What is your Financial Freedom Number (i.e., the amount of money you need to save/have to quit your job and just live off your savings)? And that answer is likely to depend on two other numbers: 1) Your cost of living (what we spend in an average month), and 2) The sum of all income from non-employment sources. When your non-employment income is equal to or more than your cost of living, you have reached financial freedom and can retire.

The first step is to understand your cost of living in an average month. This is what I like to call "Your cost of happiness." Psychologically speaking, It's the amount of money you need to spend every month without going into debt to be fulfilled at the top of Maslow's Pyramid. This requires that we track your actual expenditures. After a few months of real tracking, we can analyze your spending behavior, develop a budget and plan for the future. We need to understand which expenditures are required (reoccur every month or so and are based on real needs) and which are discretionary (based on wants). We can then work to manage these budgetary items. Note that some fixed expenses tend to show up every few months or years, like auto and home maintenance or replacement; and we need to budget for these items too. We also need to budget (plan) for other known future expenses too. We also need to setup and maintain an emergency fund, some cash reserves to handle unexpected needs for cash. This should be three to six months of required fixed expenditures depending on just how reliable your monthly income is. Think, "What will I do, if I lose my job?"

The second step (before retiring) is to have a reliable source of monthly income to cover your required average monthly expenditures, which is mostly about a reasonably safe (dependable and easily achievable) rate of return on your savings. Assuming that we have some retirement savings to work with, we setup an appropriate asset allocation (more on this later) and an investment cash reserve to take advantage of market opportunities that will surely come from time-to-time. Having a healthy cash reserve allows us to be more of a hunter in volatile markets than a deer in the headlights (market prey, the source of someone else's income).

Actually, getting to and through retirement takes a little more than just knowing the numbers above. You are going to need money (a capital base) and a strategy to earn more money from that capital base (more on this later). It also means having the self-discipline to track your progress over time, and using these numbers to manage your expectations. It is ultimately about learning to manage two competing needs for cash from whatever sources of income you have. We all have to learn how to manage the need for cash to live today and the need to save some cash for tomorrow, so we can live comfortably in the future too. I'm going to assume that you are like most people, that you were not born into wealth and have a fortune that can fund your retirement; and even if you were, you're still likely to need to learn how to make that fortune last through your lifespan. Being able to retire requires owning a small fortune. Ideally enough wealth that the proceeds can support your lifestyle without eating into the principal. Once the principal is gone, we have to either go back to work, depend on the generosity of others or die (three progressively undesirable choices in old age). I'm going to assume that you, like me, have to work for your retirement. If you don't already have the working capital base (that small fortune) needed to fund your retirement, you're simply going to have to work for it; and the most historically effective way to do that is to get a job or start a business, save (preferably in a tax-free account like a Roth IRA or at least in a tax-deferred account like a Traditional IRA and most employer sponsored plans), and learn how to invest to cover the cost of your retirement (i.e., learn how to make your money grow, so you can live off that growth).

If you're able to retire with a larger fortune (in 2015, something in excess of five million), than you should be able to retire to a life of upper middle class leisure, assuming your cost of living is not too lavish (e.g., assuming you're able to earn 3%, which is not that easy in 2015 — see www.BankRate.com 5-Year Jumbo CDs, five million should throw off about $10,000 per month of spendable cash (assuming a 30% tax rate) and at 2%, the 2015 5-Year CD rate, you would only have about $5,800 to spend). Note that the higher the cost of your happiness (monthly expenses), the more you are going to need to retire, your Financial Freedom Number. However, if you're able to be happy with just an average middle class lifestyle, then you should be able to retire with just a small fortune (say something in the range of one to five million in 2015). Unfortunately, the smaller this small fortune is, the harder you're going to have to work and the more risk you're going to have to take on to realize the rate of return needed to fund your cost of happiness. Please note that if you expect to make money from doing something, like from a job or investing for retirement, then that activity is very likely to look and feel a lot like work (it's going to require a real commitment of time and effort); and if that activity is fun or something that anybody can do, then that activity at best is not likely to yield much of a return (think CDs) and at worst could cost you a lot of money (see Trading Idiot below). This is a simple fact of life and should not be a revelation. There is very likely to be a direct correlation between the amount of skill you develop, effort you apply, the actual savings start date and amount, and the realized quality of your retirement. Understand that successful saving and investing for retirement is going to require self-discipline, homework, time (patience), and lots of money. If you're like most people, you'll need to save and invest for most of your working life to realize the retirement of your dreams.

Unlike the alternative, it's never too early to get started. I think the most important aspect of retirement planning is time; your savings are going to need lots of time to grow to meet your retirement needs. And then there's the question of your retirement needs. What are they? You need to understand your retirement numbers (e.g., your cost of living, years to retirement, years in retirement, likely inflation and savings growth rate estimates, to gage how much you'll need to save to retire — click here to download a spreadsheet that can help you know which numbers need to be tracked, to understand the relationship between these numbers, and to allow you to run what-if scenarios so you can better manage your expectations); and then find a workable balance between current and future consumption. It all begins and ends with your ability to live within your means and to save for the future. Practice the art of frugality — learning to be happy with less — a skill that can greatly enhance the quality of your retirement.

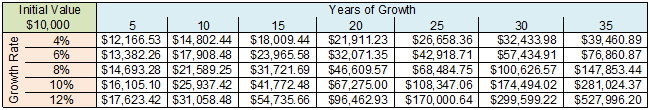

Here's a real-world example to consider. If you put $10,000 into a tax-sheltered investment that grows at an 8% compound rate, after 30 years you'd have $100,626.57. That's the way the math works; any dollar invested at an 8% compound rate would be worth a little more than 10 times as much after 30 years. Click here to play around with a Compound Annual Growth Rate Calculator to get a feel for how the math works or just refer to the table below, which shows how $10K would grow at different rates over a different number of years. Notice how the growth increases at an increasing rate as the amount of time and/or the rate of return increase; that's the magic of compound growth and the real key to wealth creation.

Let's say that you start saving at age 30 and saved $10,000 a year for 30 years, you could then retire at age 60 and live for the next 30 years (to age 90) on about $100,000 per year before taxes. That would be sweet, if we could live then at today's prices (cost of living). Inflation will reduce your buying power, which is a bitter pill to swallow in old age and the main reason we need to start saving early; getting an extra five years of growth goes a long way to solving the inflation problem. And what will we do if we can live past age 90? The ideal solution would have us save enough to be able to live off just the growth without eating into the principal (your working capital base), thus allowing us to live forever or at least as long as we can enjoy life. This amount of savings may be too much for some to achieve, and therein lies the trade-off between current consumption and future consumption, and the primary reason to manage expectations.

So where can you find an investment that can grow at 8% or better? Historically speaking, the stock market has been the best place to find this kind of growth, plus stocks are a good inflation hedge. Click here to get a feel for how an investment in the S&P 500 performed in the past. Just because the past was able to yield a better than 10% growth rate, that's no guarantee about the future. In fact, the market can generate just about any rate of growth, including all those listed in the table above. Furthermore, market rates of return are very likely to vary a lot over time, sometimes higher and other times lower. But what alternative do we have? If you have a better investment choice, take it and track the actual results to verify the claims are real. Beware of people claiming high returns with low risks; they are almost always bogus — Bernie Madoff (made off) with a lot of other people's money by promising great returns on very low risk; a little scheme he learned from Charles Ponzi. If you're like most of us, the best generic financial planning advice available today says that you should save/invest at least 10% of your income in a passively managed Total Stock Market Index fund like VTSMX, which should provide in time the growth you need without taking on undue risk. There are other investment choices that should be considered in time; but when you're just starting out, this fund or one like it is a very good place to start.

So you might be saying, "How can I save $10,000 a year? That's a lot of money." Most employers offer some kind of retirement saving plan; and many will even make some kind of matching contribution (that's free money). If you and/or your spouse can do this, start there and save up to the level of the employer match; and that's one way to save for retirement. Note that investment costs and fees reduce your overall growth rate; and many employer sponsored plans have higher fees. If your fees are higher than Vanguard, one of the very best houses in the business, you and your spouse should open up an IRA account at Vanguard. In 2013, the IRS said you can each save up to $5,000 per year, which is up to $416.66 a month each, and that's another way to save $10,000 per year (click here to see what it is now). Vanguard has a program that automatically pulls the money out of your checking account and invests that money per your instructions. If you are just starting out and don't have enough to meet the minimum initial investment amount, I understand that Vanguard will waive the minimum if you setup an automatic investment program. Furthermore, this Pay Yourself First automatic investment option makes it a lot easier to save in both good times and bad, and yields the benefits of the DCA strategy (addressed below). Look at this saving plan as just another monthly bill that has to be paid. And then study and learn how to apply the information below. As an alternative, consider reading a good book on the subject like Preparing for Retirement or Control Your Retirement Destiny. You want to have a good handle on this stuff well before you reach your retirement.

Because your savings can grow at different rates over time we need to monitor your progress and make adjustments when necessary. If we're lucky enough to realize great returns early, we may be able to retire sooner and/or enjoy a better quality of life in retirement. Alternatively, if we run into lower returns than expected, we'll have to save even more and/or defer your retirement start date and/or settle for less. We need to stay on top of our progress, so we're not blindsided when we reach retirement age. And if you're thinking, I'll just depend more on Social Security and other government programs; then you're likely taking on way more risk than you realize.

Don't allow yourself to be blind-sighted, learn how to save, track your progress, and manage your expectation about the balance between current and future consumption.

Let's start by reading about Mr. Market and Warren Buffett's approach to investing. Being one of the world's richest, a person who made his fortune in the capital markets, Mr. Buffett is clearly one of the best investors ever. A wise man once told me, "One of the easiest ways to learn how to do something, is to find someone who already knows how to do it, and then just model that behavior, and if possible ask him or her to be your mentor." Clearly, Mr. Buffett is not going to agree to be your mentor. However, he has written much, and much has been written about him. So we can, to some acceptable degree, model your behavior after his (or whomever we admire). According to him, to become a good investor we're going to need to develop good business judgment, and we'll need to find a way to protect ourselves from the emotional whirlwind that Mr. Market unleashes.

To develop good business judgement, we'll need to master or at least get a good handle on business fundaments, ideally to understand what it takes to start, run, and grow a business. Consider starting with The Little Book That Still Beats the Market, which is a great introduction and a relatively quick read. Also look into Coursera, which offers a number of great college classes on business for little to no money (when compared to most other college classes), however the knowledge will cost a considerable investment in time and effort. Start with an Introduction to Business (to understand the big picture), Accounting (the language of business), Economics (the relationship between human incentives and likely results), and a class in Finance (how and why a business project gets capital funding and the various types of funding) and/or consider getting a copy of Financial Literacy and How the Stock Market Works (on sale, these classes seem to go on sale at least once a year). We should also consider studying Fundamental Analysis, which is an examination of the underlying factors affecting the health of the whole economy, various industry groups, and individual companies. Read about the concepts of Alpha and Beta, and read as many good books on investing and the market's nature as you can handle, classic books like A Random Walk Down Wall Street, The Investor's Manifesto, and What Works on Wall Street. I know this is a lot to learn, but the more we know about business and the fundamental factors that affect market prices, the better equipped we'll be to succeed in this endeavor. I've attempted to boil it all down in my paper The Economy, Markets, and Profitable Insights.

Alternatively, many (almost everyone I know) would argue that they just don't want to spend their time learning all that "helpful stuff" in the prior paragraph, and (based on their first-hand experience) investing seems like it is just a crap-shoot and that it may not even be possible for the average guy to make money in the markets. Well, I have taken the time to learn a lot of that "helpful stuff" and I can assure you that the average guy can make money, if they are patient and persistent, and just Dollar-Cost Average (more on DCA below) in a low-cost, broad-based market index fund like VBINX. In fact, the average guy can make very good money. But they are going to have to work for it, and their rate of return is very likely to be a function of the amount of money and effort invested, and the quality of the skill applied. If you are still interested, read on; otherwise just DCA into a Total Stock and/or Bond Market(s) Index fund.

You need to understand the relationship between risk and reward — safety lies in the willingness to accept lower returns, higher returns require higher risks; but higher risks do not guarantee higher rewards and can easily yield poor to bad results. Furthermore, risk can be managed. Savvy investors only take on risk when the odds favor their exposure, and when the odds turn against them they exit to preserve capital. It's human nature to believe that risk is highest after prices have dropped a lot, and that it is safest to buy after prices have clearly rallied; but on Wall Street, the opposite is true.

On Wall Street, there are basically three activates that cause money to flow into (or out of) your pocket (brokerage account): 1) Earn capital gains (losses) from buying and selling investments (assets), 2) Earned income from asset ownership, and 3) From the sale of related products and services (for most, these tend to be costs that need to be minimized).

Successful investing requires three things: 1) Investment capital — It takes money to make money and the more you have the easier it can be to earn more while reducing overall risk), 2) A strategy that you understand and trust, and that is likely to yield the desired results — A method to identify good investments, and to identify favorable buying and selling prices. 3) Time — It will take time to save, to allow compounding to work its magic, and to learn what really works and why. So start early; you want to have all this mastered before you reach retirement and need to depend on these to retire.

Many respected investment advisors have said (like in the books above) the markets are very efficient, we're very unlikely to beat the market, and the best we can hope for is to realize the market rate of return (a.k.a., earn Beta). This is primarily due to your nature, which causes us to make bad investment choices, to do most of your buying at above average prices and your selling at below-average prices. These advisors know from experience that most people do best when they just own a top-quality broad market index fund (e.g., S&P 500), which allows their clients to benefit from two primary factors affecting the future value of their investments: 1) economic growth (fortunately for us, we live in a growth biased world), and 2) the investment's ability to survive and efficiently deliver on any value creation that does occur (note that a number of investments–think most traditional mutual funds–give a significant percentage of the value creation to the fund managers and thus leaving less for the actual investors). These two factors are a given when we just own an above-average investment with lowest possible fees (e.g., Vanguard 500 Index Fund VFINX). The two other major factors affecting the profitability of any investment is not paying too much for that investment and harvesting that investment when we've realized an acceptable rate of return (a.k.a., earning Alpha). Patient investors can and have made good money in the markets by owning above-average quality investments that are able to survive economic turmoil, that are bought at prices below the average selling price, and that are able to earn the market rate of return while they wait for that higher exit price. Assuming we can stick with good investment choices, like the few identified above, we just need a strategy that helps us to buy low and sell high. Let's take a look at Dollar-Cost Averaging, Portfolio Allocation & Rebalancing, and Value-Averaging to understand why these time-tested strategies work in a growth biased economy.

Dollar-Cost Averaging (DCA) is an investment strategy that invests equal amounts on a regular basis over a long period time (such as $100 monthly for ten years) in a particular investment or portfolio. Assuming prices will continue to vary up and down over that period of time, which is the normal case especially over longer periods of time, more shares will be purchased when prices are low and fewer shares when prices are high. Thus yielding a cost basis (the average price per share, which is also the break-even price of the investment) that is lower than the average price seen in the trading range over that investment period. Building a low cost basis makes it much easier to realize a gain on any future upturn in prices, assuming that prices will continue to trade in the range seen during the purchase period, which is not an unreasonable assumption especially if the period is long-term (more than a few years). However, in a strong up trending market, it's better to invest it all at the beginning of the period, and in a strong down trending market, it's better to invest elsewhere. But that, of course, assumes the current trend will persist, which is not always a good bet. In real life, the primary (broader market) trend is rarely smooth and consistent, is hard for newbies to see. Specific future prices are virtually impossible to predict and market time with any consistency is almost impossible. Here's the takeaway message to understand about this strategy: 1) All investments trade up and down over time, and all future prices of an index fund are very likely to stay within a broader trading range that will track the growth rate of the underlying economy. 2) It's a great way to invest in our economic system and earn Beta, the market rate of return. 3) DCA is a time-tested strategy that is very likely to yield a cost basis that is below the average trading range of a longer-term investment period, which makes it easier to realize a capital gain in the future. In time, you can develop the ability to be more of a buyer when prices are down and more of a seller when prices are up, to earn Alpha, a skills-based trading and investing reward. 4) Another big advantage of DCA is that most investment companies make it easy to setup and automate this investment strategy, which makes it more likely that a newbie will allow the strategy to work automatically when prices turn down; instead of being scared out of their investment near the market bottoms with a loss, which happens way too often with the manual process. DCA is the best way I know for new investors to start savings for their future needs.

Portfolio Allocation & Rebalancing is a strategy that tends to offer both risk reduction and higher returns. Idiosyncratic Risk (adverse risk to a small number of stocks) reduction is accomplished by diversification, which tends to smooth out the effects of a few abnormal returns in the portfolio. But that advantage comes at a cost — not only does simple diversification reduce the impacts of one or two failing issues, it also reduces the benefit of one or two nice surprises to the upside too. Simple diversification does not take into consideration asset correlation (many and often most stocks move together, following the broader market trend, they are correlated). An asset allocation among different classes (like cash, stocks, bonds, commodities, real estate, etc.) is a form of diversification that also reduces risk; but unlike simple diversification, an allocation among different classes that are un- or loosely-correlated also increases Total Return. Nobel Prizes have been won by individuals doing pioneering work in this area of finance. But you don't need a Ph.D. to build a beneficial portfolio allocation. A simple allocation of say 20% in U.S. Large-Caps (like ticker VLACX), 20% in U.S. Smaller-Caps (VEXMX), 30% in an actively managed bond fund (VFSTX), 15% in an actively manage international fund (VINEX), 10% in real estate (VGSIX) and 5% in natural resources (VGPMX) will get the job done. The reasons this type of asset allocation yields better returns is because these different asset classes are not closely correlated. There will be times when bonds will outperform stocks, small-caps will outperform large-caps, etc. When market forces cause a significant change in the original allocation, a simple re-balancing back to the original allocation forces you to sell some of the winning assets at higher prices and to buy some of the underperforming assets at lower prices. Assuming low or no transaction costs, like in a Vanguard IRA, a significant change might be as little as 4 or 5%; if transaction costs are high or if taxes must be paid on any gains, a higher change, like 10% or more, may be better. There are basically two approaches to when to re-balance. The first is calendar based, like once a year, quarter, or month. The other, and I would argue better, is volatility based; but this requires a lot more periodic monitoring to see when current prices have changed a lot relative to a broader average. Here's the main point to understand about this strategy: assets will naturally go in and out of favor, and any strategy that has you buying low and selling high and taking advantage of natural market rotations will yield a higher total return (earns Alpha) and is better than a simple buy and hold portfolio, which earns just Beta.

Value-Averaging is an investment strategy introduced by former Harvard University professor Michael Edleson. The goal of the strategy is to realize a targeted rate of return (growth). Let's say we want to buy something like a vacation/retirement home or send a child to college in 20 years, we have a good feel for how much that cost is likely to be, and we don't want to save any more than is necessary. We run the numbers and come to the conclusion that we'll need to earn at least 8% each year to achieve your goal, if we invest one or more times per year in an investment, like a total stock market index fund. A total U.S. stock market index fund, like VFINX has over time yielded something like 10% over the long run; but in any one year could return more or less. We use a spreadsheet to build a table that shows how your savings/investment should grow over time. We put in the initial amount; and then at each additional investment date, like the beginning of the next month, quarter or year, we compare the projected growth in the table against what was actually realized. If we're doing better than expected, we don't have to save as much, just enough to achieve the next starting value in the table; and if we did not get the growth planned, we'll need to add more to bring the account up to the projected milestone. Here's the take home message, it is possible to set and manage towards a reasonable investment objective, which helps to remove much of the uncertainty associated with retirement planning. If we know we can't retire until, say age 67, because your other retirement benefits will not kick in until then, this strategy allows us to live better now when your savings plans are working out nicely, and also allows us to cut back a little on current consumption instead of having to cut back a lot on future consumption when your investments are unable to grow as planned in the current period.

All three of the strategies above work on their own and can also work even better when effectively combined. For example, we can own just a few un- or loosely-correlated investments that are very likely to survive and that will pay a market rate of return to hold. We can re-balance your asset allocation as needed to maintain your target mix. We can be more of a buyer at below-average prices and more of a seller at above-average price. We can use a spreadsheet to track, plan, and manage investments results. And we can save more when your market returns are low and unlikely to reach your investment goals.

In summary, you'll need three things to grow your savings: 1) Investment Capital, 2) At least one strategy that you understand and will follow that puts the odds of success in your favor, and 3) Time in an environment that favors your strategy. Your Primary Investment Objective should be to focus your time and capital on a few dissimilar, top-quality investments, and to Buy Low (only buy at discount prices), Sell High (or at a higher price once you've earned an above average total return or an acceptable return in the current market environment), and to Earn Income while you wait for that higher price. Start by investing in a security that is naturally self-correcting (and thus more likely to survive), and that allows you to just mindlessly own "The Market", say via an Index ETF like SPY or VT or a more traditional mutual fund like VBINX; and learn as much as you can about investing and how to take advantage of Mr. Market's emotional whirlwind. In time you will grow the capital base and skill needed to retire on your savings.

Every investment begins and ends with a trade, and having an effective and efficient User Interface to the Market and market related information can truly improve investment results. We don't want to go to a professional gunfight armed with only a penknife.

Your User Interface to the Market needs to be a natural extension of your trading process. It's one thing to know what to do, but it is quite another thing to be effective and efficient. This rule is mainly about learning How to trade. Another important consideration is What to trade and When to make a trade, and that decision is ultimately based on understanding relevant market information, which can often be quickly and inexpensively pulled from the web (this rules is also about becoming good at that information retrieval process, other rules below will better address the What and When wisdom).

Start by finding a good, low-cost broker. Ask around, and if possible, find someone you trust and respect to be a mentor; a successful and experienced mentor can significantly improve your results, and can help you avoid many of those newbie mistakes. When starting out, it's okay to select your mentor's broker, even if it's not the best one for you. You'll need to master that broker's user interface, which should include a good set of real-time charts and other quality information to help make informed trading and investing decisions. Understand that your broker is not your friend, at best he or she will be a good business partner; but never forget that your broker makes his or her living at your expense. Most brokers want you to trade; and the more your trade, the more they can take from your savings. Understand that you have to pay to play, but you don't have to pay too much. The less that you can give to your broker and the market, the more you'll have to grow at a compound rate. And if one broker does not work out, try another. It's a very competitive business.

Study Trading Basics, Market Prices and Technical Analysis (learn how to read charts like a pro), which show what traders and investors are doing with their money. Please note that the talking heads on TV and elsewhere can and will say anything, which may or may not be good advice for you. But they (everyone) will always trade/invest their money in a way that is likely to benefit their best interest; and the sum of all trader and investor activity can be seen on charts — it's an objective and (preferably) real-time flow of market information that is available to all, both pro and amateur alike. Consider the price action (pattern of peaks and troughs) and volume relative to the associated news and commentary. Charts show the current price trend, trend health (is the current rate of change sustainable or overdone and in-need of a correction), and trading range (the market's collective-view of fair-value and where the big money is buying at discount prices and selling at premium prices). These three bits of information are worth their weight in gold.

"The trend is your friend." is one of the oldest sayings on Wall Street. Trading with the trend is the calmest way to make and keep your money. The easiest ways to see the current price trend is to look at the slope of the simple 20-, 50-, & 200-bar Moving Averages (MA) and the price pivot pattern relative to these MAs on longer-term charts. A price pivot is a type of ∨–bottom or ∧–top pattern associated with a trend reversal. Note that trends in longer timeframes are stronger than trends in shorter timeframes — a downtrend (e.g., 20-period MA) in an hourly chart is likely to turn up when it runs into an uptrend in a daily chart.

Current prices are a reflection of the market's collective view of the health of the underlying businesses. Trending is normal — once a trend begins, traders and investors see the trend and jump-in in the direction of the trend and that propels the trend forward. But all prices must, sooner or later, be based on some fundamental reality, the real growth prospects of the underlying business that issued the security that is trending up or down. At some point, a trend will become clearly overdone and current prices must correct (reverse). When economic prospects are improving, prices naturally trend up; and when prospects are deteriorating, prices trend down. The biggest problem with any price trend is that the move up or down is rarely smooth; they can easily get too far ahead of the underlying reality; and thus be in need of a correction. This is why an up tend will often shows a pattern of higher-pivot highs and higher-pivot lows; and a downtrend shows a pattern of lower-pivot highs and lower-pivot lows. Savvy traders know that the odds favor buying a bounce off a pivot low and selling a bounce off a pivot high. This is of course easier said than done because every savvy trader is attempting the same maneuver. May pros use technical indicators to spot when the market and individual security are Overbought and Oversold and about divergences in MACD and RSI, which is a technical indication that the current trend is starting to loose momentum and is about ready to reverse.

The third and in my humble opinion most important bit of information seeable in charts is where the pivot highs and lows occur. A pivot low is a price point (actually a small range of prices) where the bulls (buyers) were able to overpower the bears (sellers) and convert the current short-term down trend into an uptrend. A pivot high is a price where the bears were able to reverse an uptrend because there were too many savvy sellers willing to take advantage of premium prices. Fast-money traders drive the current trend forward until that trend runs into awaiting limit orders from large (in terms the size of their trades and portfolios) professional longer-term investors that do most of their buying at discount prices and selling at premium prices, and that causes the current trend to reverse. Understand that the biggest, in terms of capital under management, traders in the market are the huge fund managers, who have the ability to hire some of the best analyst in the business, and who are able to determine a reasonably good fair value price range for the stocks they are trading. These big savvy portfolio managers make a lot of their money by buying at discount prices and selling at premium prices; it's their buying that creates pivot lows and their selling that creates pivot highs. There is no guarantee that they will buy or sell again at the prior pivots; but savvy traders know the odds favor trading with this information in mind. Note that adding time, analyzing longer-term charts, also adds participation and extends (widens out) this fair-value range; the bigger the trader the longer the timeframe they tend to operate in — it takes time to move into or out of a large position.

It's a lot easier to make and keep your money when your trading is in harmony with the big money; and charts are the one source of unbiased information that's available to everyone in real-time and can show you what the big money is doing now and in the past — you just need to learn how to read these charts.

We can sometimes be your own worst enemy — a Trading Idiot (I once worked as a proprietary trader for a firm that had a mentor/coach who liked to refer to his unprepared, undisciplined protégés as Trading Idiots). I don't mean to be insulting or to suggest that you may not have what it takes to be successful. If you've earned the kind of money it takes to play on Wall Street, you likely have just about what it takes to be successful. I'll bet the only thing missing is a little situational awareness, some training, and lots of low-risk practices. Money unnecessarily lost by the Trading Idiot (our unprepared, undisciplined alter ego) cannot grow to support your retirement needs and can result in a poorer quality of life in retirement — in fact, these losses are not only a loss of principal (the original savings), they're also a loss of compound growth on the principal too because it generally takes time to re-save the new principal, time that could have been used to grow wealth on the original savings that was lost. We simply must avoid unnecessary losses.

There is a field of research dedicated to this area. It is called Behavioral Finance. The basic premise is that we humans are predisposed to make a number of common psychological mistakes thanks to your need to rely on basic instinct to quickly react in a complex, fast-paced environment, like the markets. Researchers in Psychology and Behavioral Economics have identified two personality profiles called The Thinker and The Doer, which is also known as System 1 and System 2, a dichotomy between two modes of thought. "System 1" (our Doer) is fast, instinctive and emotional; and "System 2" (our Thinker) is slower, more deliberative, and more logical. The Doer personality relies on prior conditioning and your more primitive brain to quickly react and do what needs to be done now, a think fast mode of operation, which I refer to as your Trading Idiot. The Thinker is able to analyze, learn and plan, and can teach the Doer in time, but this mode takes time and effort; it's a think slow mode of operation. Time and money spent learning about these concepts will pay handsome dividends; and surely beats the costly alternative — learning via on the job training. Take a look at The Little Book of Behavioral Investing and Misbehaving: The Making of Behavioral Economics.

Wall Street Talking Heads in the popular media likes to pander to your ego and to whip up your emotions say things like, "You can trade like a Pro...Cut your Losses Short...The Market is down on Profit Taking...Investors who bought the last dip are now up X%, etc." Understand that Wall Street (the Street) wants you to trade and offers the prospects of big, easy profits to entice newbies into the Market. In the short-run, the Street makes its living on the backs of traders. Every time we put on a trade the Street gets an opportunity to feed off your brokerage account. And yet every investment begins and ends with a trade. So we have to trade, pay-to-play, to be in this game; but we don't have to pay too much. In the long-run, the Street (and hopefully you and I) can make a living on the backs of normal economic growth, cash from sustainable business operations that tend to be paid out in the form of dividends, and on irrational over-reactions to news and commentary about those businesses. Please understand that this system (Wall Street), which provides a legitimate economic service, has also been fine-tuned to allow others to prey on your gut instincts and natural human emotions of hope, fear and greed — our Trading Idiot (the Doer personality).

Here's what you need to understand, these pros have lighting fast systems that are often located very close to the exchange; and now a days, more and more of these systems are super-computers, programmed by a team of professionals and are co-located at the exchange. No rational person would wager their retirement in an on-going game against a professional athlete playing their game on their home court. And yet it is common for retail (amateur) investors and traders to think, "The guy on the other side of my trade is some average Joe; and because I'm above average, I'm likely to win over time." This is the Trading Idiot talking! Professionals account for more than 85% of all the volume on any trading day. The guy on the other side of your trade is very likely to be a seasoned professional or computer programmed by a team of professionals; and you are unlikely to out-trade them based on real-time charts, daily news and commentary. In the long-run, short-term trading against the market is not likely to grow the size of your brokerage account. However, there are investing strategies, like those introduced above, that can grow your retirement account, if you will allow your Thinker (Planner) personality to train and supervise your Doer personality.

Also understand that stock and bond prices go up and down all the time (and therein lies the opportunity to buy low and sell at a higher price); but it's very hard, maybe impossible, to predict shorter-term prices. So we should not become upset, when prices go down just after we buy or go up just after we sell. That's going to happen; and we've got to simply accept the idea: Where the market goes is beyond your control. We can only control how we feel about it, and how we prepare to take advantage of this market behavior in the future.

Start by thinking about your trade (investment) and ask: 1) What's my strategy, and what are the odds of success?, 2) Using an appropriate set of charts and a spreadsheet, map-out how the trade is supposed to work — ask? a) Where do I want to enter the trade, b) Where is my profit target exit, and c) What will I do if things don't go as I hope, where is my stop-loss exit or what's my trade recovery strategy? Paper-trade that strategy. If that seems to work, try to trade the strategy with real money in very small size (just a few shares). Only increase size (risk) as positive results warrant it; but never forget, it's not how you handle the winners that counts, it's all about how you handle and avoid the losers — especially those really big losses caused by leverage that can wipeout your account.

The goal is to develop an intuitive feel for what is likely to work, and how to best manage the trade win or lose — a properly trained Doer. To succeed on Wall Street you need some training (to know what to do), some self-discipline and lots of patience. If we're not careful, the market will take your hard earned money or trick us into giving it away in hopes of earning big profits. Take a look at your physical and psychological profile; and ask, "Am I truly fit to take on this challenge; to step into one of the most competitive, high stakes arenas open to both professionals and armatures alike?" Your future livelihood depends on your ability to take this seriously. Most people believe they are; but their results suggest otherwise. Money lost on unplanned, undisciplined, impulsive trades and squander away on get-rich-quick products and services can never grow to provide for your retirement. As Buffett reminds his shareholders (us too) that to be a successful investor, one needs good business judgment and the ability to protect oneself from the emotional whirlwind that Mr. Market unleashes. To be your best, get enough sleep, exercise, and eat a healthy diet; it also helps a lot to open your eyes and mind to new information, to plan out your investments, and to then trade your plan. Find trading and investing strategies and market opportunities that put the odds of success in your favor, and develop the patience and self-discipline to wait for the market to offer up these favorable opportunities. Don't be a Trading Idiot — make sure that every allocation of capital has a high probability of yielding a positive total return!

One of the first things we all learn is "The trend is your friend." and the "Easiest way to make money is to trade with the trend." The problem is, most people have a short-term time horizon and once the trend is obvious on their chart (their operational timeframe); it is probably overdone and ready to reverse. It is this paradox coupled with the fear of losing even more money that causes most newbie traders to actually lose money. Professionals trade with the health of broader market trend. A healthy broader market trend is likely to continue, and an unhealthy trend is very likely to reverse. Professionals understand that it's the health of the broader market trend that is actually their friend and is the market force that tends to yield profitable outcomes.

In a healthy trend, current prices will naturally bounce off or near the popular 20-, 50-, and 200-period MAs as they advance in anticipation of changes in the underlying economics. It's also common to see slightly higher (above average) volume on the advancing bars and slightly lower volume on the counter-trend bars, and much bigger or smaller volume on major trend reversals. A healthy uptrend has a pattern of higher pivot highs and higher pivot lows, and tends to have current prices trading at or a little above these MAs; and a healthy downtrend has a pattern of lower pivot highs and lower pivot lows, and tends to have current prices trading at or a little below these MAs. The big problem with trading with the current trend is that all this trend trading naturally causes the current trend to go too far and become unsustainable, no longer reflecting likely economic outcomes. When prices and these three MAs get spread out vertically (have gone too far too quickly), that's a clear indication of an unhealthy trend that is likely to reverse (to correct); and this is especially true when RSI is signally an overbought or oversold condition.

The broader market trend is found on longer-term charts. For example, if the primary focus is trading the Daily chart, then the broader market trend can be found on the Weekly and Monthly charts. Professionals use more than one chart and timeframe, and they focus their attention on the market's collective view of fair-value (Support and Resistance on the various chart). which allows them to buy at discount prices and sell at premium prices in the direction of the broader market trend, which helps to create these minor trend reversals. They use counter trend moves on shorter timeframes to enter and exit their positions (refer to Triple Screen Trading in Trading for a Living). It's these professional tactics, that any one can learn and use, that so frustrate new traders and can cause (portfolio) death by a thousand cuts.

The broadest market trend is a function of the economy's boom-and-bust Business Cycle; and your operations should always be in-synch with that trend. There are also shorter seasonal trends too and you can learn to play these (start with one of Jeffrey Hirsch's Almanacs), after mastering the broad economic trend. The best way to stay in-synch with these is to set your trading bias (bullish or bearish) based on the trend in the next longer timeframe, which might disagree with the trend on the current chart, which is actually a good thing as that will bring prices to your advantage. For example, let's say you are trading (looking for setups in an) hourly chart (that's your timeframe), use the trend on the daily chart to set your trading bias; and if your trading a daily chart, like most people, use the trend on the weekly chart.

A healthy uptrend shows a pattern of higher pivot highs and higher pivot lows, and a healthy downtrend shows a pattern of lower pivot highs and lower pivot lows (refer to Seeing The Market's Big Picture in my paper The Economy, Markets, and Profitable Insights for more information on this topic).

If you're in a healthy broader market uptrend, be bullish and look to buy the dips; only allow yourself to be in cash or long up-trending issues. When the broader market trend is bearish, only allow yourself to be in cash or to short ETFs that are trending down. When the broader market trend is unclear or unhealthy, only allow yourself to be in cash or issues that are relatively price stable, very likely to survive and that will pay you to wait for a health trend to present itself.

When the broader market trend turns against your position, exit that position or at least lighten up (reduce the size of that position). This is your primary stop-loss mechanism. A better stop-loss mechanism is to avoid trades and investments that require a stop-loss trade (see Rules 6 & 7 below).

A survivable issue is backed by a mature business run by seasoned managers with lots of, preferably diversified, revenue streams. Simply put, they tend to be above average in terms of their proven ability to deliver good risk-adjusted total returns over longer periods of time. An excellent example of a survivable issue is an index fund, like VFINX or SPY that very closely tracks the S&P 500, which is a naturally self-correcting index of the biggest and best 500 U.S. based companies.

Very good examples of a survivable investment that will pay you to hold are large, mature closed-end funds, exchange-traded funds, and most of the high-yielding issues in the Dow Jones Composite Index, which operate very much like a sector focused mutual fund — click here to learn more about investing in high-yielding mutual funds. Survivable investments offer one significant advantage over most tradable securities — survivable issues give you the real option to hold, to manage your cost-basis (the opportunity to earn Alpha), and to earn the market rate of return (Beta) while you wait for your reward (your target rate of return). The normal market rate of return for stocks is about 8 to 10%; and for bonds is about 5 to 7%. Plus, longer holding periods are better able to realize tax-advantaged, compound rates of return; the beneficial side effect of exercising the hold option. Here's list of some of my favorite tickers that meet the requirements of this rule: VT, SPY, IOO, IWM, QQQ, FEZ, EFA, BOE, BGY, CII, CHI, EOS, ETW, GAB, GGN, GUT, JCE, NFJ, PGP, PHK, PMF, PTY, RCS, RFI, SDIV, TDIV, and TEI.

Buy Low and Sell High is one of the very first things we learn about trading and investing. But this trite bit of wisdom is often lost in the massive stream of conflicting information flowing from Wall Street. Like may market professionals, we can learn how to use fundamental analysis and/or technical analysis as a guide to valuation to better understand if a security is either trading at a discount or a premium. Mastering either or preferable both types of analysis can greatly improve your odds of success. But unfortunately, neither approach is fool proof. An issues can be trading at a discount and before long be trading at an even bigger discount, and the alternative is also true.

Take the following points as a Market given:

- Price tend to trend and the current trend is likely to continue until it's overdone and will then reverse and trend in the other direction.

- Prices trade Up and Down in a Range that reflects the market's collective view of Fair Value (the current trading range can be seen on charts).

- The market is fickle and is quick to change its mind about what Fair Value should be.

- The current trading range can expand, contract, shift up or down, and exist in multiple timeframes, where bigger timeframes have bigger trading ranges and quicker timeframes have narrower ranges (that can be seen on longer-term charts when compared to shorter-term charts).

- When prices trend into one end (the top-end or bottom-end) of a trading range, prices tend to reverse, but can also continue after a pause, meaning that Prices can always go Higher and/or Lower (refer to Seeing The Market's Big Picture).

Professional investors understand this behavior and one of their big keys to success is their ability to manage two averages — their average Price per Share (a.k.a., their buy low price, their cost basis, the break-even price for the whole position) and their (average) Rate of Return (their sell high price). They do this by pursuing the lowest trading cost possible so they can break their buying and selling power into smaller parts thus allowing them to take advantage of favorable prices when presented. They use tools to track the details of the buying and selling, and that allows them and their computers to quickly see the Profit and Loss (P&L) profiles for their whole position and for the various combinations therein. These tools and insights allow the portfolio manager to exploit available market prices as they are present to realize (to lock-in, book) the best rate of return the market is currently yielding. Basically, these professional money managers are able to exploit their ability to analyze the markets they specialize in thus giving them a good work idea of what market's current fair value trading range is and it should be over longer timeframes, to track the associated details, to quickly understand the alternatives available and the historical odds associated with each alternative to grind out an above average rate of return.

Retail investors can also exploit this enlighten strategy, but we'll need a brokerage service that offers some number of free trades or at least very low trading costs. We need to reduce your operational costs, thus leaving more of your savings in your account to grow; and thus allowing us to take advantage of further discounts and premiums to optimize your Average Price per Share and Average Rate of Return. These are the most import averages that we can manage and that can enhance your trading results. But in order to do this effectively, we need to track the associated details, and used this data to plan out and understand the cost-benefit profiles of the alternatives — what if prices go higher or lower from here, and how can I best exploit the alternatives? We can use charts and a spreadsheet to track your trade specifics, to analyze and understand that data, and to plan out or at least better understand how the alternative can affect your rates of return, and to also see when we've realized an acceptable rate of return or when and by how much your average price per share has moved out of the current trading range (i.e., when it's best to make another trade to improve one or both of your two averages). A wise manager once told me, "You can't manage what you can't analyze and understand, and you can't analyze data that you don't track." And that's why we simply must track and analyze your trading data. To be better able to manage what we can control. We cannot control market prices, but we can control (choose) which prices we'll take advantage of (e.g., we can choose to only buy at discount prices and to sell at premium prices, when doing so improves or is likely to improve your averages; and we can choose to ignore all the other prices).

Here are the strategy details. Assuming the two prior rules are in effect, wait for prices to approach intermediate term support (if going long) or resistance (if going short) before making an opening trade. Then scale into (and if appropriate, scale back out of) these survivable positions over increasing intervals of price, time and size to optimize the position's Cost Basis (the average price per share) and Total Rate of Return (the average return for the whole position). These two averages are factors that we can manage and that will greatly affect the growth of your capital base. The odds significantly favor being a buyer at discount prices and (appropriate to portfolio size) a bigger buyer at increasingly bigger discounts, and a seller at premium prices and (as appropriate) a bigger seller at bigger premiums. Going into a position, work to optimize the position's cost-basis. Keep an eye on the difference between the position's basis (average price per share) and current market prices; when the position is showing a loss, work (scale in) to keep the basis as close to current market prices as possible; and when the position is showing a gain and the trend is healthy, let it run — try to hold for an above average total-return or until market conditions deteriorate. But never allow a nice Winner to turn into a Loser. When the trend or market conditions become questionable or you've reach the other end of the current trading range, close or reduce the size of (scale out of) that profitable position to lock-in a positive rate of return. Don't get greedy and hold for an unlikely move. Locking in available profits can increase an account's total rate of return far quicker than the very rare grand-slam trade because it facilities rapid compounding, as it also frees up capital to fund similar opportunities. Focus on being a Consistently Profitable Trader (CPT) — someone who is able to grow his/her equity curve (the value of their brokerage account) over their target trading timeframe (e.g., year-after-year, quarter-after-quarter, or month-after-month) by learning to hit lots of singles and doubles. CPT status is rarely earned by trying to be the next super-star trader (a home-run hitter); in fact, swing for the fences tends to cause big losses that can kill a profitable string of singles and doubles.

Here's an imaginary example. Let's say the broader market trend is up, and you wait for a low-risk setup and get in at a reasonably available discount (e.g., buying a bounce off near-term support). If that issue goes as planned and you reach your 10% profit target or whatever percentage the trading range and position size allows; great, you're free to take your profit (or at least book some of that profit). But what if that trade goes against you? Professional Wall Street says, "Cut your losses short!" mainly because they want you to trade as much as possible (which tends to move money from your account to theirs) and generally promote short-term trend trading, which facilities competition with professional day-traders and their super computers — a Losers Game. I say (assuming Rule 5 above), "Why give your capital to the market when it's likely to go your way in due time?" Break your position capital down into parts, say fifths, to be better able to take advantage of any future price movement; thus giving yourself options as to how you'll earn your targeted rate of return. This allows you to take advantage of natural volatility over time — to buy support (at discount prices relative to the current trading range) and sell resistance (at relative premium prices), which are levels (pivots) found on the current chart and on longer timeframes. Note that support is often found at prior pivot lows and resistance at pivot highs, and both can often be found near the popular 20, 50 and 200 period moving averages. Also note that everyone else (the pros) knows this too, so if you want to be sure to get your order filled you're going to have to set your limit order price just before these levels are reached. Continuing the example above where you bought a bounce off support, but this time, prices breakdown through near-term support, putting in a lower pivot low (a bounce off a lower, longer-term support level). Instead of executing your stop-loss, when the initial support level was broken (like you should on any non-Rule 5 issue), you're free to add to that survivable position at some loser support level, which lowers your cost basis (break-even price) and makes it easier to reach your capital gain target on the next or a future price upswing. The goal here is to keep your cost basis (the average price per share) as close to the market's current price range as possible, thus allowing any significant upswing to be a profit taking opportunity, which means you need each successive commitment of capital to be that much larger (either a larger drop in price and/or a larger capital allocation) thus pulling down that average price per share to within the current trading range. Click here to see actual historic (technical) example.

This is not always easy in a small account, which requires a much greater degree of patience because the trading interval between subsequent commitments of capital will naturally have to be bigger to be effective. Furthermore, we must limit ourselves to issues, like CEFs and ETFs, that can survive and that will pay us to hold because we may be forced to hold for a long, long time, when we run out of cash to invest. But note that all this holding income adds up and contributes to the position's total return, which also makes it easier to realize your targeted rate of return. Once the account grows, along with your skill, feel free to take a look at large, mature blue-chips that are trading near their 52-week lows and seem to no long go down much on bad news; but keep these position small and the trading intervals large as these issues are much more volatile and not as likely to survive as ETFs and CEFs.

In taxable accounts, use LIFO or Assigned-Lot accounting to minimizing the overall tax burden, and to be able to exercise the option to make each part of the investment work in whatever way possible to realize your targeted total return. Note that any lots held for more than a year will enjoy a much lower tax rate.

There's a time to be mostly in stocks, mostly in bonds, and mostly in cash. But there's never a time to be in only one asset class. Even if you become a great analyst and develop some amazing ability to predict future price trends, life does not always go according to plan. Surprises happen all the time. Even the pros have a very hard time predicting future prices with any consistency. Having an uncorrelated (or at least loosely correlated) Asset Allocation is a great way to reduce risk and improve total return in any portfolio.

The economy naturally goes through boom-and-bust (recovery-and-recession)

business cycles.

The stock market leads (anticipates) the current economic trend

(a Bull Market actually begins before the current Economic Cycle bottoms out; refer to the figure on the left).

Notice that the stock market bottoms out well before the economy bottoms.

This is because the market is forward looking and the economic data is backwards looking,

plus the economic data tends to be revised a few times well after the fact.

Economically sensitive issues, like stocks and corporate bonds, do better in times of economic expansion

(beginning with Early Recovery);

and the best time to increase (average in) your exposure is when the economy looks completely busted

(it's ready to recover because weaker businesses have already gone out of business, survivors have taken market share,

and interest rates have been coming down for a while and have stabilized near at longer-term lows).

Once the economy starts to recover,

reduce the size and duration (time to maturity)

of your bond exposure before interest rates start to rise.

Defensive issues, like government bonds, do better in times of economic contraction;

and the best time to rotate most of your capital out of economically sensitive issues

and into defensive issues is when the economy looks great,

interest rates have been rising to better compete with stocks and to cool-off the rate of growth and inflation and are near longer-term highs —

in fact, we often see an inverted yield curve

during stock market tops.

The economy naturally goes through boom-and-bust (recovery-and-recession)

business cycles.

The stock market leads (anticipates) the current economic trend

(a Bull Market actually begins before the current Economic Cycle bottoms out; refer to the figure on the left).

Notice that the stock market bottoms out well before the economy bottoms.

This is because the market is forward looking and the economic data is backwards looking,

plus the economic data tends to be revised a few times well after the fact.

Economically sensitive issues, like stocks and corporate bonds, do better in times of economic expansion

(beginning with Early Recovery);

and the best time to increase (average in) your exposure is when the economy looks completely busted

(it's ready to recover because weaker businesses have already gone out of business, survivors have taken market share,

and interest rates have been coming down for a while and have stabilized near at longer-term lows).

Once the economy starts to recover,

reduce the size and duration (time to maturity)

of your bond exposure before interest rates start to rise.

Defensive issues, like government bonds, do better in times of economic contraction;

and the best time to rotate most of your capital out of economically sensitive issues

and into defensive issues is when the economy looks great,

interest rates have been rising to better compete with stocks and to cool-off the rate of growth and inflation and are near longer-term highs —

in fact, we often see an inverted yield curve

during stock market tops.

The economy (business) cycles overseas too. International securities often lag the U.S. Market; but more importantly, these issues, like bonds, are loosely correlated to U.S. stocks and that give us a more diversified asset allocation.

Understanding the relationship between the Economy and the market for Stocks and Bonds allows you to average in and out of survivable issues before the big cyclical moves are made. This knowledge can earn and save you a ton of money over time.

Just as there are broad economic business cycles, there are a number of smaller (quicker) market cycles that re-occur with amazing predictability. You can and should learn to profit from these too. Take a look at "The Little Book of Stock Market Cycles" and/or "The Almanac Investor" both by Jeffrey Hirsch.

On the subject of appropriate asset allocation, let's not forget about Cash, which is completely uncorrelated to all other asset classes. It's the opportunity asset class. The market presents opportunities all the time, but we need to have ready cash to take advantage of these.

Employ an economically appropriate asset allocation. That is, have the major part (say 65%) of your capital base in asset classes that are likely to appreciate in the upcoming phase of the business cycle. However, also employ a reasonably diversified asset allocation with the capital balance to allow the portfolio to benefit from both natural inter-market and intra-market (sector) rotations and from economic surprises, which all yield the benefits of Modern Portfolio Theory. But note that intervals (price and time) need to be much bigger for sectors and assets that are likely to be out of favor when scaling into survivable securities.

Warning: Wall Street is very good at transferring wealth from the impatient, impulsive and uninformed (i.e., the Trading Idiot) to the patient and methodical.

The best way to control the Trading Idiot is to have a limited number of tickers (security symbols) to follow, to develop a process to find Good Trades (Trades with Favorable Odds), and an investing strategy that is simple to understand and that is very likely to yield a positive Total Return. You want an iterative process that is so simple an Idiot can understand it and make money using it — be able to become a CPT. There are generally two parts to this approach.

- The first part is a general discussion about your approach (your methodology) and will require some work up front; but in time should become mature and stable as you become more effective at the process. This part should identify each strategy you know and will be looking to trade. For each strategy, provide a basic description of the key points needed to understand the strategy and identify the triggers you need to see to take action (i.e., to open, add to, reduce the size of, or close a position). Your plan should include information about issue selection criteria (remember rule 8 above — Have a Diversified Asset Allocation). These are the issues you'd be willing to own given a favorable setup. The plan should also include a discussion about how you'll monitor the market and your tradable issues — how you'll build, maintain and use a watch-list. A watch-list is a tool that allows you to focus your time on the key pieces of information you'll need to make good trading and investing decisions and ignore all the other noise that can lead to confusion and distraction. The plan also needs to include some thoughts on how you'll analyze the health of the economy and the broader market trend, and each issue on your watch-list; the result of this analysis will be used to set your trading bias (bullish or bearish), and you're level of aggressiveness (this is a statement about the current odds of success).

- The second part of the plan is more dynamic. While the market is closed or you're not watching the current market action, create or update your current plans. You do not want to be under any pressure to trade. If the market is open and you're watching or listening to the real-time action, the Trading Idiot is likely to get excited and will want to take over. You want to do your thinking (planning) in a quiet, thoughtful and focused environment. Keep a Trading Journal (I use Microsoft Excel spreadsheets and Word documents) to plan-out the details of each trade. These plans need to address all possibilities to keep the Trading Idiot from feeling like he or she has to step-in and get the job done. Begins with an analysis of the current economic data, all major market indices and then each issue on your watch list — a top-down approach. Actually, it's best to have two watch lists. A full watch list that contains every ticker symbol that should be considered; and a short watch list, which is actually a small sub-set of the full list. This short list should include all those tickers that you have an open position in or have favorable or potentially very favorable trading patterns developing and therefore require a much greater degree of attention. Most tickers spend most of their time in a trading range that is of no real value, and these can stay on the full list, which only has to be reviewed often enough to catch a potentially favorable move. Automation can greatly help to find tickers that should be moved from one list to the other (e.g., use your broker's alert system to watch for overbought or oversold conditions, which may require you to enter prices based on your analysis — if that price is reached, send an alert). This iterative analytical process should be done as needed for your current trading timeframe. Update, validate and revise your prior assumptions. It helps to take pictures of your charts; and add your thoughts and plans as notes. For each issue you own or would like to take a position in: identify the issue, the strategy you're looking to play, the entry criteria, the exit criteria (both profit target and stop-loss); and if you're going to allow the position to expand and contract, what criteria you must see to add or reduce the size of the position. As time progresses, this plan needs to be updated when new information becomes available and relevant. I know this is a lot of work; but trust me, if you don't do this, the Trading Idiot will try to do this on the fly and the results Will be Hazardous to your Wealth! In time, all this will become second nature — a trusted, habitual routine that any Trading Idiot can use because s/he does not have to think or second-guess the process because prior experience supports a profitable track record. But first you (the Thinker) must acquire the wisdom and earn the trust of the Trading Idiot (the Doer)!

Success in trading and investing requires the self-discipline, patience and persistence to work your iterative process (created in the prior rule). Start by maintaining relevant market wisdom — Monitor the tape, keep an eye on the Economy and its Key Data Points, and use a watch-list to more efficiently track news, commentary, and the associated prices for leading market indices (e.g., Wilshire Total Stock Market Index, S&P 500 Large Cap Index, Russell 200 Small Cap Index, and Total Bond Market Index,), and individual issues you own or would be willing to own, given a favorable setup. And when a planned trigger fires, perform the planned action as planned! As things progress, update your Trading Journal.

Learn from both success and failure. Grade each trade in your Journal as Good, Bad or Ugly; and update your plans as needed. Win or lose, a Good Trade is backed by a strategy identified in your plan and was traded according to plan. The plan and execution may still need a little work, but that's no real problem; make incremental, measurable improvements over time that are based on your market analysis, trade planning, and the actual results in the current market. This is how a beginning trader becomes a better trader and in time becomes a great trader (investor). A Bad Trade is any trade run by the Trading Idiot, which was unplanned and in response to the emotional stimulus of the moment. Getting rid of these trades is critical to your success; and a failure to do this will in time deplete your savings! Do you want to work at Wal-Mart or McDonalds when you get old? Please don't learn this lesson the hard way. An Ugly Trade is one that was backed by a plan; but executed by the Trading Idiot because the plan did not address the evolving situation or because you lost the self-discipline to follow the plan. These too will in time consume valuable savings.

Rate of return is a function of time; any return (positive or negative), when annualized for comparison basis, is bigger (magnified) for shorter holding periods than longer holding periods. It's better to make money quickly; but don't confuse better with easier. If you are like most people, the only thing that happens quickly on Wall Street is losses. It's frighteningly easy for the Trading Idiot to quickly reduce the size of any brokerage account. However, it's also relatively easy to make money slowing over time using the rules listed above, which promote growing your savings as an opportunistic longer-term Value Investor. Profitable shorter-term returns require a significant increase in trading skill, risk management, expense, and a much greater commitment of time and attention to real-time markets. Furthermore, the shorter your time horizon, the more you'll have to compete against professional traders and their super-computers, who are often backed by a well-trained support team and led by a seasoned manager to enforce discipline. It is very unlikely that you'll ever be able to out-trade these pros (the best of the best) over time; but you can earn a better total return than that offered by the big professional fund managers, if you learn to operate like them* and keep your cost structure below theirs, which is actually easy to do. And if you keep your eye on the macro economy, the market, and have some ready cash, every now and then the market will give you a lower-risk, high-reward opportunity to capture a relatively quick capital gain thanks to the market's tendency to over-react to breaking news and the short-term traders tendency to drive the current trend to unsustainable premiums and discounts; but you've got to learn how to spot these opportunities. In the long-run, economics and business fundamentals will drive price valuations; but in the short-run, traders drive prices based on technical patterns, breaking news and commentary, which can occasionally drive prices to irrational extremes when viewed from a fundamental economic and business perspective. It's these shorter-term moves that drive prices to discount and premium levels and the waiting arms of big professional fund managers. *Most big professional fund managers operate as patient value investors, buying at discount prices (this creates Support) and patiently selling at premium prices (creating Resistance), and whenever possible they earn income while they wait. These Support and Resistance levels can be seen on charts and you can learn to trade like (with) them!

Using the Rules above, learn to become a CPT in the longest and easiest timeframe (the economy's boom-and-bust cycle). Once CPT status is achieved, work to reproduce the prior results in a slightly quicker timeframe using only a small portion of your capital base to avoid big losses. Once CPT status is re-achieve, you're free to slowly increase your position sizes, while probing the next quicker timeframe. Continue the process until you find that you're unable to re-achieve CPT status, go back to a prior CPT timeframe, that's your current Optimally Effective Timeframe (OET) in the current market environment using your current skill set. But please note that the market is dynamic and can change, and so is your ability to learn. So your OET can and will change over time.

The key to compound growth is to first learn how to make a profit and then to use that profitable activity along with the original investment capital (your savings) to make an even bigger profit. Amazing compound growth occurs when the size of the investment capital gets bigger (note that a 10% return on $100 is only $10, but a 10% return on a million is $100,000) and/or when the time interval between profits gets smaller. But never forget that compound growth works for losses too and that's why we must maintain your CPT status and to focus the bulk of your capital in your OET.

Note that CPT status does not mean that we never take a loss. Sometimes we have to take a small loss to grow your ability and to learn something new, and to avoid taking an obviously bigger loss later (recall Rule No. 5 above). A Consistently Profitable Trader is someone who is able to grow the size of their account in their Optimally Effective Timeframe, which must change as market conditions change. The primary key to CPT status is to only put on bigger positions that are very likely to yield a positive Total Return sooner or later, and to avoid all those trades that tend to attract the attention of the Trading Idiot.

Good entrepreneurs study their business model and the market they operate in. They understand what twenty percent of their activities result in eighty percent of their profits and losses (their P&L); and that their P&L is very much a function of preparation, discipline and work ethic. They manage their cash-flow, know their operational numbers, and works to maximize profits and minimize losses. A good business man or woman will invest in their business, both cash and operational skills; and they create processes (i.e., a system, a daily routine, a set of rules) that can greatly improve the likelihood of future success. Having a repeatable, testable, and adjustable process that is understand, trusted, and used is the true mark of a professional (and is, frankly, the best way I know to control the Trading Idiot).

Take this business seriously; your future wealth and retirement is riding on the success of this business and your ability to be a successful owner/operator of this small business (note that the IRS will recognize a profitable activity as a business once it is properly structured — talk to a lawyer and an accountant that specialize in this area — thus allowing expenses to be a tax reducing costs of running the business).