Measures of Success

Bull markets naturally attract traders, like moths to an open flame; and initially, most find that they can make some money. Most people are naturally optimistic and tend to only think in terms of buying this or that; and because it's a bull market, they tend to realize some initial success. But most, if not all, new traders have faulty techniques for selecting and managing their trades; and as a result, this eventually kills their brokerage account when the market turns choppy or bearish. On the other hand, professionals focus on favorable setups, in the direction of the trend, with appropriate stops; and as a result, they are more likely to realize more winners than losers and/or bigger winners than losers.

There are two statistics that every trader should be tracking as part of their daily ritual. The first is your "Win/Loss Ratio" or "Simplified Sharpe Ratio". The actual Sharpe Ratio was developed by a man of the same name and is used to measure risk-adjusted performance of a diversified portfolio. We'll use a simplified form of this to compare your average winner to your average loser. The other statistic is your "Batting Average", which measures on the number of winning trades.

One of our goals as traders regardless of what time frame we are playing is to find chart patterns that have a relatively large target compared to the stop. The biggest problem for most traders is that the reward to risk ratio (RR) number becomes a fallacy. This happens because many traders never realize the RR that they project. In other words, what good is a 3-1 RR if you always sell way before you hit the ‘3’? What we need is a way to track how much of that RR you are ACTUALLY capturing. It is one thing to project a big RR. It is entirely another to bring it home to the bottom line.

The Win/Loss Ratio formula is the average dollar earned over the average dollar lost:

Total Winning Trade Dollars / Number of Winning Trades

------------------------------------------------------

Total Losing Trade Dollars / Number of Losing Trades

If every winning trade you have makes 100 dollars and every losing trade loses 100 dollars, you would have a Win/Loss Ratio of 1.0. If there is one formula you should apply to your trading stats, this is the one. Once traders get past the evils of not taking stops, they often begin to find some success. They start to have some winning days and start to feel good about what they know, and feel they are making money consistently. The only problem is that their account is not growing. For these people it is very likely that a look at their Win/Loss Ratio would reveal a very low number and thus, the evils of their trading.

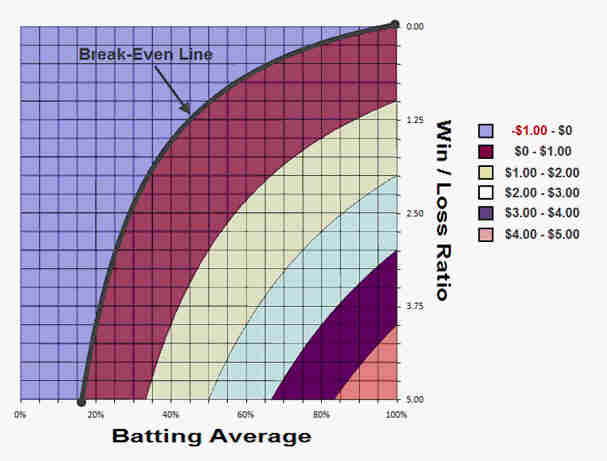

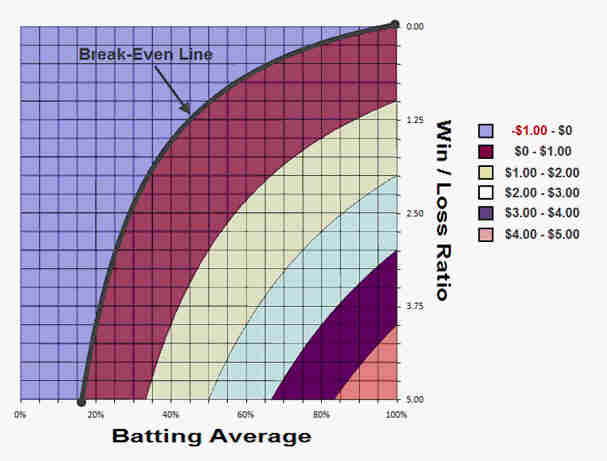

We are left off with the question, ‘What is a good Win/Loss Ratio?’ As we alluded, the answer is not an easy one. Some traders may throw out a number like 2.2, or 3.1 or 1.8. Any one of those could be an excellent number. However, a Win/Loss Ratio of 1 could be excellent also. It depends on the other component, your ‘Batting Average’ - the other important statistic to be tracked.

Your Batting Average is the percentage of trades that make money. The formula is the number of winning trades over the total number of trades:

Number of Winning Trades ------------------------ Total Number of Trades

Like all of trading, there are trade offs. It is easy to have a high Win/Loss Ratio if it comes at the expense of your Batting Average. This happens when large targets are picked but the quality of the play makes only a small percentage that get to the targets. The reverse can happen also. That is obtaining a fairly high Batting Average but at the expense of a small Win/Loss Ratio. For example: to improve your Batting Average (at the expense of your Win/Loss Ratio), use wider stops and/or take profits earlier; and to improve your Win/Loss Ratio, use tighter stops and/or let your winners run further.

Most traders are guilty of the last one. The reason for this is the eternal fear for most traders of having a losing trade. This makes them take profits early, leading to small but frequent profits. The problem is that the small profits are wiped out by the losing trades. The trader feels good because they are getting lots of trades ‘right’, but they seem to be forever at ‘breakeven’.

So a Win/Loss Ratio of ‘1’ may not be impressive, but a scalper who gets 65% of the trades right will make serious money at those numbers. As the time frame gets bigger, the Win/Loss Ratio tends to go up and the Batting Average tends to go down. Some core traders are very successful with a 40% Batting Average because they are obtaining a three, four, or five Win/Loss ratio. Many intraday scalpers may have a difficult time obtaining more than any "1" Win/Loss Ratio, but they may be getting way more than half the trades right. The answer will vary with your style, and it is the combination of a good Win/Loss Ratio with a good Batting Average that will determine your bottom line. Many traders will actually graph a product of the Win/Loss Ratio and Batting Average since they are reciprocal numbers. The higher the overall product the better your trading results will be.

While this may seem like it is simply redundant with the bottom-line dollars you make, it is not. You may be making money but if it is happening with poor "internal statistics" you may find the profits to be short lived. For example many swing traders in the late 1990s were making money, but with terrible statistics. They were simply being carried by a bull market. Once the bull market ended, their statistics told the truth and they had a difficult time trading the market. The types of trades you do, your initial reward to risk ratio, your final Batting Average and Win/Loss Ratio are all numbers that should be outlined in your trading plan. The more you plan and compare your results, the better the trader you will be.

For Example:

Trade 1 earns $500 Trade 2 earns $500 Trade 3 has a $400 loss Trade 4 earns $200 Trade 5 earns $200 Trade 6 has a $600 loss Trade 7 earns $600

Yields the following statistics:

Here are some notes to consider: