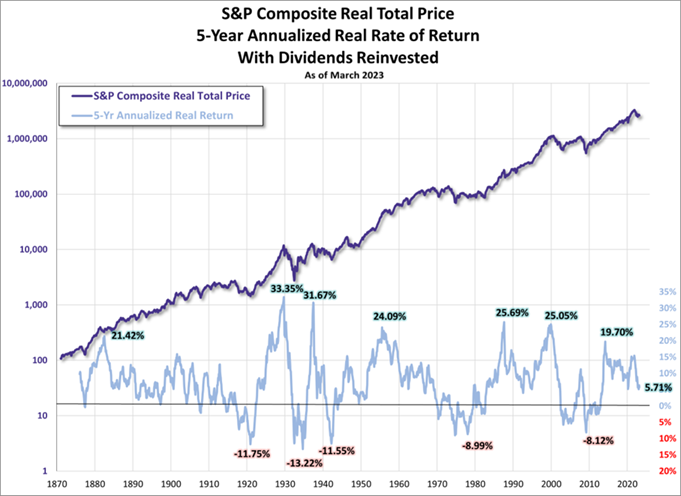

Develop a simple understanding of how you can exploit Mr. Market's growth biased cyclical nature. We also need to understand our own nature when it comes to trading and investing; and to that end, I strongly recommend reading The Psychology of Money, which provides a profound exploration of the intricate relationship between human psychology, investing, and personal finance. As revealed by the book, we can often be our own worst enemy. You don't have to learn how to avoid all these perfectly common pitfall lessons the hard way. Like the book suggests, I think that it helps a lot to have a positive mindset towards Mr. Market's nature. I like to think of Mr. Market as my traveling companion on the road to investment success. He is like a dance partner. I, of course, let him lead as his market prices cycle up and down over-and-over again along his broader economic growth trend. I consider the various opportunities that are offers up in his wake. Those with favorable odds, in my eye, I jump on and then work them to acceptable profitability; and the rest I leave for everyone else. Learn how to profitably dance to his melody of perpetual (up and down) price swings. Don't worry about perfectly buying every cyclical bottom and selling every top as that's a fool's errand. Just work to take a profitable chuck out of every price swing you see in a timeframe that you can effectively manage (i.e., start by learning how to generate a positive rate of return in a longer timeframe). After you've learned how to profitably invest (dance) with Mr. Market, then you can work to improve your trading skills (improve your rate of return).

Buy Low and Sell High, we're told, is how to make money in the markets, but that's not the only way.

There are basically two ways for the average investor (saver) to make money on Wall Street (the markets for tradable securities):

We want every trade (investment) to earn the market rate of return, and once we have met or beaten that objective, we simply must take some or all of that profit off the table. We need to book (lock-in) that rate of return and then re-invest the proceeds at better prices to earn a compound rate of return, which is the real key to wealth creation in the markets. Capturing the market rate of return should be our principal motivation to accept volatile Market Risk on Wall Street.

What I giveth, I can taketh away. — Mr. Market

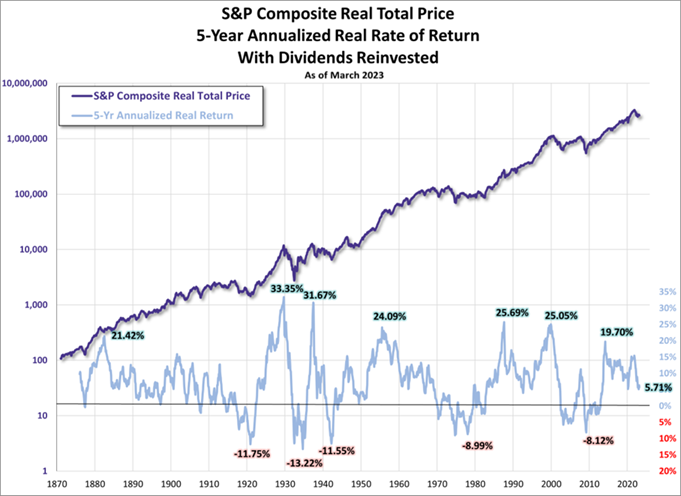

In the following Chart of the Total U.S. Stock Market, we see two important things. In the upper part, we see a graph (a squiggly line) that shows the value of a $100 investment in that stock market index in about 1870, which is about as far back as we can go given the historical record. This upward-sloping growth curve is typical of a broad-based stock market index that represent an investment in a growth-bias economy governed by the predictable rule of law that supports property rights and sensible free-enterprise, like what we have in the U.S. In the lower part of this chart, there's another graph that shows a rolling 5-Year window of real (adjusted for inflation) returns. Even though the upper graph generally goes from the lower-left to the up-right, that is from less value to a lot more value, any arbitrary investment within a shorter interval of time can show either a very nice positive rate of return (like up as much as 33.35%) or a very bitter return (like down as much as 13.22%). What if we were able to capture more of that upside and less of that downside while we also own some exposure to this natural wealth building index?

In the short run, the market is a voting machine; but in the long run, it is a weighing machine. — Benjamin Graham

Market prices trade up and down, over-and-over again, in the shorter-run; but over the longer-run, market prices will generally track the real growth in the underlying economic system. Unfortunately, the longer-run can take a lot of time to yield our desired savings growth. Is it possible to learn how to profitably trade these shorter-term market swings? Yes, but it is not easy, and mistakes will be made. The pros are very good at timing the market or at least able to be consistently profitable. They are also very good at minimizing the impact of their mistakes. Everyone else, well, let's just say, "Not so much." The thing is, most of us can learn how to profitably invest in the market, to develop the wherewithal to generate wealth; but it will take at least some amount of time, money, and some appropriate security selection. Some of us can also apply some additional (and appropriate) skill and effort. Clearly, very few of us can become professional traders. So, what are we supposed to do? Turns out, time in the market can be almost as good as effectivity timing the market when you invest in, just own, securities that have a positive compound growth rate. Alternatively, if you have a trading strategy with favorable odds of success and the self-discipline to work it, that can also deliver a positive compound growth rate. Appling the second approach to the first can generate even better savings growth. Furthermore, adding additional periodic savings can yield truly amazing results. But it will all take time, patience, and appropriate methodical persistence. Are you ready and able to take advantage of all the up and down price action? To work for that sweet retirement (or for whatever you desire)? I believe anybody can do this if they'll commit to it.

The historical data indicates that you are unlikely to become a professional trader. But you may be able to become a professional investor or at least good enough to retire in reasonable comfort. In the balance of this paper, I'll talk about things that can help you become an effective investor and maybe a consistently profitable trader. By-the-way, an investor is someone with a longer-term time horizon that can rely on economic growth to generate wealth. Whereas a trader is someone who expects to Win the Loser's Game (i.e., Beat Mr. Market at his own game, which can be done, but it is not easy — you'll have to find the self-discipline to play to your advantages after you learn what they are, and all this will take time, money, appropriate training, and lots of focused effort). It is best to first become a profitable investor, and then learn how to use appropriate trading tactics to make money quicker.

Most come to The Market with a Lottery Ticket Mentality. They expect to get rich quickly and are surprised when they get lottery ticket results, losing all or most of their money. And yet, Mr. Market is reliably making ordinary people rich enough to retire over just a few decades of methodical saving and investing using Buffett's value-based approach or some other time-tested method with favorable odds. And you can do this too! Just stop chasing the latest hot tip or story. Taking your buy and sell ideas from someone else is generally a recipe for savings disaster. Please accept that almost no one ever gets rich quick on Wall Street, and the few who do (or think they can) end up giving it back to Mr. Market (or in prison). It is hard to keep an ill-gotten gain, a simple fact of life for most good people. Focus your time and money on an understandable approach with a track record of success. Earn your own success. Folks that can do this tend to be better equipped to keep it and acquire more, another simple fact of life. It takes time, money, a strategy with favorable odds (like the two presented below), some effort, and lots of patience and persistence. Treat this like a part-time job (or a small business) that can get you retired. Be about the Business of Growing your Wealth.

Mr. Buffett counsels investors to never forget that stocks are simply a fractional ownership claim on a business and bonds are simply a loan to a business or government entity; and the rate of return on both investments depends on: 1) how much you pay for that investment (the cost to get in), and 2) on future economic prospects and prudence of the issuer of that security (the tangible form of the investment). Buffett says, "To be a successful investor, one needs good business judgment and the ability to protect oneself from the emotional whirlwind that Mr. Market unleashes."

Warren Buffett likes to say, "On Wall Street, you pay a pretty penny for a cheery consensus of value." When an investment is popular, it commands a premium. But when it becomes very popular (or unpopular), prices can become a momentum play and can significantly deviate away from any rational intrinsic (economic) value. Buying at excessive premium prices greatly reduces the odds of success. Doing so requires finding someone else (Buffett says, "A Greater Fool") to pay an even higher premium to realize a profit (a capital gain), and this must be done before the popularity fades. Popular momentum stocks are infamous for running up to ridiculously high prices; and then tanking to astonishing lows, in the eyes of those who paid some of the prior high prices. Worst yet, most of these busted momentum stocks will never, ever again see their prior highs. Wall Street is one of those marketplaces where most otherwise rational people will gladly pay a premium to buy a popular investment (just to be in it) and will then accept a big discount (just to be rid of it) after that previously desirable investment has turned sour (goes out of favor). Initially, their friends, the media, and the price trend all say, "Prices are Going Higher!" Not wanting to be left behind, these uninformed investors jump in at any available price. Having no real plan (besides, "I plan to make money!") or strategy to manage that investment, these newbies often find their new investment losing value as the pool of new buyers runs out of steam and the only eager traders left are sellers. Human nature being what it is, like deer in the headlights, they hold-on hoping to break-even (get their money back) or (worse yet) to get back to the prior high profits they once had. Unfortunately, the primary trend has now turned down and the popular media personalities say, "Prices are Going Lower!" In time, these novice investors become scared, not wanting to lose even more money, they sell at any available price just to stop the pain. Thus, earn a capital loss by buying high and selling low. Most uninformed investors lose money trading with the popular crowd. Savvy investors, like Buffett, see premium (above average) prices associated with a popular investment as an opportunity to raise cash by harvesting a profitable investment they bought at discount (below average) prices, when that investment was out of favor. These savvy market operators buy at below average prices, sell at higher prices, and earn income while they wait for their capital gains. They work to generate above average total return profits, which is the sum of the capital gain or loss and all the income earned while holding that investment. I believe just about anybody can learn how to do this too.

Price is what you pay, but value is what you get. — Warren Buffett

Buffett is a value investor — Mr. Value. Market prices change all the time, but the intrinsic value does change all that often or as much. "Whether we're talking about socks or stocks," Buffett says, "I like buying quality merchandise when it is marked down." He only buys Good Investments at discount prices. A Good Investment is one that is supported by a business (or government) that is highly likely to survive an economic downturn and is likely to generate wealth over time (i.e., see higher prices in the future and/or will pay a market rate of return to hold). Because it takes time to analyze and follow the factors supporting the value of a good investment, it's best to focus on just a few good investments (a manageable watch list of dissimilar investments). Buffett says he and his business partner Charlie Munger apply their Four Filters to find Good Investments: 1) The company must have a simple (understandable) business model that is both profitable and able to grow earnings, 2) have a durable competitive advantage (whenever a business is able to generate high profit margins, others naturally enter that market to get a share of those high profits, which tends to arbitrage away excess profits when there are little to no barriers to entry), 3) a seasoned management team with a high degree of integrity, and of course 4) a sensible price tag. Buffett says, "Paying a below average price for an above average business creates a significant margin for error." An investment only sells at a discount when it is out of favor. Because an investment can stay out of favor for a long time, Buffett requires his investments to pay him to hold. Assuming the investment passes the Four Filter test, he is happy to buy a little at a little discount, buy more at bigger discounts, and buy a whole lot more at ridiculously large discounts, when his good investment is very unpopular. Buffett is able to properly execute this strategy because he knows what he is buying. He can see the real (economic) value and knows that Mr. Market will see that value sooner or later too, it's just a matter of time and patience. When Mr. Market cheers back up, he books above average profits as they become available. Only make a trade when Mr. Market offers prices that are favorable to Mr. Value.

Warren Buffett holds a Bachelor's Degree in Business and a Master's Degree in Economics; and understands that in the long run, market prices ultimately follow the growth rate trend of the underlying business. These growth trends are extremely likely to follow the boom-and-bust business cycles of the broader growth-biased economy. We don't need a Master's Degree in Economics (or in Business) to understand this historic reality: Riskier investments like stocks and corporate bonds do better when the economy is growing and safer investments like government bonds do better when the economy is in trouble. Here's another business fact that does not require a degree to understand, investments that are backed by the biggest and best businesses (the Blue Chips) in every market sector are likely to survive cyclical downturns and often come out stronger because they're able to take market share from weaker businesses that failed to survive. Furthermore, the survivors are often able to buy up the valuable assets of the failed competitors in bankruptcy for just pennies on the dollar. Savvy investors see market volatility as an opportunity to buy low (build a discounted cost basis) and to sell high (harvest a profitable investment) when their investment objectives (targeted rates of return) are reached or when the economic data signals, "It is time to get out." Like most other professional investors, he (Buffett) knows that when we are being paid to hold a good (survivable) investment, with a below average cost basis, making money is just a matter of time and our ability to periodically track market prices against our cost basis (break-even price) and to then take acceptable profits when offered up by Mr. Market. Furthermore, Buffett likes to hold cash to take advantage of irrational market opportunities, especially those that always show up at or near the bottom of every cyclical downturn. On Wall Street, it is best to invest in securities that will benefit from the current economic trend, that will pay us to hold, and that are likely to survive economic surprises. It is the best way to avoid realizing a permanent loss of principal.

The real secret to generating wealth in the markets is avoiding losses and a positive compound growth rate. Buffett has two rules. Rule No. 1: Never lose money; and Rule No. 2: Never forget rule No. 1. Charlie Munger says, "The first rule of compounding: Never interrupt it unnecessarily." When the younger version of me first got this advice, I was quick to dismiss it as being trite. The much older version of me now knows, this is some of the best advice ever given to me. Simply put, money spent on unnecessary investment products and services or lost on risky trades can never realize a compound growth rate. But mistakes will be made! We must learn how to avoid the big mistakes, investments (trades) that contain anything but the smallest likelihood of realizing a (large) permanent loss. We also need to avoid all unnecessary trading and investing expenses. These capital losses force us to take a double and maybe even a triple hit. Not only do we lose some (or all) of our hard-earned savings, but we also lose the time it took to save, and possibly any compound growth realized on that savings. So, Buffett and Munger are correct about the priority to avoid unnecessary savings losses. Unfortunately, market timing mistakes are unavoidable. We need to learn how to minimize these drawdowns. We also must learn how to convert these small timing mistakes into acceptable profits. Learn to hit low-risk, reproducible singles and doubles by focusing on survivable investments that can yield a doable 5 to 10% yield over-and-over again. It is very rarely achieved by swinging for the fences (chasing the current fast-money trade) or buying lottery tickets (penny stocks and options). Our primary objective must be to become a Consistently Profitable Trader/Investor (CPT). A CPT can grow their savings at a positive compound growth rate (i.e., new growth on top of old growth from initial savings and investments, over-and-over again). There are two ways to realize a compound growth rate. The first is to invest in businesses that have it. The other is to reinvest profits that we realize in our savings (brokerage) account. Any company that can consistently grow its earnings per share (EPS) can yielding a compound growth rate. These are called Growth Stocks. Holding a Growth Stock is one way to be paid to wait. But not all businesses are growth companies. Some are just a money machine that have already lived through their growth phase. These are called Value Stocks. They can consistently earn money without much growth. These are profits, free cash flow (FCF), that can be paid out in the form of dividends. When a growth company loses their ability to grow, Mr. Market tends to cause a significant and permanent price adjustment down. They lose their growth premiums. That's the risk of holding a growth company for too long. Big mature value companies pay dependable dividends and can do stock buybacks to attract investors. So, we don't need a growth company to realize a compound growth rate. The FCF from any business can be either retained by that business to fund future growth opportunities or they can pay out some or all of that cash to their shareholders so that they can reinvestment those proceeds into opportunities available to them via Mr. Market. Historically speaking, a major component of total stock market returns come from dividends. Iterative re-investment of capital gains and dividends also yields a compound growth rate. This, plus a focus on survivable investments that will pay me to hold, is my primary CPT approach. If you are not yet a CPT, please understand and accept that it is far easier to become a CPT in longer timeframes, like over an economic boom-bust cycle, a yearly business cycle, and then a quarterly business cycle. First achieve CPT status, and then learn how to acquire CPT status in slightly quicker timeframes, our secondary objective. CPT status is of primary importance because compounding will naturally occur over time and will magnify whatever trading and investing results we realize. A string of profits, no matter how small or slowly they come, will cause an equity growth curve to turn up over time, and after many years can allow us to retire in comfort. But a string of losses and unnecessary expenses can simply hollow out a retirement account and force you to start over and may force you to work in a more traditional job for the rest of your life.

Bull markets are born in despair, grow amid skepticism, mature in optimism, and die amid euphoria. — Sir John Templeton

Some have said, and I believe there is some truth to the saying, Prices are driven by Market Sentiment. Prices are driven by our beliefs (feelings), and that propels the trend forward (until it has gone too far). But there is a deeper truth. The market is not just driven by feelings, like fear and greed. I believe that the Smart Money uses Market Sentiment via their market commentary to motivate the Dumb Money (those less informed market participants) to buy high (near the top of a broader trading range, like a 52-week high) and to sell low (the other end of that trading range). That is, to buy from the Smart Money when prices are supporting a rich premium (and it feels like prices are going higher but fail to advance on more good news and commentary), and to sell when prices are discounted (and it feels like prices are going lower but fail to stay down on more bad news and commentary). I've seen this pattern of behavior all my investing life, over-and-over again. There's a reason why Sir John's admission has stood the test of time. It is not that hard to learn to see and profitably work this cyclical market reality. We can learn to invest more like the Smart Money.

Watch Ray Dalio's "How the Economic Machine Works" on YouTube at

http://www.youtube.com/watch?v=PHe0bXAIuk0 to better understand the big picture

and the economic boom-bust cycle, which is the most fundamental factor driving the value of all investments.

We need to be able to get this right, but it's not that hard.

Watch Ray Dalio's "How the Economic Machine Works" on YouTube at

http://www.youtube.com/watch?v=PHe0bXAIuk0 to better understand the big picture

and the economic boom-bust cycle, which is the most fundamental factor driving the value of all investments.

We need to be able to get this right, but it's not that hard.

The future tends to look a lot like the past, not always and never perfectly identical, there will always be some degree of variant randomness; but similar enough to seriously favor those that can learn from the past, understand basic business and economics, and can think in statistical terms. On average and as noted above, professional money managers (big traders and investors, by virtue of the amount of capital they manage) are responsible for the largest amount of trading volume on any given day and are considered to be the Smart Money. They know how to play this game. Money naturally flows towards the better operators on Wall Street. They can afford to buy the best real-time information, and tend to have some of the best fundamental and/or technical analysts on their team. So, the guy on the other side of your trade is likely to be a professional or a computer programmed by a team of professionals. I'm not saying that they never make mistakes. They do. I'm saying those guys are good, and probably way better than the average retail investor (you). This does not mean that you can't make money too. You can, if you trade (invest) with (like) the biggest investors; and wait for Mr. Market to offer up favorable prices, better implied values. Let Mr. Market come to you. A savvy investor can wait for favorable prices. We can use real-time charts to see what the Smart Money is doing now and has done in the past. (Yes, this paragraph is a little redundant; but that's only because this information is so important and is worth a fortune.) It pays to understand the big picture and to be able to see the well-informed professional forces driving market prices forward, to receive The Message of the Market and to know when that message is likely to be true and when it is more likely to be wrong, given what we can know about the economy and the market's nature. In broader timeframes, when the general economic news is good and prices are likely to slowly grinding higher (like while the economy is growing amid skepticism and then optimism) or the news is bad and slowly grind lower (hope and fear), we want to believe that message and trade with that trend. But, at some point, prices will stop going down on more bad news (while in despair) or stop going up on more good news (euphoria); and this is a market message that should not be believed. The pros are saying one thing but doing the opposite or the guy or gal doing the talking is simply out-of-sync with the broader market. Beware of Pump and Dump, a classic Wall Street tactic that is illegal but still done. One respected guy or gal will advocate the purchase while everyone else in-the-know is selling. It is important to understand that the retail participant is generally the last to get the news or commentary. But everyone can get about the same real-time access to the market data and we can learn how to receive and process the message of the market. We can learn how to make our own buy and sell decision based on all that.

Focus on survivable investments that'll pay you to hold. Buffett runs Berkshire Hathaway like a virtual mutual fund. However, unlike traditional mutual funds, which are only allowed to own a very small percentage of any publicly traded securities, a holding company like Berkshire is legally allowed to engage in any, non-criminal, business opportunity that is consistent with that company's controlling documents as interpreted by that company's senior managers, the board of directors, and (when necessary) the courts. So, Berkshire (like most large, mature blue-chip companies in the S&P 500), is a diverse portfolio of quality (mostly small) business opportunities that Berkshire owns outright (private holdings that are not available to other investors) and various securities issued by other blue-chip businesses (most of which are publicly traded on Wall Street). Like most mutual funds and blue chip investments, thanks to diversification, Berkshire Hathaway is an investment that is extremely likely to survive the vagaries of the market. However, as of this writing, Berkshire has never paid a cash dividend, but it does pay you to hold because of its internal growth rate. Berkshire has been a wonderful investment for those who were able to get in years-and-years ago at much lower prices. Unfortunately, Berkshire Hathaway is now a very high-priced stock. (Click here to see the current price of the Class A shares or here to see the lower priced Class B shares.) Don't confuse a high price with a large premium. Berkshire can have a high price tag and still be a cheap stock from a value perspective and that is often the case. The high price tag simply means that it takes a lot of money to buy just one share. Buffett says, if you can't afford to buy his stock (BRK.a) it is best to just invest in a low-cost S&P 500 Index fund, like SPY or VOO (an ownership in the biggest and best part of the U.S. economy). The S&P 500 is one of many U.S. Large-Cap Indices. Don't try to pick the next super-star investment, which is no easy task. Just patiently own one of these Large-Cap Index Exchange Traded Funds (ETFs) as this will expose your savings to all of the super-stars that can survive and will naturally become a part of these ETFs. Unfortunately, the price per share of these ETFs is a lot of money too. Fortunately, there are relatively lower priced ETFs that have very similar performance characteristics, like SCHX; and some pay a very nice cash dividend, like SCHD. A broad-based (diversified) index ETF, like these, are both lower-cost and naturally self-correcting investments that passively track a market index and are great examples of investments that can survive and that'll pay you to hold. Low-Cost means you pay the fund managers less every year to run the fund. Paying a below average expense ratio means there is more of your savings working to grow at the currently available market rate of return. Naturally Self-Correcting means that when a stock (company) in the current index gets in trouble, it is replaced by the next best alternative that is not already in the index. I think an ETF like SCHX and/or SCHD is an excellent choice for new savers, just Dollar-Cost Average in until you have enough capital and skill to properly manage higher-yielding alternatives. I also think that investing in a broad-based market index ETF is a great way to expose your savings to all the future growth that is very likely to resemble the past. It is best for new investors to focus the majority of their time and money on just one or a few dissimilar investments that can survive volatile market forces and that will pay a market rate of return to hold.

Why is Dollar-Cost Averaging (DCA) a tried-and-true savings strategy? DCA is an investment strategy that invests equal amounts on a regular basis over a longer period time (such as $100 monthly for ten years) in a particularly safe investment that will track market prices over normal of boom-bust economic cycles and quicker quarterly earnings and dividend cycles. This strategy forces savers to buy more shares when prices are below average and fewer shares when prices are above average. Thus, yielding a cost basis (the average price per share, which is also the break-even price of the whole investment) that is lower than the average price seen in the trading range over that investment timeframe. Building a lower cost basis makes it much easier to realize a gain on any future upturn in prices. So, DCA works in a growth biased economy, which is the world we live in.

DCA is a calendar-based strategy. What if we regularly looked at Mr. Market's pricing data? What if we used a volatility-based strategy? What if we only bought low, when prices are below average; and maybe sell some of those buys that have a lower cost-basis at above average prices or at least at some higher price? If so, we could earn a capital gain profit and free up some buying power to re-invest in the next cyclical downturn, thus yield a better compounding rate of return. We would have a strategy that can far exceed the rate of return of the alternative DCA approach. But this alternative requires more effort. It requires that we periodically monitor market prices and track our trading details to see if it is better to buy, sell, or just wait for better prices. Is this extra effort and rate of return worth a little more of your time? Do you have the self-discipline to do this? If not, just stick with DCA and skip to the Summary below. There is a reason why DCA is the default recommendation for most retail savers.

What are Market Prices? Get a quote from Mr. Market for any stock, bond or whatever security has caught your eye, and you're likely to get the following standard pieces of information: The Last Price is the price of the latest trade, which is recorded on the Ticker Tape (Time and Sales) for all to see. The Asking Price (a.k.a., Ask or Offer Price) is the price a willing seller (Mr. Market) is asking for their shares. This is the price you would pay per share to quickly get into that investment. The Bid Price is the price a willing buyer (Mr. Market) will pay for your shares. This is the price you would receive to quickly get out of that investment. Plus, the following two trading ranges. The first is the Day's Trading Range (High and Low Prices) and the other is the 52-Week High and Low Prices (the range of prices seen on The Tape over that prior year). This 52-week trading range is generally very wide and should prompt you to ask, "How can a security trade for such a wide range of prices when the underling business that issued that security almost never changes all that much over that same period of time?" And therein lays the proof that Mr. Market's prices really can be irrational at times and may not always be a good measure of value for that security. So, what would be a better measure of value?

Fundamental Analysis is a great way to understand the economic value of an investment. It uses accounting and financial statements to generate a standard set of figures like, Top-Line Sales (Revenue) and Bottom-Line Net Earnings (Profits) and ratios like growth rate, P/E or Yield. Fundamental analysis considers all relevant business specific information, like cash-flows, debt, business model (how they make money), competition, the management team, etc. (i.e., stuff like Buffett's Four Filters) to determine if the stock or bond issued by that business is a Buy, Sell or Hold given current market prices and the price of alternatives. Some prefer to use a Price-to-Earnings Ratio (P/E). P/E is the current market price for a share of stock divided by the prior year's (or next year's expected) Earnings-Per-Share (EPS) for that stock. P/E can also be thought of as the number of years required to earn break-even or pay-back. Many savvy professionals prefer to use the Earnings Yield for stocks, which is just an inverted P/E (EPS divided by Price) because that makes it easier to compare the yield on a stock to the yield on a bond from that same business or other companies in similar businesses. Yield is a superior measure of value because it is based on the relationship between Mr. Market's price and the earnings ability of the business that issued that investment opportunity. Warning: beware of exceptionally high yields caused by a sudden drop in prices, which move first and followed later by a drop in yield driven by truly bad news about a business's deteriorating fundamental situation. When this happens, wait and let prices and yield settle down, and then re-analyze the situation. It is best to compare the current yield (like all standard fundamental values and ratios) to a longer-term average for that security (business) or group of similar securities. Generally, it's best to invest in securities issued by businesses that generate stable Higher Yields (i.e., it's best to be a buyer at above average yields and a seller at below average yields relative to that average) assuming all other things are equal, which is rarely the case when considering alternative investment opportunities; but is always the case when the only thing that is changing is market prices. Warren Buffett is known for his expertise at fundamental analysis. Unfortunately, good fundamental analysis is hard to do. That's the bad news. Most brokerages will give us free access to their fundamental analysis (good news?). But you still have to make good actionable sense of it. Plus, you only get to see it after it has been given to those who paid to see it first or paid to have it generated. So, what can new and less fundamentally gifted investors do to improve their odds of investment success?

Let's take a closer look at Mr. Market. Market prices contain information called The Message of the Market. We can learn how to effectively receive the market's message. Market prices have a natural tendency to trend. That trend is likely to continue until it is no longer reflective of likely future value and therefore that trend reverses, over-and-over again. And thus, market prices naturally trade in a range that is more reflective of likely future value. By law, every trade must be recorded on The Tape for all to see. Market prices on The Tape are Mr. Market's Message, which is a momentary reflection of the sum of all that is known or believed about likely future possibilities at that time. Market prices are both forward and backward looking. They attempt to anticipate news and commentary (and the reaction to that news and commentary) about the economic realities of the businesses and governmental entities that can issue stocks, bonds, and other financial securities that we can buy, sell and hold in a brokerage account. Mr. Market's prices are ultimately based on backward-looking fundamental factors. When forward-looking expectations fail to correctly anticipate backward-looking evidence, market prices correct, and that correction can be surprisingly fast. However, thanks to the fast-money day-trading crowd, there are times when forward-looking expectation can become disconnected from backward-looking fundamentals, and that disconnection can last for a surprisingly long time when driven by fresh commentary on the latest news. But sooner or later, backward-looking realities always catch up with forward-looking beliefs. The re-connection tends to happen after the fast-money swarm has turned their attention to some other security in the news. Because market prices are forward looking, they naturally trade in an uncertain (dynamic) range. So, market prices trade up and down, over-and-over again, probing and defining the range of fair market prices, given all the information that is available to trade on and that reflects the market's collective wisdom about likely future value, which can be wrong at times and is always subject to change. This begs the question, "When are market prices likely to be about right and when are they likely to be wrong?" or better yet "When are market prices likely to be useful and when is it best to ignore them?" It is useful to think of current and historic market prices as a probability distribution that can lend themselves to statistical methods of analysis (how are prices trading relative to an average). It is best to focus on securities that are well anchored to objective fundamentals because they tend to be more predictable and easier to trade profitably. We can see all this trading history and the range of prices on a chart. This price range exists between the highest and lowest prices seen on that chart. Warren Buffett is not known for his expertise at Technical Analysis (visual chart analysis), but that doesn't mean that you can't learn how to use charts. Our brains seem to be able to quickly detect familiar patterns in visual images. Most people are also able to perceive statistical properties. These abilities can be greatly improved with appropriate training and practice. Mastering technical analysis is far easier than fundamental analysis. However, mastering both is best as that allows us to better judge when the price action (message of the market) is likely to be correct about the future fundamental picture.

Technical Analysis (TA) is another way to gauge the relative value of an investment. We can use charts to leverage the Market's Collective Wisdom. Charts show the current trading range, the trend, and the health of that trend. They show the sum of all market activity now and in the past. TA is a great way to see the habitual behavior associated with specific markets. Future price patterns tend to look a lot like the past, rarely exactly the same, but often similar enough to favor those who can learn how do the analysis and planning to effectively exploit the findings therein. Keeping it simple for now, we can use charts to see the current trading range, which is called a Support and Resistance (S/R) Channel that shows the market's collective opinion of likely fair value at this time. Charts make it easy to see where current market prices are trading relative to this S/R Channel, thus indicating if Mr. Market is offering discount or premium prices or somewhere in between.

Why does Technical Analysis work? We all want to make money in the market, to earn capital gains, which requires a buy price below the sell price (i.e., buy low and sell high). So, we all want to buy at a relative discount and sell at some higher price, like at a premium. On any average day, 70 to 80% of all trading volume is generated by professionals, people who do this for a living. They are well-trained, properly equipped, and most have a manager to impose discipline. Plus, these pros have a clear track record of success; without this, the business will force you to find some other occupation. They are "The Smart Money". Big professional value investors are responsible for the longer-term market trend and longer-term trading ranges. They work to harvest economic market swings in the normal boom-bust cycle and quicker quarterly cycles. Furthermore, about 80% to 90% of shorter-term market behavior is driven by professional day-traders (and their super computers). They are "The Fast Money"" and responsible for shorter-term trading ranges and trends. Fast Money traders compete for cyclical profits in quicker (smaller) timeframes. They are some of the very best traders in the world. These professional day-traders don't care which direction prices go, so long as they go; and they're happy to be bullish, bearish or whatever is working now. The Fast Money tends to push quicker (shorter-term) trends into the waiting arms of longer-term investors that do their relatively larger buying and selling at discount and premium prices thus causing trend reversals, which are also known as chart pivots. These pivots define the size of the current trading range (S/R Channel) within the timeframes and markets that they both specialize in. There is a natural symbiotic relationship between these two groups of professionals; and charts show their interplay, the perpetual interaction between competing profession forces of supply and demand. Professionals buying low and selling high causes market prices to trade up and down, in a dynamic trading range. Over any given interval of time, there are a finite number of active professional traders and investors participating in their specialized market. Because we are all creatures of habit, training, and (in the case of computers) programming, we naturally do the same kind of things over-and-over again. These pros naturally do more of what generates profit for them, and they are quick to Stop what causes loss. Furthermore, when any group of individuals interact with each other on a consistent basis, additional collective patterns emerge. All these behavior patterns are observable, quantifiable, and they repeat with statistical reliability. We can use charts to see and analyze these reoccurring patterns on any and every interval of time.We can learn to profit from the perpetual money game played by savvy market professionals. Let's consider the chart on the right, which shows a Support and Resistance Channel, the current trading range. Discount prices exist in the lower half of this (any) S/R Channel and that attracts savvy buyers (the Bulls, which create demand). When the bulls are dominate (i.e., are more aggressive using buy Market Orders to force a trade), their extra demand near the bottom of a channel creates Support for higher prices and that causes prices to uptrend. Premium prices are seen in the upper half and that attracts savvy sellers (the Bears, who provide supply). Aggressive bears create Resistance to higher prices by providing a little extra supply near the top of the channel. That excess supply causes prices to downtrend until that supply and demand imbalance is resolved or reversed. When supply and demand forces are relatively balanced, prices trade more or less sideways, like in this chart, which is called a basing pattern. This savvy buying and selling naturally defines the size of the current trading range, based on evolving supply and demand dynamics for that security. Patient market operators (traders and investors) can use Limit Orders to advertise their willing to trade at favorable prices, normally just within the current S/R Channel, and that also helps to define the size of the current trading range. Ideally, we'd like to develop an ability to take profitable (capital gains) chucks out of every price swing in the trading range we see. We simply need to do our periodic analysis (more on this later) and use limit orders to target our favorable trading prices. We can learn to effectively target likely future support and resistance levels as indicated by our technical analysis. But don't try to pick the next perfect top or bottom, and don't try to out-trade the Fast Money. Pivots (trend reversal tops and bottoms) tend to happen quickly (especially in quicker timeframes). And if you do try to out-trade the Fast Money, don't be surprised when they (Mr. Market) get more-and-more of your brokerage capital (remember, they're pros and you are...what?). It is far easier to profitably trade with the Smart Money (in longer timeframes). Buying close enough to the likely bottom of the current channel is generally good enough. To lock-in a positive capital gain, sell close enough to the top of the channel or when you see an attractive profit starts to lose value as it bounces off resistance. (All stocks need wiggle room, especially when entering or adding to a position, but try not to let a nice profit turn into your next drawdown.) When starting out, it is far more important to take a string of acceptable profits, one-after-another, than it is to try to take everything Mr. Market has to offer in each cyclical swing within the current trading range. The latter is an impossible task that can easily yield a poorer rate of return. However, once you can reliably generate that string of profits (be a CPT), then feel free to work on improving your rate of return.

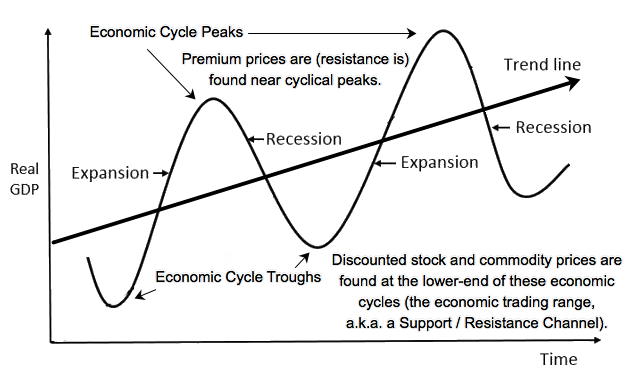

All trading ranges have a natural tenancy to trend (to move), up, down, and sideways. When the underlying economics are presumed to be improving, the trend is up, and down when deteriorating. In the following chart of the Wilshire 5000, we see an uptrending S/R Channel. It is best to trade with a healthy broader market trend. Healthy trends are likely to continue, and unhealthy trends are likely to reverse.

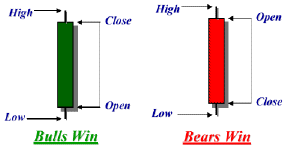

What information can we see in a candlestick chart,

like the one above?

Each candlestick bar

shows the range of prices seen in that sample size.

That is, on a daily chart each bar shows

the highest price (the High), the lowest price (the Low),

the price of the first trade (the Open),

and the last price (the Close).

If the Close is above the Open,

my bars are green indicating that the Bulls dominated that sample of market data;

and when the Close is below the Open,

the bar is red indicating the Bears came out on top.

On a weekly chart, each bar summarizes the trading seen each week,

but it takes a week to build each bar, and so on.

Like the pros, use Log Scale on daily and longer-term charts and Linear Scale on all intraday charts.

The bar on the far-right side of the chart is the latest or current bar.

Try not to focus on the individual bars.

Focus on broader repetitive patterns.

Take another look at the chart above.

Notice how prices react to prior S/R levels and other technical indicators like the standard

Moving Averages (MAs).

Most professional charts include the 20-, 50- & 200-period MAs.

Some also include the 100-period on all their charts,

and some others prefer the 150 instead of 100 and 200.

I think it is very important to see what the pros see on their charts,

especially when it comes to the 20 and 50.

I've tried all the combinations of 100, 150, & 200

over many years.

I'm not convinced that it makes a big difference.

I prefer the 100 and 200.

These MAs act like automatic trend lines, and they help to smooth out erratic price swings.

The 20-period MA shows the short-term average rate of change in prices,

which is subject to a relatively greater degree of error

thanks to short-term herd behavior.

The 50-period is the medium-term average.

The 100+ period MAs show longer-term averages.

Many pros include a momentum indicator like

RSI.

When prices have moved up too quickly,

RSI can get above 70% indicating that prices are near-term overbought and likely near resistance.

When prices drop too quickly,

RSI can get below 30% indicating that prices are oversold and likely to be near support.

Ideally, we want to be a buyer when prices are oversold and a seller when prices are overbought.

In an ideal uptrend,

RSI should be between 50% and 70%;

and between 30% and 50% in an ideal downtrend.

Mr. Market's price action is rarely ideal;

but it is possible to see this in longer-timeframes.

Trade volume, if available, is another good indicator to have on a chart

(and I'll address this below).

Most new traders and investors are impatient and focus on shorter-term trends and timeframes,

which can be noisy, more random, and much harder to profitably trade.

Professionals focus on longer-term trends and trading ranges

while profitably working price swings in quicker timeframes

relative to those longer-term details.

Each candlestick bar

shows the range of prices seen in that sample size.

That is, on a daily chart each bar shows

the highest price (the High), the lowest price (the Low),

the price of the first trade (the Open),

and the last price (the Close).

If the Close is above the Open,

my bars are green indicating that the Bulls dominated that sample of market data;

and when the Close is below the Open,

the bar is red indicating the Bears came out on top.

On a weekly chart, each bar summarizes the trading seen each week,

but it takes a week to build each bar, and so on.

Like the pros, use Log Scale on daily and longer-term charts and Linear Scale on all intraday charts.

The bar on the far-right side of the chart is the latest or current bar.

Try not to focus on the individual bars.

Focus on broader repetitive patterns.

Take another look at the chart above.

Notice how prices react to prior S/R levels and other technical indicators like the standard

Moving Averages (MAs).

Most professional charts include the 20-, 50- & 200-period MAs.

Some also include the 100-period on all their charts,

and some others prefer the 150 instead of 100 and 200.

I think it is very important to see what the pros see on their charts,

especially when it comes to the 20 and 50.

I've tried all the combinations of 100, 150, & 200

over many years.

I'm not convinced that it makes a big difference.

I prefer the 100 and 200.

These MAs act like automatic trend lines, and they help to smooth out erratic price swings.

The 20-period MA shows the short-term average rate of change in prices,

which is subject to a relatively greater degree of error

thanks to short-term herd behavior.

The 50-period is the medium-term average.

The 100+ period MAs show longer-term averages.

Many pros include a momentum indicator like

RSI.

When prices have moved up too quickly,

RSI can get above 70% indicating that prices are near-term overbought and likely near resistance.

When prices drop too quickly,

RSI can get below 30% indicating that prices are oversold and likely to be near support.

Ideally, we want to be a buyer when prices are oversold and a seller when prices are overbought.

In an ideal uptrend,

RSI should be between 50% and 70%;

and between 30% and 50% in an ideal downtrend.

Mr. Market's price action is rarely ideal;

but it is possible to see this in longer-timeframes.

Trade volume, if available, is another good indicator to have on a chart

(and I'll address this below).

Most new traders and investors are impatient and focus on shorter-term trends and timeframes,

which can be noisy, more random, and much harder to profitably trade.

Professionals focus on longer-term trends and trading ranges

while profitably working price swings in quicker timeframes

relative to those longer-term details.

It is best to analyze just a few market charts like the one above. Focus on the chart set (e.g., monthly, weekly, and daily) for just a few dissimilar securities that can survive and that will pay you to hold. Be patient and persistent. In time, your brain will start to naturally see patterns that you can profitably exploit. These extra profits will require extra effort and time. But this attainable skill can turn you into a consistently profitable investor with an above average rate of return, an ability that can get your retired in comfort. And maybe in time, it can also turn you into a true market professional, which is someone that can make their living in the market for tradable securities.

A longer-term average is a great way to gauge relative value and risk. On average, Mr. Market is a relatively good forecasting mechanism, but the dispersion (range) of prices around a longer-term average can become very wide and erratic at times. At any arbitrary moment in time, the market's forecasting error can be considerable. This realization can be good for patient investors that can learn how to exploit Mr. Market's natural tendency to overreact to surprises, to push price trends to unsustainable extremes (to go to longer-term trading range or channel boundaries), and then back towards a moving average again, which is called mean reversion, as seen in the chart above. It is this self-correction mechanism that makes longer-term averages such a good forecasting mechanism. Predicting future prices is hard, especially at trading range extremes when emotions are high. But waiting for favorable prices is not that hard, especially when being paid to wait while prices cycle (swing) around a longer-term average. Just patiently, persistently, and periodically check market prices, like every day at 10 am and 3 pm eastern time or just once a day or every weekend or whatever works best for you. When Mr. Market presents favorable prices relative to your trading records (your mark-to-market P&L), take advantage of that opportunity. A superior operational (process) enhancement is to do your technical analysis to identify favorable prices relative to your records and prior S/R Levels, then use your broker's tools to raise an alarm when/if Mr. Market wonders to what you consider to be a favorable price or just open a Limit Order to request a trade at that price. This approach is amazingly effective at securing a string of profits.

All securities go in and out of favor, over-and-over again as money flows in and out of the various market sectors. It is hard to predict which will go in or out of favor next. But it is not that hard to see which are in or out of favor now. The pros specialize and you should too. For each ticker, learn how prices tend to react to news, to the standard set of MAs and to RSI extremes. On your charts, notice how prices tend to bounce off the standard MAs and to mean revert when prices get too far away from the 20 or when RSI is above 70% (overbought) or below 30% (oversold). Prices bouncing off an MA and prior pivots (trend reversals) indicate Support and Resistance (S/R) levels, as seen in this chart. The price action relative to S/R Levels is a good way to gauge trend health. The slope of an MA is another way to gauge trend health. That is, lower (flatter, closer to horizontal) MA slopes are healthier and higher (steeper, more vertical) slopes are not. We can learn to see, anticipate, and profit from these naturally reoccurring patterns. For example, if prices are above the 20 MA or 50 MA (and preferably above a longer-term MA too), the bulls are likely the dominate group and the odds favor Bullish (Long) Positions. But when prices get too far above the 20 or when RSI is above 70%, beware of (look for) a bearish trend reversal, a near-term topping pivot, major resistance. This is a good time to close or reduce the size of profitable longs. When prices are near the 20 or 50 and up trending, enter or add to a long position. Take profits when prices move too far away from the entry MA or approach a prior trading range edge or a prior trend reversal pivot. If prices are below the 20 MA (and preferably below longer-term MAs too), the bears are the likely dominate power. Look for favorable Shorts. Avoid new shorts when prices get too far below the 20, are at the lower end of a broader trading range, or whenever RSI is below 30%. All of these chart patterns have favorable odds and are likely to yield profitable results, especially when you specialize on a few dissimilar securities that can survive economic boom-bust cycles.

Trading ranges exist in multiple timeframes. Example timeframes include a month, week, day, and an hour, and can be seen on charts set to each timeframe. On a daily bar chart, each bar summarizes the trading range data for each day (bar) on the chart with the latest data (bar) being (created) on the far right edge of the chart. On a weekly chart each bar summarizes a week of data, but it takes a week to finish generating the next bar. Longer-term charts tend to show bigger trading ranges and are more fundamentally grounded because the biggest and best portfolio managers operate mostly in longer timeframes. It just takes time for them to adjust their asset allocation without negatively impacting their rate of return. This is a profitable insight. You want to see what these pros are doing and invest with them. Focus on trade volume, big money creates bigger than average volume as best seen on longer-term charts. Longer-term charts are also more likely to show the range of likely future prices, just project the S/R Channel seen there into the future. There will be surprising exceptions, but the overwhelming majority of all future prices are likely to be within the highest and lowest prices seen on a monthly chart. If your security cannot fill a monthly chart, it may not be a survivable investment. An investment that has been trading for a decade or more is likely to be around for another decade, when the economic value backing that security is likely to be desirable in the future. Buys in the lower half of a broader trading range of a survivable investment are more likely to see profitable prices sooner or later, and this is a very profitable insight. But it is hard to be patent and that is why new traders and investors gravitate to quicker timeframes. There are even quicker intraday timeframes (e.g., 1-, 5- and 15-minute charts), but these are too noisy and erratic for most to profitably trade. Plus, few have the time and ability to just sit and watch intraday charts while they wait for a favorable setup. And if you don't wait for those favorable setups, you are just competing with the Fast Money. However, it is not that hard to periodically check a longer-term chart to see if Mr. Market is offering up favorable prices. Let me repeat, It is far easier to become and retain CPT status in longer timeframes.

These S/R Channels exist simultaneously in multiple timeframes with bigger (longer) timeframes having bigger channels that contain smaller (quicker) channels (i.e., smaller trading ranges within bigger trading ranges within even bigger trading ranges). These S/R Channels have a noisy, erratic, quasi-fractal (self-similar) relationship. All channels have a tenancy to expand and contract based on investor confidence that is subject to change, and to shift up and down in quicker timeframes within their next broader timeframe in response to surprising news and commentary. This is the biggest problem facing traders and investors. We're going to need a strategy to deal with all this quicker channel shifting within broader channels.

Many market professionals employ a strategy (or variation on this theme) that allows them to harvest profitable price swings in quicker, smaller, channels, while also being able to take advantage of channel shifts up and down in broader trading ranges. The pros specialize and break up their trading power to simultaneously trade multiple timeframes. Many have computer systems that automatically track their trading details and that can show them their P&L in real-time for their whole position and for profitable parts therein. So, that they can know if it is better to buy, sell, or hold, and how much they should buy or sell now. Their systems can also indicate (suggest on the fly) how much they should hold back for likely near-term price improvement, which may or may not happen. It is all about iteratively working the real-time odds as indicated by their decision support system that are now often backed by machine learning sub-systems that can analyze dynamic real-time market data projected against historic patterns of behavior.

When I worked on Wall Street as a senior software developer and project manager, I had the good fortune to help prepare for and sit in on a couple of meetings and presentations to some professional traders, fund managers, and their bosses that were seeking this type of automation to better compete. I was also able to attend seminars and participate in development efforts that focused on professional trading tools and techniques. All this gave me an amazing opportunity to really understand some of the inner working on Wall Street. But we don't need all this automation to make money. We can develop and deploy our own simple mechanical version of What Works on Wall Street. First we need to become consistently profitable. Once that primary goal is achieved, we can then work on tools and techniques to improve our rate of return. But this secondary goal must never come at the expense of our primary objective, being a CPT. I say this because our desire to make more can easily backfire on Wall Street. In time, we can maybe automate more of our mechanical CPT process.

Let's take a closer look at some professional strategies and techniques that I became aware of just to understand how some pros make money. The pros specialize, have proprietary models and processes, and are simply very good at what they do. They tend to focus on simple iterative processes that make them a little money over-and-over again. We also need to recognize that the pros often work in teams, with an experienced team leader or manager. They tend to have a team member that can do a proper fundamental analysis or has very good access to it. All this skill and information can yield an advantageous portfolio allocation with favorable (long/short) trading biases. Plus, they have the capital base that allows them to lean in and let their winning process run when their strategy is profitably working, and they're able to execute an appropriate Stop-Loss trade to cut their losses short when market forces turn against their approach. We may never have the good luck to join a team like this. But we can work to find other like-minded individuals that we can work with and leverage each other's strengths. We can also develop the self-discipline to learn what works and what does not, and then only do more of what works. We can become our own specialist. Someone that can make a little money over-and-over again. In time we can also grow the size of our capital base that's allow us to lean in when appropriate. We can also develop the self-disciple to avoid all those risky trades and investment that require a stop-loss trade, which forces us to take a loss while giving some of our hard earned savings to Mr. Market.

Warning, Danger: Most retail traders will never master the skills required to Cut Their Losers Short and Let Their Winners Run. And the few who can tend to pay a very heavy tuition in the form of lost savings and growth. Trust me, I know from firsthand experience. I've paid this tuition to Mr. Market U and learned, "I just don't have what it takes to make this approach work for me.", and I know way too many others who also paid to learn the same lesson. Please understand that Professional Wall Street wants you to buy into the belief that you too can be the next semi-professional trader capable of making a ton of money if you'll just trade like the Fast Money Pros. Yes, you just might be the next big winner, but the historical data clearly indicates otherwise. By far, most Wannabes just end up giving their money to Wall Street while hoping to be the next big Lottery Ticket winner. We must learn to control our natural desire to get rich quickly. For the overwhelming majority, slow and steady wins this race. To reap the easily achievable benefits available to anyone with money on Wall Street, you must do some amount of trading. Every investment begins and ends with a trade. And every time you make a trade, the Pros get a chance to feed off your savings account. You do have to pay to play, but you don't have to pay too much. You can wait for trading opportunities that are likely to favor growing the size of your account, if you can just focus on appropriate investments and prices. Don't get sucked into the idea that you have to trade with the Fast Money to make money. You don't. You can learn how to trade like (with) the Smart Money, and you can learn how to use trading tactics that play to your natural tendencies. You can learn how to profitably play your version of their professional games.

Furthermore, when I say "lean in" I mean the pros add capital to their winning trades, which can sometimes include going on margin too, a two-edged sword that will magnify whatever results are realized. Take it from me, if you do not command clear CPT status or are unable to properly cut your loser short, stay off margin. In fact, retail savers should just avoid margin, the great destroyer of wealth. This is also true for other leveraged securities, like options. If you can't be a CPT with a simple investment, adding leverage or an expiration date is just a big mistake, a permanent loss of our hard earned savings. Please, don't pay to learn this lesson too.

We need to be very selective about which professional tactics we choose to try and which we need to leave to the pros. Furthermore, we need to understand that appropriate security selection is key to making almost any trading tactic successful.

Most pros know how to avoid big mistakes or cut them short to avoid big drawdowns. They are also very good at quickly converting smaller timing mistakes into acceptable profits relatively quickly by iteratively scaling in and out (we'll take a closer look at this strategy in the next paragraph). Most retail investors are simply unable to compete at this level because they do not have the skill or capital base. So, what are retail savers to do? We need to develop and deploy a more appropriate competitive edge. We need to focus on investments and trading strategies that play to the strengths that we can easily bring to the market. For example, security selection and patience are true competitive forces any retail investor can bring to this game. Focus on securities and trading tactics that will not require a Stop-Loss trade. We need to learn how to avoid trades that can become a big mistake. We should only buy (enter or add to) investments that we are willing to patiently hold until Mr. Market shows us an opportunity to book an acceptable profit. We should focus on just a few dissimilar investments that can survive volatile markets and that will pay us to hold, like a U.S. Large-Cap Index fund (ETF, CEF or traditional fund), a U.S. Small-Cap Index fund, a Bond Index fund, and an International Large-Cap Index fund. Once CPT status is achieved with funds like this, we can then consider an issue (a.k.a., a security or ticker) with strong Relative Strength (RS) performance within each index, which are more volatile (have bigger S/R Channels) and most offer bigger dividends. But these issues can also a little riskier (i.e., may not be as survivable), which is why we need to obtain CPT with the index first before applying the same trading tactics to a more volatile blue-chip security. It is very important that we approach the market as investors first and as traders second. As noted above, every investment begins and ends with a trade, so we want to learn how to optimize these investment entries and exits to improve our rate of return. But we don't want to rely on these techniques to maintain CPT status. We want to only own securities that we are willing to hold for the long-run because Mr. Market will force us to hold for longer periods from time-to-time and because no one has unlimited trading power that can be used to manage and optimize portfolio returns. Let me reiterate, market timing mistakes will happen, and we do not want to have to take a Stop-Loss trade when we get it wrong. Holding will force us to experience an equity drawdown, a temporary loss, but a loss that we can turn into an acceptable profit sooner or later when we focus on investment that can survive and that'll pay us to hold. These drawdowns happen all the time, and we'll need to become okay with this. If you become concerned about holding a big drawdown, focus on security selection and at what level (price) within the broader trading range you choose to start with. Furthermore, as indicated in the next section, you can choose how you'll scale in and out. The best way to avoid a larger drawdown is to wait for market prices to drop into the lower half of the current or broader trading range. But this will require a lot of patience and may not always be doable, like when in a strong broader bull market, which means missing out on too much of the capital appreciation available in that bull market. So, sometimes we'll just need to risk a bigger drawdown to capture some of the current market rate of return. An alternative approach is to always invest with a healthy broader market (economic) trend as seen in longer-term timeframes. Given that, we can then use a counter-trend move in a quicker timeframe to enter or add to existing positions (more on this later). We're basically looking for Buy-the-Dip trading opportunities, which has us buying a little as prices drop into likely support while in a broader market uptrend (i.e., buying a bounce off support). We simply must learn to avoid all unnecessary Stops-Loss trades. We are not professional traders, we're investors; and as investors we'll need to ride out the drawdowns. Let's save these stop-loss trades for truly appropriate times, like when that broader (primary) market trend is turning against us near the top or bottom edge of our broadest S/R Channel (e.g., we're all-in while at likely Major Resistance Levels, like those seen on monthly and some weekly charts) or when we find ourselves holding serious dead money and we see a clearly better place to invest that capital — note that we don't have to recover a loss in the same security that turned out to be that big mistake. But all this is moot when appropriate survivable securities are selected because they give us a Big Hold Option in a security that is very likely to see a new higher-high sooner or later, like all Large-Cap Index ETFs. To date, there has never been a sell-off of the U.S. Large-Cap Stock Market Index that did not turn into a new all-time record high. Don't be a member of the all too large group of savers that got scared out and sold near to bottom, only to learn that they would have been okay had they just held that survivable investment. When being paid to wait for better prices in a survivable investment, being a CPT is just a matter of time and normal economic growth. Let's be honest about it — most of us will never be pros. But we don't have to be pros to realize CPT status, and that can allow us to earn a comfortable retirement in the market, if we can just save and learn to live within our means.

Professionals work to iteratively take profitable chunks out of every price swing within all available trading ranges. They break up their trading power, converting the single buy-low and sell-high prices into two averages that can be managed and optimized, which also allows them to convert small timing mistakes into an acceptable profit. They scale in and out as prices trend up and down in normally dynamic S/R channels that can expand and contract, and that can also shift up and down in quicker timeframes, over-and-over again. When their near-term swing trade goes as planned or when a channel shift goes their way, they book some profit. But, when the current Channel shifts against them, they still have trading power to help manage the position. They want each commitment of additional trading power to truly work to import their average price per share (their cost basis). For example, when scaling in, each additional buy must be at an increasing interval of price and/or share size to improve our cost basis more effectively (the average price per share of the whole position or some part there in). They can also work to improve their rate of return. For example, when a position or a smaller part has made a nice move up, is showing a profit, but is also heading to likely near-term resistance, sell half or whatever is appropriate and hold the balance for possible price improvement, which may or may not come. If near-term resistance holds and prices pivot back down, they have locked-in some profit and also have some cash to buy back in at lower prices, at the next likely lower support level. This trading tactic is the best way I know to convert a bigger drawdown into a bigger profit earning opportunity. The pros specialize in a few securities and trading techniques, some like this. They profitably trade around the same core holding that they know well. We can learn to do this too.