VCM Weekly Trading Lessons

Increase Your Odds Part 4 of 5 – Proper Share Sizing

Over these five lessons, we are going to give you five important, yet very simple concepts that should be a part of every trade you do. These are some of the very things we train our VCM traders to do, to increase the odds of every trade being successful…

The concept of share sizing gets the award for most important, but most overlooked concept in trading.

Think about this. What if you have a trading plan that has proven to deliver winners much more often than losers, and in addition, what if your winning trades moved 20 cents for every 10 cents that your losers move? This guarantees you will be a winner on any day when these numbers play out as you expect, correct?

Wrong! What if you ‘bet’ big money on all the losers, and small money on the ones that turned out to be winners? The losers could add up to more losing dollars than the winners. Has this happened to you? Have you ever had a ‘good day’, but you lost money because of one or two losing trades?

Traders usually share size in one of several different ways.

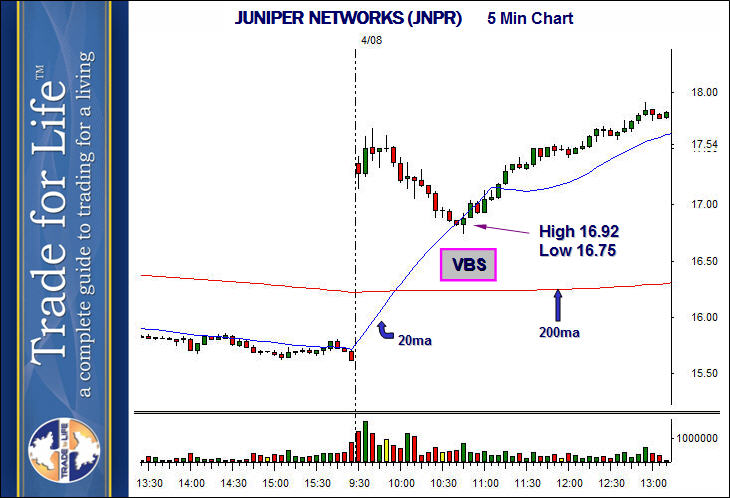

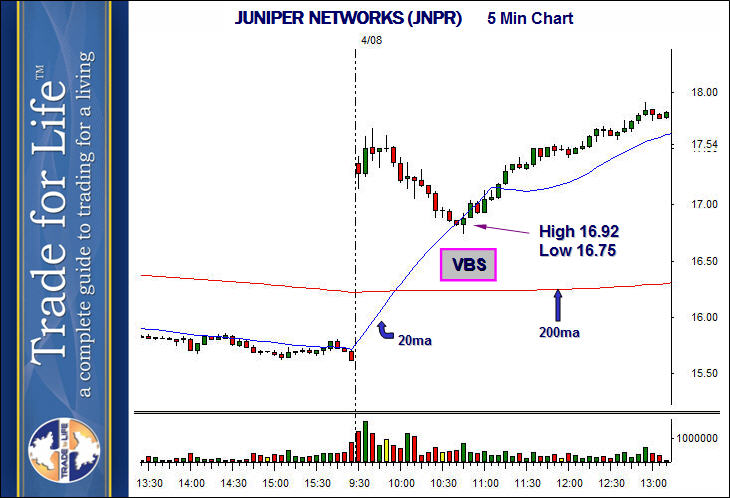

Compare the chart of JNPR, above, with the chart of RIMM, below. They are similar plays on the same day.

Note that if you share size by the first method, you are risking $170.00 (with a 1000 share size, for arguments sake) on the JNPR trade, and $850.00 on the RIMM trade. However, these are the same trades. Why is one worth $680.00 more of a loss than the other if they stop? Some traders may say that they will pass the trade if the stop is too wide. However, it may often be the case that the risk to reward is better on the wider stop trade, so why pass the trade?

If you share size by the second method, you are letting your wild emotions during the trading day decide what the ‘best’ trades are, rather than your statistics. Do you really say, “This trade looks like a poor trade, so I will take less shares?” Do you really feel you can predict which of the ‘best’ setups will actually be winners?

The third method means that you are taking the size of the stop into consideration and adjusting the share size, so every trade that stops will lose the same amount of money. There are several advantages to doing this.

As you can see, the third method is superior for most traders. If you fall into the category of being ‘successful’, but you keep losing more money on the minority of trades, take a look at your share sizing. You will be much more relaxed and consistent, share sizing the by the third method.