VCM Weekly Trading Lessons

Power Trends and Riding the ‘Eight’

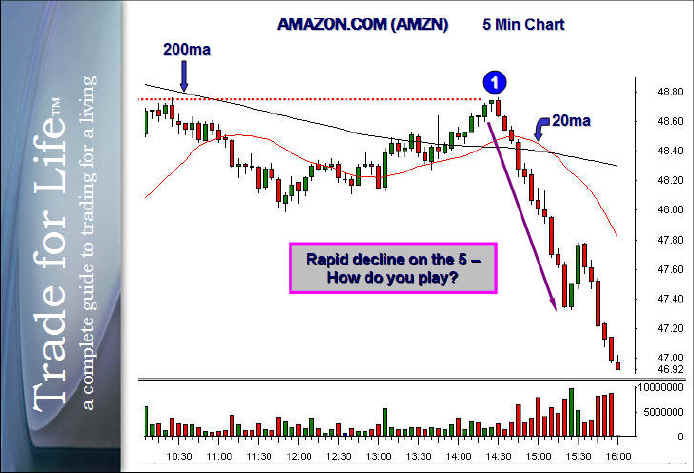

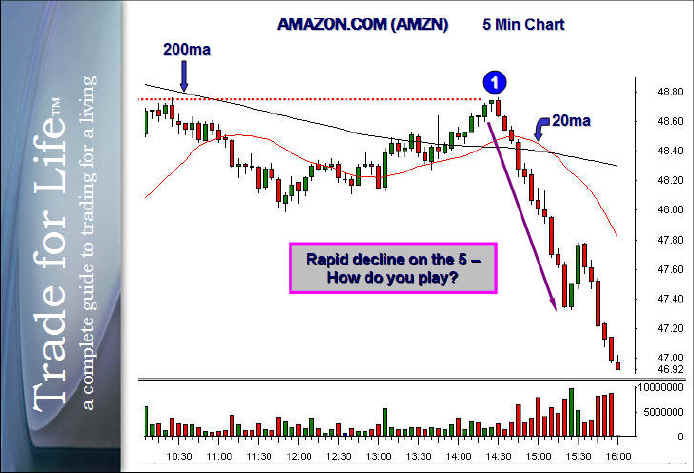

One issue that often leaves both new and experienced traders flat footed is the ability to find an entry to a stock that is moving quickly. It often seems that once the original entry is gone, the perfect play becomes frustrating, because another entry is never found. Perhaps you have experienced this in your own trading. Take a look at the 5 minute chart of AMZN for an excellent example of this.

There was an entry available at "1", as the stock rallied into a double top high. If you missed this entry, or you deemed this entry to be not acceptable because of other things on the chart, how can you participate in the incredible decline to follow? You may be asking "why not just jump in anywhere?" The answer to that question should be obvious to some of you. At the time the decline begins, we have no way of knowing how much it will follow though. We must take entries that show the stock intends to go in a certain direction, and have a stop attached to it that is a reasonable amount. Once the stock began falling, there was no stop available on the five minute chart other when where the stock rolled over at "1". Answer; move down one time frame. Here is the two minute chart.

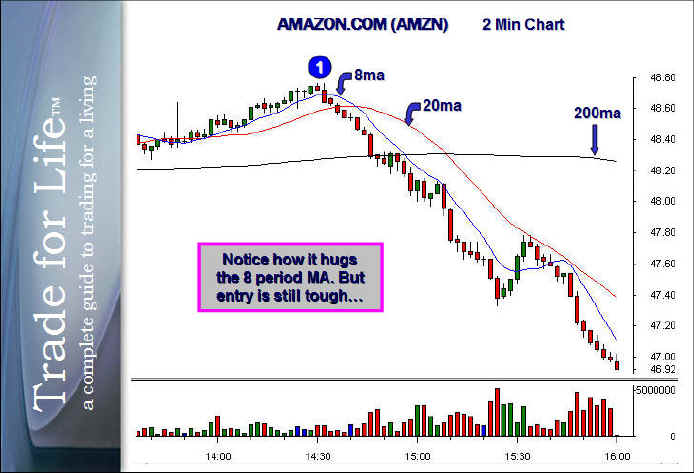

By coming down to the 2 minute chart, we are allowed to see more detail. One of the first things that catches our attention on this chart is the 8 period moving average. Notice that every rally dies into the declining 8 period moving average. So this becomes a possible way to play this declining stock. There is still a problem however. There is not enough movement on this two minute chart to set up most of our strategies. Notice most rallies are only one or two bars, and most bases are only a few bars as well. It becomes difficult to make decisions when the chart is moving so "fast". Let us take a look at moving down one more time frame, to the one minute chart where many scalpers live.

Now, here we begin to see with much more clarity. If the initial play was missed at the high at "1", there were other entry points available. Shortly after the decline began, there was a pause where four bars in a row had similar lows setting up a small base from which a breakdown could be played. Shortly after the stock fell beneath the 200 period moving average, another consolidation formed for a longer period of time that created a break down play (BDP) into the declining 20 period moving average. After that, a VCM sell setup (VSS) occurred into the declining 20 period moving average.

Some of you might be wondering if this is a good idea, because the moves that occur are smaller and smaller as we move down in timeframes. Doesn't this take away from the overall profit? The answer is ‘no’. As experienced traders know, your profit is determined by the reward to risk ratio on each trade. For example, let us look at that last VSS. The drop that occurred was many times the risk amount, as determined by the stop loss. It doesn't matter if the stock drops $.40 with a $.10 stop, or four dollars with a one dollar stop. The profit generated by proper trading should be the same in both cases.