VCM Weekly Trading Lessons

Restricting Your Trades

One of the biggest impediments to success for many traders is the inability of virtually every trader to write an effective plan. Those who do manage to write one face the challenge of determining if the plan is effective both in how it is written, and in the actual results it achieves. Traders usually have a difficult time in the actual writing of the strategies that are going to be used. Often (almost 100% of the time) the first attempt at writing a trading plan has strategies that are simply a ‘cut and paste’ from the manual. The problem usually is that if the strategy is for a day trade, the strategy could show up hundreds of times throughout the day. The question then becomes, ‘Which one of those hundreds of trades are you actually going to take?’ The plan is totally ineffective if it does not help restrict the total possible trades. The trader, during the trading day, will usually pick the trades that do not work well. The filtering process was not complete.

Solving this is really quite easy. There are as many ways to fix this as the mind can imagine. Even a newly trained trader can combine several things he or she knows to come up with a more effective plan. Let’s take a look at just one idea.

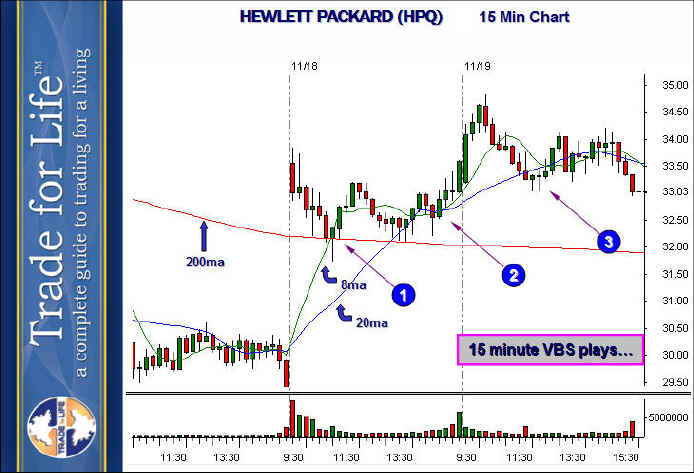

Suppose the trader’s main objective was to play VCM buy setups (VBS) on the one minute chart. The usual trading plan will repeat the basic requirements in the manual, and would occur several hundred times a day if you had a large universe of stocks. So let’s restrict it. Let’s use a smaller universe of stocks to look at. How should we restrict the universe? Let’s use a universe that is already taking a step in the right direction. What if we came to the market that day armed ONLY with stocks that were in 15 minute uptrends and above the 200 period moving average. Your plan would have to specify EXACTLY what is needed to form that uptrend, of course. Then you search ONLY this list of stocks to find your two minute buy set ups. For example, below is a 15 minute chart of HPQ.

First of all, understand nothing written in this lesson is a ‘rule’. It is a spark to get you thinking of ways to make your trading plan effective. If you wanted to use an hourly chart to qualify your trades, that is fine. If you wanted to use stocks that gapped bullishly that is fine. If you wanted to use a 15 minute uptrend, or trade only inside of a 15 minute buy set up (VBS), that is fine. In the above example, let’s say you were going to look for your one minute buy set ups ‘after’ a 15 minute VCM buy set up triggered. You would then be looking at the one minute chart after the areas marked ‘1’ and ‘3’, and maybe ‘2’ depending on how you wrote your plan. So let’s take ‘1’ for an example, and get down on that one minute chart.

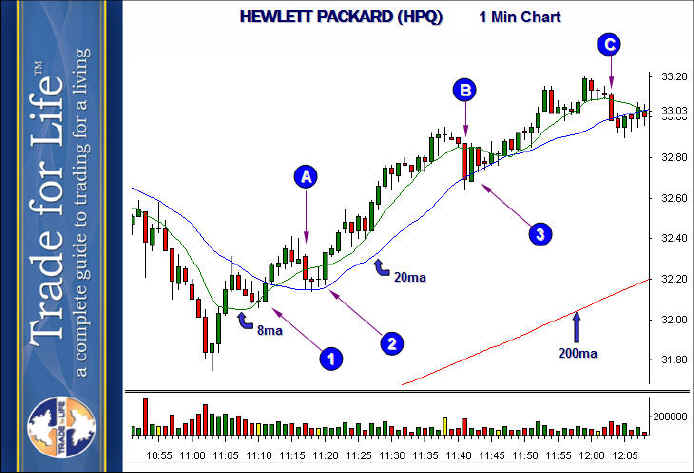

The 15 minute chart ‘triggers’ at about 11:05 and the very first pullback occurs at ‘1’, above. This forms a very nice one minute VBS. If your plan called for using an ‘eight period moving average’ trail stop (beyond the scope of this lesson), you would have entries at ‘1-3’, and the corresponding exits at ‘A-C’. That makes three near perfect trades.

Now, you will likely say that we searched to find this perfect example. However, that is not the case. Check for yourself. Look inside 15 minute uptrends and check the reliability and quality of the smaller time frames. You will always find it superior. Not only is the quality better, but you have a limited universe to be looking at, which increases quality by reducing the focus and eliminating the low quality distractions.

Again, this is merely and example. There are many other ideas you can implement. Write your trading plan and follow it.