Futures

Speculating in the Futures Market

What is a Futures Contract?

A futures contract is a legal agreement that is regulated by the

Commodity Futures Trading Commission (CFTC)

that is generally created at a futures exchange

when a new buyer and a new seller agree to a future exchange of assets

(e.g., the purchase of a commodity);

and that is why the security is called a Future, which is also known as a Forward.

A futures contract is a standardized agreement (an obligation)

for both the buyer and the seller

that specifies the quantity (amount) of a specific commodity (a real asset, like corn)

or of a financial instrument (e.g., a dollar amount of a specific stock or bond index, like S&P 500).

This standardized agreement specifies the settlement details,

like the future purchase price,

a description of the financial instrument or the commodity

(commodities can also specify grade or quality when more than one exist),

the quantity of assets to be sold in the future at

the specified time and location.

These are called the delivery details of the futures contract.

Why do we need (want) these futures contracts?

Most commodity prices go through normal boom-bust cycles

because the supply and demand for raw material normally go through boom-bust cycles.

The future (forward) contract is actually a very old form of financial agreement

that was created to smooth out the cash-flows that occur

during a normal year.

For example, it takes time for corn, cattle and other farm related goods to grow,

to be produced,

and when that commodity is ready to harvest and sell to the market,

there is often a surplus of supply and a big drop in market prices.

But at other times of the year when demand exceeds support, market prices are higher.

The current market price is called the spot price.

Let's say that a corn farmer plans on raising a crop of corn this summer,

like they have done for years.

The farmer can sell a futures contract in winter or Spring when

there's not a lot of corn around for sale and prices are a little higher than normal.

By selling this contract,

the farmer is being paid (the cost of the futures contract)

to take on an obligation to deliver a specified amount of corn in Fall after the harvest

(or some future harvest).

The farmer can use the proceeded from this sale (the cash raised) to buy (for example) seeds.

By selling the contract, the farmer also locks in the price and therefore the proceeds from

that future sale of that corn,

which has real economic value.

This contract can also be used to secure a business loan from a bank

to maintain farm equipment or to buy crop insurance.

If the crop fails,

the farmer can file an insurance claim

and use that cash to buy back the contract before the specified delivery date.

Producers of raw materials (like corn) can use the futures market to smooth-out

normal boom-bust cycles in cash flows and spot commodity prices.

Let's say that a producer of breakfast cereals

needs some amount of raw material (e.g., a commodity like corn) in the future

to produce their end product.

They can buy a futures contract from the farmer above (or anybody else that has a contract for sale) to lock-in

the price, quantity, and related details of the raw material they'll need in the future.

There is real economic benefit in turning these unknown variable costs into know values,

and that's why the cereal producer will gladly pay the farmer the cost of the contract.

Having a known future cost and production schedule to meet expected future demand for cereal

enables this business (and other businesses like this) to better project their future earnings.

The price of this contract today (the current market price),

will depend on the current level of economic activity

and on the expected future market environment.

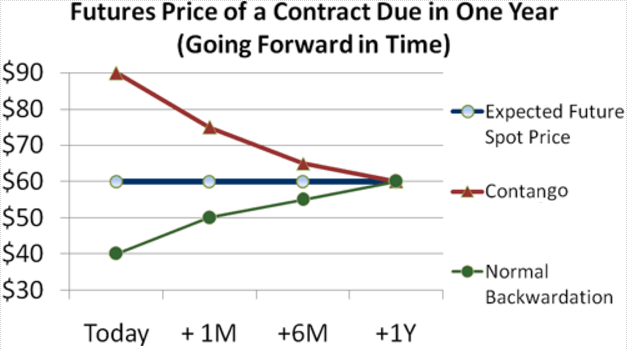

If the price stated in the future or forward contract is above the current (spot) price,

the market is said to be in (Normal) Backwardation;

and when the contract price is below the current (spot) price,

the market is in Contango.

What is Backwardation and Contango?

We'll hear these terms when we deal with futures contracts.

The difference refers to the shape of the future's price curve

relative to expected future spot price,

which is the price stated in the contract

(refer to the image "Futures Price of a Contract Due in One Year").

Because of inflation, prices in the future are normally higher then today,

and that should generate a rising (bullish) price curve called

Backwardation.

It is the market condition wherein the price of a commodities' futures contract

is trading below the expected spot price at contract maturity.

The resulting futures or forward curve would typically be downward sloping (i.e. "inverted"),

since contracts for further dates would typically trade at even lower prices.

In practice, the expected future spot price is unknown,

and the term backwardation may be used to refer to "positive basis",

which occurs when the current spot price exceeds the price of the future.

Backwardation is created when demand for the commodity (or financial index) exceeds supply

or when the rate of increase in demand exceeds the rate of growth for supply

(meaning, even if the current supply exceeds demand,

the rate differential will soon reverse that).

Backwardation creates a positive carry environment,

meaning that it's easy to buy low today and sell at a higher price in the future

(at or just before delivery).

Contango

occurs when supply exceeds demand or

when the future market environment appears to favor supply,

which creates a negative carry environment,

meaning that folks that hold the actual commodity

have to pay to store it until needed or until better market conditions return.

It is a situation where the futures price (or forward price) of a commodity is higher than the spot price.

In a contango situation, hedgers (the producers and users of the commodity)

or arbitrageurs/speculators (non-commercial traders and investors),

are willing to pay more now for a commodity then at some point in the future,

based on the expected price of the commodity at that future point.

This may be due to people's desire to pay a premium to have the commodity in the future

rather than paying the costs of storage and carry costs of buying the commodity today.

Backwardation is normally associated with normal economic growth

and Contango with economic contractions.

We'll hear these terms when we deal with futures contracts.

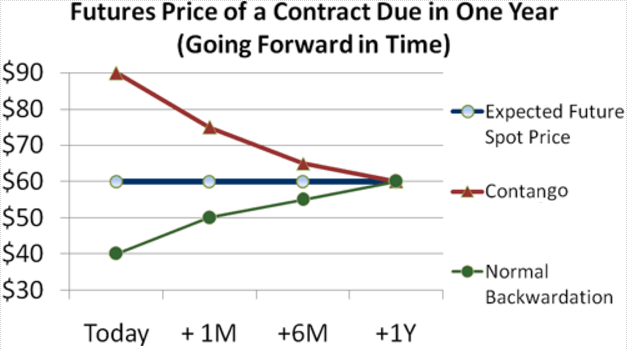

The difference refers to the shape of the future's price curve

relative to expected future spot price,

which is the price stated in the contract

(refer to the image "Futures Price of a Contract Due in One Year").

Because of inflation, prices in the future are normally higher then today,

and that should generate a rising (bullish) price curve called

Backwardation.

It is the market condition wherein the price of a commodities' futures contract

is trading below the expected spot price at contract maturity.

The resulting futures or forward curve would typically be downward sloping (i.e. "inverted"),

since contracts for further dates would typically trade at even lower prices.

In practice, the expected future spot price is unknown,

and the term backwardation may be used to refer to "positive basis",

which occurs when the current spot price exceeds the price of the future.

Backwardation is created when demand for the commodity (or financial index) exceeds supply

or when the rate of increase in demand exceeds the rate of growth for supply

(meaning, even if the current supply exceeds demand,

the rate differential will soon reverse that).

Backwardation creates a positive carry environment,

meaning that it's easy to buy low today and sell at a higher price in the future

(at or just before delivery).

Contango

occurs when supply exceeds demand or

when the future market environment appears to favor supply,

which creates a negative carry environment,

meaning that folks that hold the actual commodity

have to pay to store it until needed or until better market conditions return.

It is a situation where the futures price (or forward price) of a commodity is higher than the spot price.

In a contango situation, hedgers (the producers and users of the commodity)

or arbitrageurs/speculators (non-commercial traders and investors),

are willing to pay more now for a commodity then at some point in the future,

based on the expected price of the commodity at that future point.

This may be due to people's desire to pay a premium to have the commodity in the future

rather than paying the costs of storage and carry costs of buying the commodity today.

Backwardation is normally associated with normal economic growth

and Contango with economic contractions.

Future traders are categorized as either

Hedgers or Speculators.

The corn farmer and the corn cereal producer in the examples above

are basically hedging —

their trades are basically designed to firm-up their business plans and to reduce their risk (smooth-out) of abnormal market forces.

Speculators are traders that take on that risk in hopes of making a profit

and normally close out their trade on or before First (Delivery) Notice.

Note that some hedgers can also be speculators when their trades are designed

to take advantage of their superior knowledge of the market they trade in and their excess cash reserves.

When a future is traded (created) by a new buyer and a new seller,

open interest (the number of existing contracts) goes up by one.

If a new buyer or seller does a trade with an existing counter party,

then open interest remains the same

(they're just moving the obligation around);

and when an existing buyer trades with an existing seller,

the open interest goes down by one and

the contract is effectively settled without an exchange of the underlying assets and the obligation is dismissed.

What drives prices?

There are three factors:

1) The natural convergence between the Cash Price of the underlying commodity and related Futures Price

as time approaches the delivery date the spread between the two shrinks to zero

(click here to learn more).

2) Technically speaking, Supply and Demand.

3) Fundamentally speaking, it depends on the nature of the underlying asset and the market environment.

Stocks and bonds are Anticipatory Assets,

and current (spot) prices attempt to anticipate future prices

and ultimately depend on growth rates and interest rates,

and do best (are very bullish) before full economic capacity is reached

(for details, refer to the second paragraph

in The Business Cycle section

of my paper The Economy, Markets, and Profitable Insights.

Anticipatory prices move before economic reality and are therefore subject to correction

when future economic reality does not confirm anticipated prices.

Commodities (real assets) are spot priced and perform best when at full capacity,

and depend on the level of economic activity.

Spot prices for commodities trace real economic growth.

Corrections can occur in the futures market too,

but tend to occur as a result of natural disasters or other unexpected impacts on the economy.

Stan Benson

We'll hear these terms when we deal with futures contracts.

The difference refers to the shape of the future's price curve

relative to expected future spot price,

which is the price stated in the contract

(refer to the image "Futures Price of a Contract Due in One Year").

Because of inflation, prices in the future are normally higher then today,

and that should generate a rising (bullish) price curve called

Backwardation.

It is the market condition wherein the price of a commodities' futures contract

is trading below the expected spot price at contract maturity.

The resulting futures or forward curve would typically be downward sloping (i.e. "inverted"),

since contracts for further dates would typically trade at even lower prices.

In practice, the expected future spot price is unknown,

and the term backwardation may be used to refer to "positive basis",

which occurs when the current spot price exceeds the price of the future.

Backwardation is created when demand for the commodity (or financial index) exceeds supply

or when the rate of increase in demand exceeds the rate of growth for supply

(meaning, even if the current supply exceeds demand,

the rate differential will soon reverse that).

Backwardation creates a positive carry environment,

meaning that it's easy to buy low today and sell at a higher price in the future

(at or just before delivery).

Contango

occurs when supply exceeds demand or

when the future market environment appears to favor supply,

which creates a negative carry environment,

meaning that folks that hold the actual commodity

have to pay to store it until needed or until better market conditions return.

It is a situation where the futures price (or forward price) of a commodity is higher than the spot price.

In a contango situation, hedgers (the producers and users of the commodity)

or arbitrageurs/speculators (non-commercial traders and investors),

are willing to pay more now for a commodity then at some point in the future,

based on the expected price of the commodity at that future point.

This may be due to people's desire to pay a premium to have the commodity in the future

rather than paying the costs of storage and carry costs of buying the commodity today.

Backwardation is normally associated with normal economic growth

and Contango with economic contractions.

We'll hear these terms when we deal with futures contracts.

The difference refers to the shape of the future's price curve

relative to expected future spot price,

which is the price stated in the contract

(refer to the image "Futures Price of a Contract Due in One Year").

Because of inflation, prices in the future are normally higher then today,

and that should generate a rising (bullish) price curve called

Backwardation.

It is the market condition wherein the price of a commodities' futures contract

is trading below the expected spot price at contract maturity.

The resulting futures or forward curve would typically be downward sloping (i.e. "inverted"),

since contracts for further dates would typically trade at even lower prices.

In practice, the expected future spot price is unknown,

and the term backwardation may be used to refer to "positive basis",

which occurs when the current spot price exceeds the price of the future.

Backwardation is created when demand for the commodity (or financial index) exceeds supply

or when the rate of increase in demand exceeds the rate of growth for supply

(meaning, even if the current supply exceeds demand,

the rate differential will soon reverse that).

Backwardation creates a positive carry environment,

meaning that it's easy to buy low today and sell at a higher price in the future

(at or just before delivery).

Contango

occurs when supply exceeds demand or

when the future market environment appears to favor supply,

which creates a negative carry environment,

meaning that folks that hold the actual commodity

have to pay to store it until needed or until better market conditions return.

It is a situation where the futures price (or forward price) of a commodity is higher than the spot price.

In a contango situation, hedgers (the producers and users of the commodity)

or arbitrageurs/speculators (non-commercial traders and investors),

are willing to pay more now for a commodity then at some point in the future,

based on the expected price of the commodity at that future point.

This may be due to people's desire to pay a premium to have the commodity in the future

rather than paying the costs of storage and carry costs of buying the commodity today.

Backwardation is normally associated with normal economic growth

and Contango with economic contractions.