VCM Weekly Trading Lessons

Secondary Entries, Part 1 of 2

There are many times when using more than one time frame can be a big advantage. We have looked at this concept in prior issues when confirming a strategy, to see multiple time frames confirming a direction or a pattern. Today and next week we want to look at two ways in which using two different time frames to find the entry can be very useful.

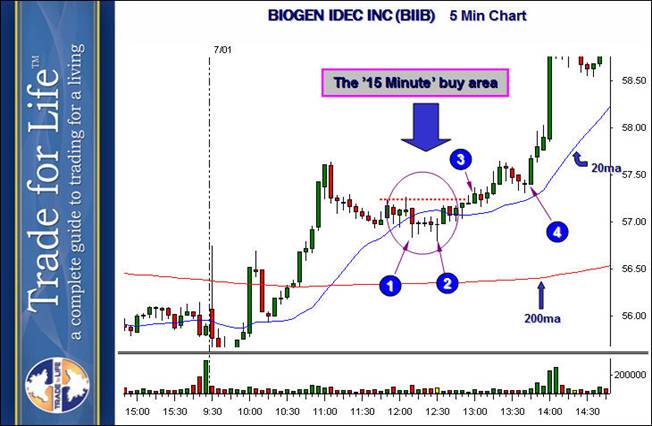

Have you ever found a play you liked, but after getting stopped out the play goes to the target you wanted? You look back and find out that you just got ‘jiggled’ out and then the play went on to be a success. This happens often, and can be bad for two reasons. First, it is obviously a problem because you are finding the ‘right’ plays, but instead of making money you are losing money. Second, you may feel the way to fix this problem is to ignore your stop, but this is the worse of the evils. You may save a couple plays, but the one that doesn’t work costs you more than all your winning plays made that day. Here is where a ‘confirmed’ or ‘secondary entry’ can be useful. Look at the 15 minute VCM buy set up on BIOGEN IDEC INC (BIIB), below.

Notice that the bar labeled ‘1’ is you entry bar. If the entry came first (traded above the prior bar’s high), then the play stopped on the same bar. Even if it traded down first and the entry was not stopped on the same bar, it was stopped two bars later at ‘2’. Notice also, that after stopping by a couple pennies, the stock goes on to hit any target you may have had. What can be done to minimize this? Let’s take a look at the five minute chart for the same play.

Note that ‘1’ and ‘2’ are the same bottoming tails, just so you can relate these two charts and compare them. There are many times that you should play a perfect set up. But many times there are questions about the play and you my want to make ‘sure’ as much as you can about the play rather than take the quickest entry. Look at this play for example, on the 15 minute chart. There are many positive things about the play. A strong uptrend, no resistance above, and a very strong advance. But there are some negatives. Do you see them? First the advance to 11:00 was a climactic one, so the first pullback is not a great entry. Second, the pullback is shallow, not even coming close to the 20 period moving average. Third, this is happening at lunch, a time known for sloppiness.

So to be ‘safer’, the concept is when the 15 minute chart buy set up triggers, you don’t actually take the trade. You watch the five minute chart and get a ‘second sign of strength’. This can be done using one of two entries. Either enter at ‘3’, as the stock trades above the bar that triggered the 15 minute buy set up. If that stop is getting too wide, then after ‘3’, let the stock pullback and play the first 5 minute VCM buy set up. This is perhaps the ‘best’ way because your stop is even tighter and the resulting profit can be even bigger even though the entry is later. But the real advantage is the you will not be in many of the failed plays, and you may avoid the stops on the plays that do work on the second of third try. Next week we will take a look at a different saturation where a 15 minute entry may have you playing long while the five minute chart is still in a downtrend.