VCM Weekly Trading Lessons

Learning From a Loser…

Now don’t get us wrong, we are not talking from learning from a losing trader. It may be possible to take the opposite of all of the loser’s trades, but in this article we are talking about learning from a losing trade. There are a few different ways to do this. All trades should be studied after the fact to determine if the play done was a valid strategy, if it was entered properly, and if it was managed properly. Whether it was a winner or a loser does not matter. There ARE bad winners and good losers. Sometimes you may find you made a mistake and it was a trade that should not have been entered. Sometimes you may find it was a good play, but it is just one of those that didn’t work. Sometimes the play was so nice, that the ‘failure’ to work tells you something. THAT is the point of this article.

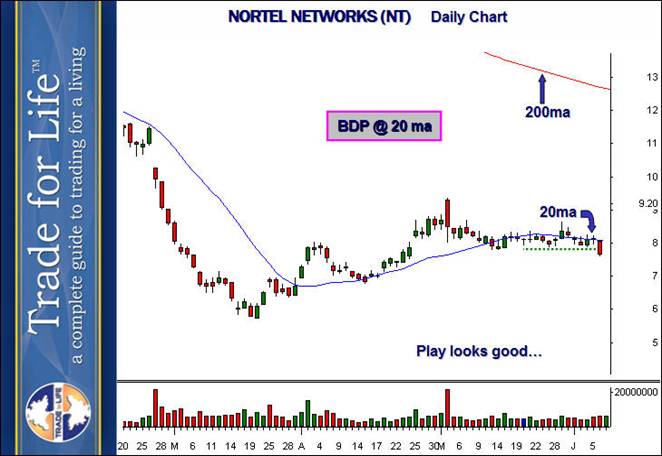

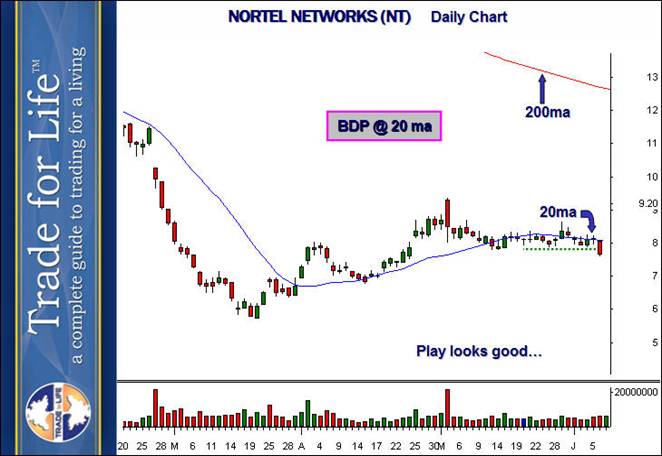

Below is a play that was actually posted in our Daily Trading Letter last Monday, June 9th. It called for a VCM breakdown play at the newly declining 20 period moving average. As you will soon see, this play did not work.

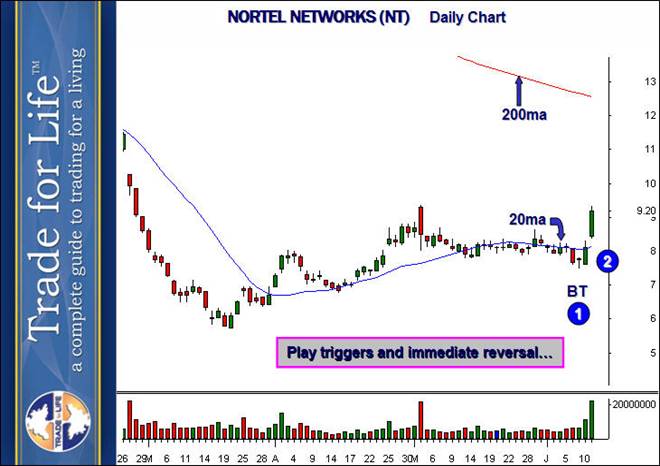

In review, this play actually looked very good. It was confirmed by the weekly chart and actually began with a bearish wide range bar. What is really interesting is that the play not only failed, but failed instantly and with style.

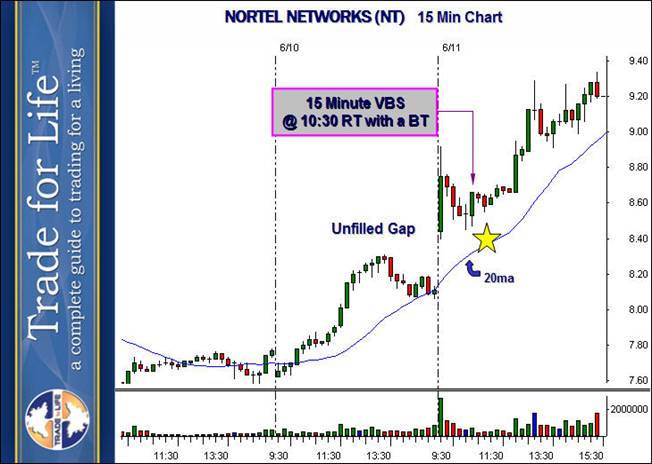

It triggered the following day, but it no sooner triggered than it formed a bottoming tail on day one, and day two was a bullish green bar that countered the original red break down bar almost perfectly. This was enough to raise an eyebrow and that night it was placed on the watchlist for the Proprietary Trading Room. That following day, it gapped up, and the first pullback gave the following set up on the 15 minute chart.

The resulting 15 minute buy set up happened right at 10:30 reversal time, with a nice bottoming tail (BT) after an unfilled gap to the upside. It also had relative strength as the market was falling to support at the time. The Proprietary Trading Room sold half into the 8.85 high of the day area and half into the topping tail going up to 9.20. It was a high risk reward play and the play of the day from the room.

What is important is that it all came into play because it was noted as an ‘exceptional failure’. When you have strict standards and wait for good plays, they usually work. But the market often speaks to us best through its failures. When great plays fail, the chance of them going the other direction becomes very high. This is what happened with Nortel.