VCM Weekly Trading Lessons

Is that a Strategy or an Entry?

There are many terms that get thrown around when you are learning to trade, and some of them have a very significant importance. Take for example, the following terms that are tossed around quite freely; strategy, tactic, setup, entry, trigger. Most of these differences are just ‘definitions’, but a couple of them may be key to your trading. Let us define them, and then talk about how a couple should be used properly. Here are some ‘Webster’ dictionary definitions.

Tactic - a device for accomplishing an end.

Strategy - a careful plan or method.

Setup - the assembly and arrangement of the tools and apparatus required for the performance of an operation

Entry - the act of entering.

Trigger - something that acts like a mechanical trigger in initiating a process or reaction.

In the trading world, we can simplify these terms. “Entry” and “Trigger” are the same terms, they have the same ‘meaning’ in trading. If we are going to enter a play ‘over the prior bar’s high’, the prior bar’s high is the ‘entry’ or the ‘trigger’. It is the threshold that must be crossed to enter. That bar becomes the entry bar, or the trigger bar.

“Strategy” and “Tactic” are vey similar terms as well in trading. “Strategy” is the broader term. The “strategy” may be to buy a strong market when it pulls back to support; the “tactic” may be to use a VCM 15 minute buy set up to accomplish that. In real use however, these terms are used interchangeably. At VCM we teach the VCM buy setup as a “strategy” or a “tactic”. Again, setup is a sub category of the tactic, and refers to the smaller pieces that make up the tactic. For example, when looking for that 15 minute VCM buy setup, we may be looking for the play to be setup with a rising moving average, or minor support.

So, if we condense these words down to just a “strategy’ and an “entry’, which are distinct words, can we identify the difference? It sounds easy, but many traders make the mistake of mixing these two important terms up. In other words, they will take a play ‘because the current bar traded over the prior bar’. However, if that is all that happened, there is no ‘play’ that should be taken. Trading above another bar’s high is not a ‘strategy’, it is an ‘entry’ to a strategy. Unless all the elements of the strategy exist, trading over a prior bar’s high is meaningless. In other words, ‘entries’ do not stand alone.

Finally, many times a ‘strategy’ can also serve as an ‘entry’ to a bigger strategy. Let us take a look at how all the terms apply in the following two examples.

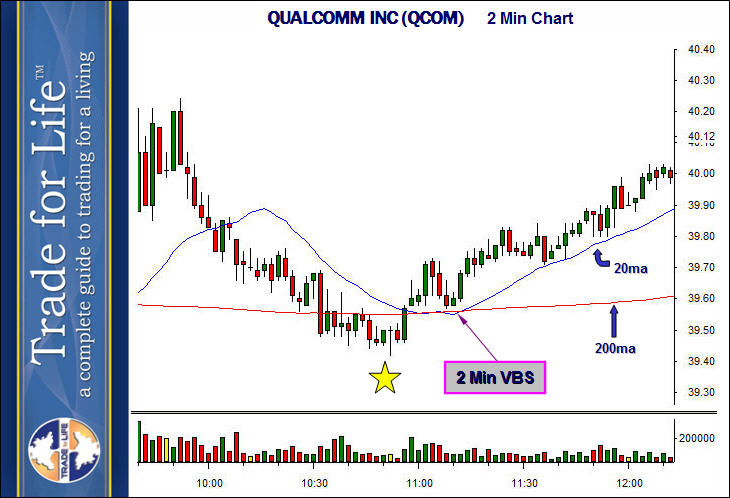

Above is a two minute VCM buy setup on Qualcomm (QCOM).

Tactic – to use the two minute chart to capture quick moves in trending stocks

Strategy – to use two minute VCM buy setups once the uptrend is in place

Setup – price above a rising 20 period moving average, price above the 200 period moving average, 3-5 bar pullbacks that sit on minor support

Entry/Trigger – the high of any prior bar once the setup is in place

In this example, the trader is focused on the two minute chart, the two minute buy setup is the strategy, and the entry is a prior bar’s high.

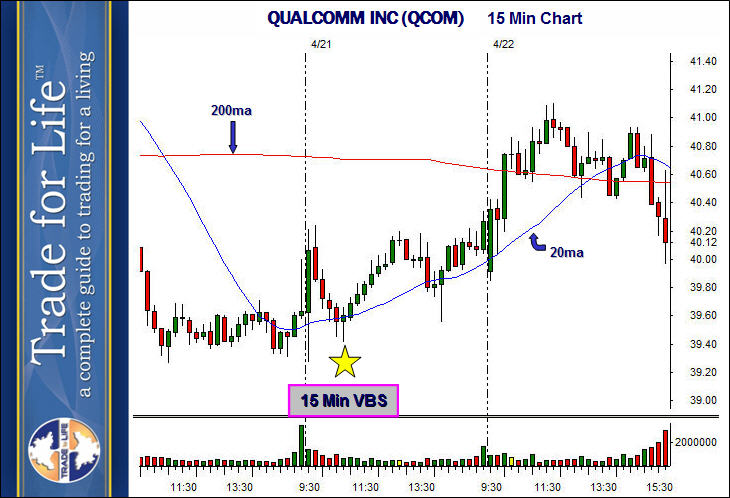

Now look at the 15 minute chart of QCOM, on the same day. Note that the ‘star’ represents the same moment in time on both charts.

Above is a 15 minute VCM buy setup on Qualcomm (QCOM).

Tactic – to use the 15 minute chart to capture longer day trading moves in trending stocks

Strategy – to use 15 minute VCM buy setups once the uptrend is in place

Setup – price above a rising 20 period moving average, 3-5 bar pullbacks that sit on minor support, and a bar trading over a prior bar on the 15 minute chart, once the setup is in place

Entry/Trigger – the two minute VCM buy setup (from first chart)

In this example, the trader is focused on the 15 minute chart, the 15 minute buy setup must form as part of the setup, and then the entry waits for a two minute VCM buy setup to form. This helps eliminate many ‘failed’ plays that can occur by taking the first buy setup on the 15 minute chart.