— Warning: This notebook, like my life, is a work in progress and subject to change! —

As a student of life and the markets, I've learned that there are basically two common ways to make money on Wall Street. The first is through effective application of your own skill and capital; the other is to sell products and servers to those who lack the skill, but believe you've got what they need to profitably invest their capital. I prefer to operate in the first arena because there are too many morally troubling conflicts of interest associated with the latter approach. Furthermore, there's nothing else I know that can legally generate wealth as quickly as Wall Street while generally offering a favorable degree of liquidity (the ability to get your money back). Unfortunately, the markets can destroy wealth just as quickly; and even faster, if you're not careful. With this understanding in mind, I work to grow my trading and investing prowess, in hopes of one day being able to comfortably live off our retirement savings. To that end, I've read countless books, attended many trading and investing seminars, and I've also studied to take the Series 7 exam, which are required to become a licensed Financial Advisor (FA, which is also known as a Securities Broker). In 2002 I enrolled in an online program from Kaplan University and earned a Certificate in Financial Planning in 2004; and for a while, I ran a small family financial planning practice. Except for the few family clients I've agreed to retain, I'm no longer interested in taking on any new clients. I do, however, work to keep my skills current because I simply feel it's prudent to know what my FA and CFP should tell me (if I had a good one that would always put my best interest first — good luck finding one of those). Besides, it's always nice to have occupational alternatives.

Success in trading and investing requires Capital, Knowledge, Preparation, Patience and Self-discipline.

I use this notebook to help me master these keys to success in the business.

In my first paper, Health, Happiness, and Success (click here) I address the foundation of my philosophy. This is my daily mantra, a psychology tool, which helps me to stay focused on who I am and what I want to achieve in life. It helps me to avoid self-sabotage, the Achilles' heel of most traders and investors. This is the first section of my notebook for a reason — success starts with a proper mental foundation. This notion is based on the classic book by Napoleon Hill—"Think and Grow Rich"; and it (or any number of similar works that teach the power of a goal-focused, disciplined, opened mind) should be read and applied before investing time and capital elsewhere.

The Market's Nature — This is one of the most important paper in my notebook as it is a review of my understanding of the market's nature. It contains fundamental information that must be understood before taking your first trade.

Successful traders and investors need to Keep their Operations In-Synch with the Health of the Broader Market Trend

(e.g., Wilshire 5000 - Total Stock Market Index,

which is ultimately driven by the economy's boom and bust cycles.

I've found that ECRB's Recession-Recovery Watch

is excellent source of basic economic information;

and I monitor their U.S. Public Indexes.

Protective Stops is key to survival. Failure to understand and employ this tool will, in time, result in the loss of all or most of your investment capital.

In Risk Units & Position Sizing I address one of the most over looked subjects to new traders and investors. Here's a little Risk Calculator spreadsheet.

In Measures of Success, I address the statistics you can use to professionally monitor your progress.

— Seven Steps to a Good Trade —

— Gap Plays —

Once you find a good trade and know your maximum position size, should you go All-In or Pyramid Into your position or should you Scale In and Out of your position?

This is My Trading Plan. After a clear understanding of the market's nature and the information that follows in other papers above, this is the most important paper in the notebook because it lists the detailed strategies I look to trade and it contains the rules I've imposed on myself to control the Trading Idiot (within me) — the Trading Idiot is our undisciplined, emotionally reactive alter ego that professionals prey upon to make their living.

Every day, after the close, document (in my journal) and analyze the day's trades and market action — Grade each trade as Good, Bad or Ugly. Learn from both success and failure.

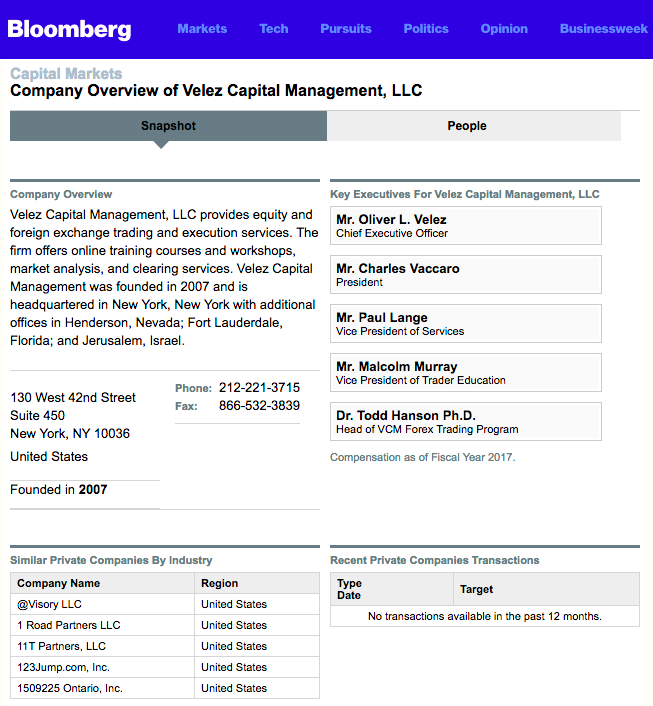

As a VCM Prop. Trader, my two-year attempt a being a professional day-trader in 2008 & 2009,

I received daily and weekly email lessons on trading.

Here's a link to an edited copy of the Daily Lessons and

a link to my edited copy of the Weekly Lessons.

Here and there, I've made minor edits to add information or to clarify points that we're unclear to me in my first reading.

I don't know this for a fact, but I believe most of these were written or edited by Paul Lange our mentor at the time,

which I believe is his take on market knowledge gathered from many sources.

I received daily and weekly email lessons on trading.

Here's a link to an edited copy of the Daily Lessons and

a link to my edited copy of the Weekly Lessons.

Here and there, I've made minor edits to add information or to clarify points that we're unclear to me in my first reading.

I don't know this for a fact, but I believe most of these were written or edited by Paul Lange our mentor at the time,

which I believe is his take on market knowledge gathered from many sources.

Finally, if you can only read one book on the subject of trading and investing, read "Trade Your Way to Financial Freedom" by Van Tharp. Van does a great job of addressing the three most important ingredients of successful trading and investing — System Development (how to find good trades/investments), Money Management (how to manage a trade/investment), and Psychology (how to understand and manage your beliefs and biases, which turns out to be the biggest obstacle to long-term success). Here is some additional information on trade planning.

A video "Creating and Using a Trading Plan with Paul Lange" and the associated PDF Slides.

And another video "Seven Steps to a Good Trade by Paul Lange" and the associated PDF Slides.

Psychology stuff

I highly recommend Mark Douglas books and lectures.

Mark authored two great books on trading — "The Disciplined Trader" and "Trading in the Zone".

Here's a link to an audio lecture on

Psychology of Trading.

How to Make Money in the Market (as a trader) is a brief one page summary.