VCM Weekly Trading Lessons

When to Trade What, Part 1 of 3

If the title sounds a little confusing, it was meant to. The issue to be discussed today, is not just ‘when’ to trade. There are trades that can be done any time the market is trading. That does not mean that you should be trading all day long, it just means that the times you pick to trade can be any time, IF you know what to trade. That is the point of this article.

Even lunch. While it is often much discussed ‘not’ to trade lunch, part of that statement is left off. Do not trade lunch, unless you know how to trade it. Lunch is the time when many traders get into trouble, because they don’t realize that many things will not act the same during lunch as they do during ‘non-lunch’ times.

The first issue to consider is the volatility and target expectations. If you could give a ‘volatility rating’ to the market, or stocks in general, it would look like this. If things move ‘1’ during lunch, they move ‘3’ between 2:15 and close, and move ‘5’ between open and noon. If you do not realize this, targets will be unrealistic and lead to frustration.

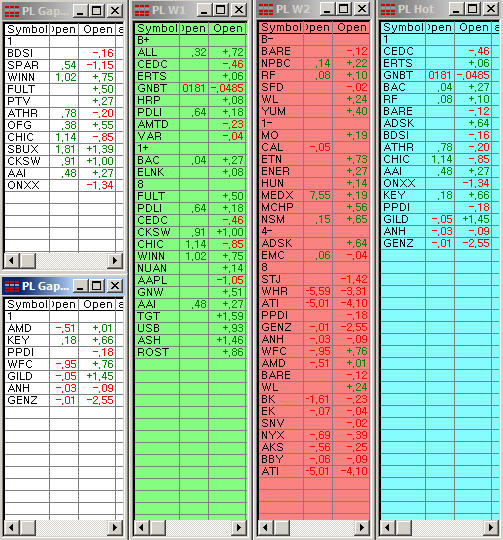

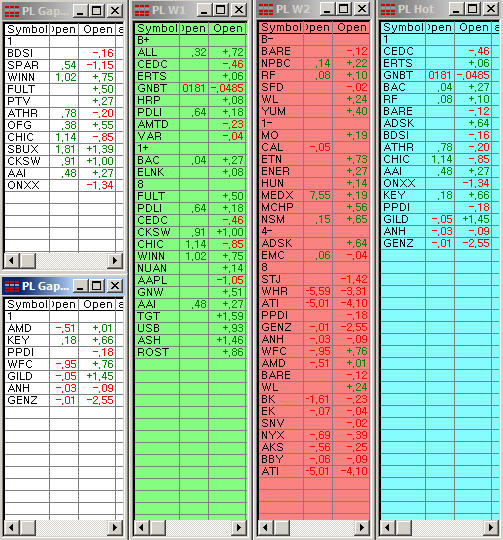

Before Open: So how do you focus your time? For many people, the time spent between 8:30 and 9:30 may be the most productive (all times are Eastern, New York, market time). Preparing your watchlist, forming a gap list, and starting a market bias can be key to how your day goes.

Get ready for the open by picking the best of your favorite stocks, the best of your daily watchlist, and the best of your gapping stocks and know how you will play them, if at all, before the market opens.

The First Five and Thirty Minutes: Very few traders realize the power of reversal times, or the power of having the knowledge of how to trade each part of the day. Most traders, who play trends and breakouts, should not even be playing the first thirty minutes of the day. Look at your records. The chances are that you have a very low batting average for trades taken during the first thirty minutes. The only trades that should be taken during the first thirty minutes are based on gaps or other very special strategies. The 9:35 reversal time is one of the most reliable, yet few traders realize its power. Many get stopped out of plays, rather than profiting from, the 9:35 reversal.

The above chart shows an example of a stock that gapped bullishly, but sold off hard for less than two minutes, and turned around so quickly, most traders who mistakenly tried to short the move down suffered losses. Knowing that this flurry move down offers a buying opportunity, on a regular basis, when played on the right stock, can turn potential losers into big winners.

Once the five minute reversals are over, many stocks have solid moves into the 10:00 reversal time. This reversal time can run anywhere from 9:50 – 10:10, but the power move usually comes closer to 10:10. Trends between 9:35 and 10:00 are usually very reliable, if backed by a strategy. However, 10:00 or 10:30 are the reversal times that often set highs or lows for the day. Stocks that do not reverse at these key times may go on to be ‘power trends’. Next week, we will look at the power of these two critical morning reversals, and the arrival of lunch.