VCM Weekly Trading Lessons

Maintaining a Market Bias

To have a market bias simply means that you have formed an opinion of which direction the market is most likely to take next. There are three directions available. Up, down, and sideways. We have written prior articles on what the "market" could be considered, but for practical purposes now, let us just assume that the S&P 500 will be our measurement for the market. We will look at the S&P 500 through the eyes of the SPY, which is the ETF tracking stock for the S&P 500.

There are two issues we need to discuss first. The first is why we need to form an opinion of market direction. The second question is whether or not we need to incorporate a bias in our thinking on every single trade.

The reason we form an opinion of market direction is because the greatest odds always lie in playing with the trend. Generally speaking, for most trades, we are either interested in buying pullbacks in an uptrend, or selling pullbacks (rallies) in a downtrend. Therefore, we need to determine if we are in an uptrend or downtrend. That part is fairly simple, and should be the primary focus. That is to say, we are most concerned with what the market is currently doing. However, on an intraday basis, on smaller time frames, the market direction can change several times throughout the day. Therefore, we want to be able to identify the times that the market will be most likely to change, so we can stand aside or begin preparing for the next move.

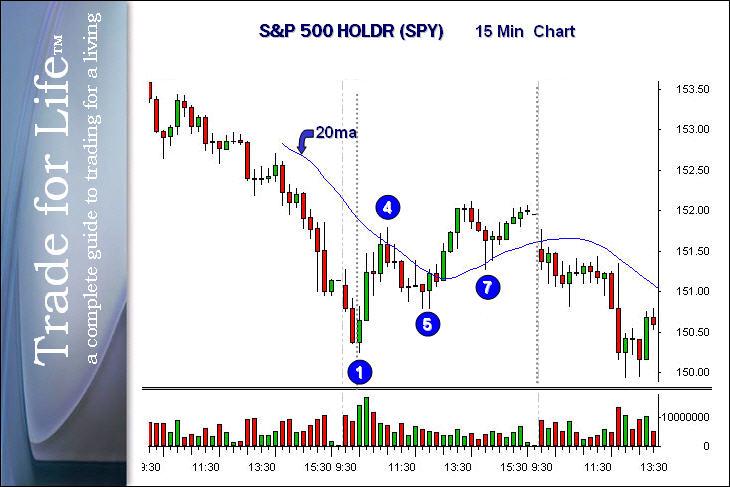

Let us take a look at the SPY on both the five and fifteen minute charts on a recent trading day.

The first thing to consider when trying to get a handle on the market in the morning is what happened on the prior day, and what happened going into the close. On this particular day we can see from the 15 minute chart that we had a continuous all day drop and the drop actually accelerated it right into the close on the prior day (the first of the three days shown on the 15 minute chart, just before ‘1’).

This is important information, because early-morning sell-offs are generally bought. They are bought because novice traders think the market is continuing lower underneath the 1, 2, or five minute lows, get short, and add to the buying when the market moves up. When this happens, be set to go long on the first set up available.

On the five minute chart, we had just such a set up. At "1" we had a continuous drop into 10 o'clock reversal time, after the extended move down yesterday. We also had the widest bar coming at the end of the move (on the five minute chart), a likely sign that the move is almost over. The buy setup that formed at 1, was an excellent opportunity to get long. The target was the 20 period moving average, on the five minute chart.

As it turned out we went through the 20 period moving average on the five minute chart. The amount of this rally was very bullish, and that creates a bias to want to get long on the next pullback. Generally, anything that retraces more than 60% of the prior drop is bullish. On an intraday basis, we retraced 100%. Because this was such a bullish move, the next pullback was deemed to be buyable. We had that pullback happen on a five minute chart at 3, sitting on top of the rising 20 period moving average. The rally took us to 4, which happens to be the declining 20 period moving average on the 15 minute chart.

Once we get into lunch, the more reliable setups start to occur on the 15 minute chart. There is too much data that late in the day for the five minute chart to continue to act correctly and hold all support and resistance levels. That next pullback which landed at 5 was a fairly nice looking 15 minute VCM buy setup (VBS) after pulling in with about a 50% retracement. For a tighter entry we can also see that as this was happening, there was a retest on the five minute chart that gave an alternate entry as a five-minute VBS.

The next pullback landed itself on top of the newly rising 20 period moving average on the 15 minute chart with bottoming tails at 7. The rally from here took us into the close that day.

Using the tactics that we teach at our seminars and in the VCM Trade for Life™ Live Trading Room every day can keep you on the right side of the market. This can be used to trade the market itself, such as trading the QQQQ or SPY, or the E-mini contracts, or the futures. They can also be used to develop a bias for the day, to play other stocks and time your entries properly using relative strength and relative weakness.