VCM Weekly Trading Lessons

A Safe Way to Play a Gap

Many traders like to find plays in stocks that gap up. It stands to reason. Many gap plays are very reliable, and there is often a large movement in the stock very quickly. This amount of ‘instant gratification’ attracts many traders. Some are drawn for good reasons, and some not for good reasons.

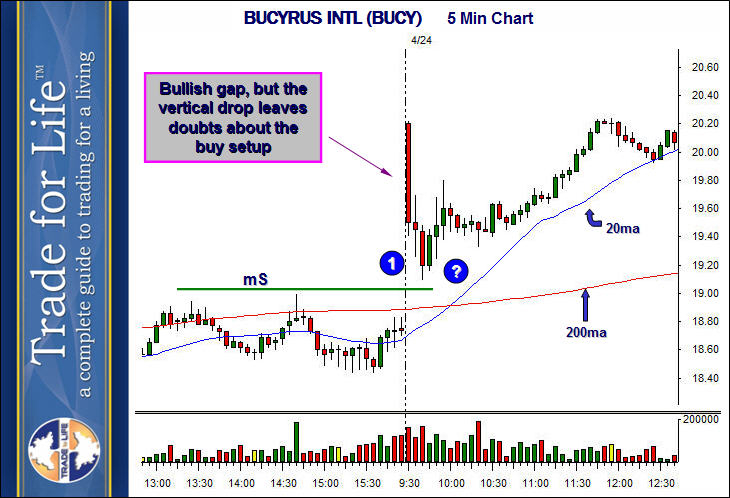

Unfortunately, these fast moves attract many new traders who liken this to ‘gambling’. These new traders may win on any given day, but will lose over the long run. Without the trader understanding where the odds lie, and where the best entries are, the wins will be far and few between. There are many misconceptions about gaps, and trading gaps during the first few minutes can be very difficult. They move fast, there can be a lot of slippage, and good plays can stop out before they work, even when they do work. Look at the drop on Bucyrus Intl. (BUCY) on the five minute chart below, after it gapped up on 4/24.

This stock dropped over 5% of its price in five minutes. Look at all the topping and bottoming tails and wide bars between open and 10:30. Even the best trader would have a tough time with that.

Let us look at the whole play. This was a bullish gap. We are not showing the daily chart, but it gapped over a daily consolidation 4/24. This lesson is not about rating the gaps, so assume it was bullish. Like all bullish gaps, this does not mean the stock will go higher when it opens. It already gapped up a significant amount, and many times we want to buy the pullback. Sometimes, we get a nice smooth move down, that can be played at the appropriate level. Sometimes, we get what we have above. The buy setups we want to take should not follow a vertical move down. This makes for a lot of failed setups. Yet, the gap was bullish, and the stock seems to be holding at ‘1’, above minor support (mS), which is bullish. So this leaves a big ‘?’ on how to handle this.

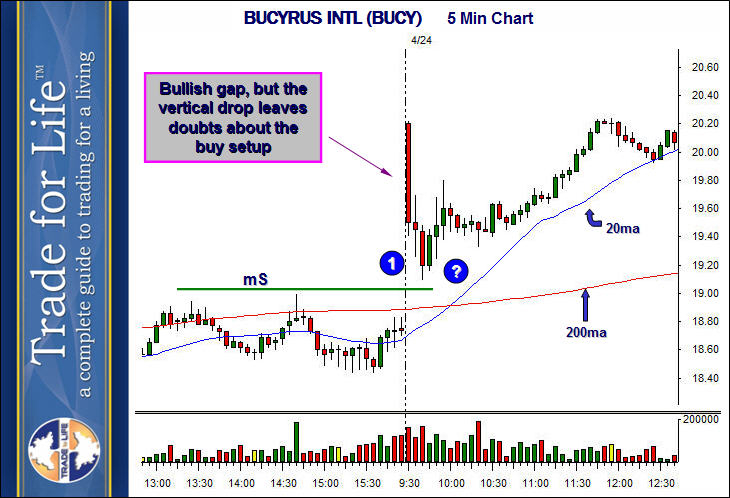

Here is an answer that will work for many people, and is perhaps the ‘smartest way’ to play these. Just wait. Let the volatility leave the stock, and see if there remains significant buying pressure. Look for the ‘secondary sign of strength’. Look at how this pullback looked on the next time frame lower, on the two minute chart.

Notice the vertical line in the middle of the chart. Notice the difference in the bars on the left side, and on the right side. The left has large bars, tails, and no real pattern. Now, look on the right side. Tight bars, and a smooth pattern have developed. Notice that on both sides of the bar, the stock stabilized and found support, on the green dotted line, around 19.40. The next rally then set up a nice smooth two minute buy setup at ‘1’. This is the entry we want. While it is later than the early morning setup, it is also more reliable, and the smooth pattern often gives a reward to risk ratio the delivers more profit at the final target. Trade smart. Use the power of a bullish gap, with a secure, refined entry.