Weekly Trading Lessons

Good Relative Strength and Bad Relative Strength

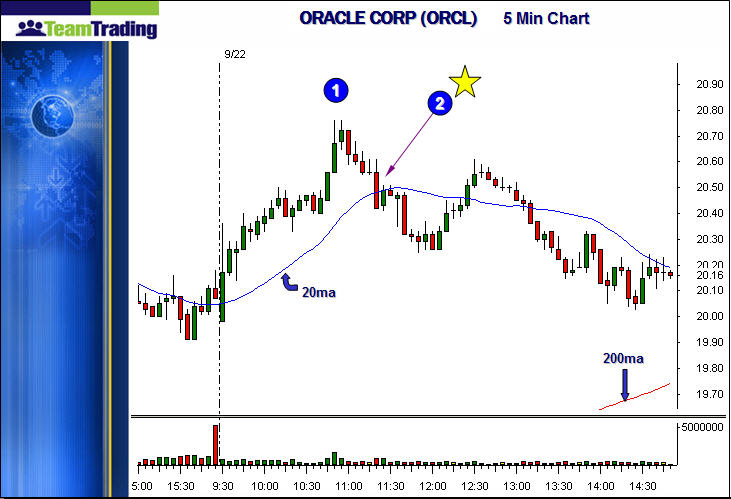

We are going to look at the same two charts as we looked at last week in our discussion on using an intraday market bias to help make better play selections. These are the five minute charts of Oracle Corp. (ORCL) and the NASDAQ 100 HOLDR (QQQQ) from the same day. The question is, was the pullback on ORCL at ‘2’ buyable due to the incredible relative strength? Note that the charts are marked with a ‘1’ and a ‘2’ at the key points at the same moment in time, so it is easy to compare the charts. Also, all of these comments apply equally as well to relative weakness, but for simplicity we will discuss relative strength.

The issue is not about how nice the buy set up was, or if it actually triggered. Assume it was perfect, even though there were some flaws. This is the real issue. As the market falls, and the stock in question holds near the high of the day, the more the market falls, the more relative strength it shows. But is ‘too much’ a problem? There are times when the market will drag down even relative strength stocks. In other words, sometimes relative strength means the stock will ‘fall slower than the rest’. So how do you tell the ‘good’ from the ‘bad’?

Once you understand the answer, it is simple and will save you (and make you) money. The secret is in how the market is falling. IF the market is falling, the relative strength stock may be played (on the appropriate set up) if it is still holding as one of the following exists in the market drop:

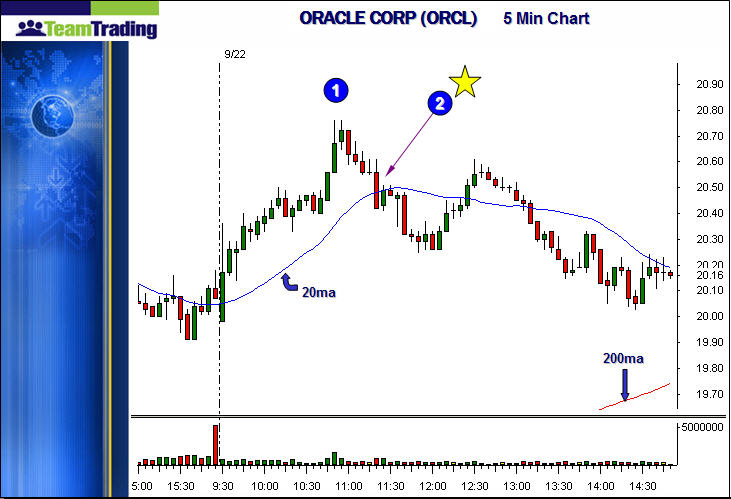

Let us look at the chart below of the QQQQ as ORCL was pulling back form a new high.

Note, that as the QQQQ was pulling back at the moment ORCL was under question, the hourly chart of the QQQQ had gone into a downtrend. The morning of the 19th set a ‘lower high’ and the QQQQ had made a ‘lower low’ just before ORCL pulled back. This would then dictate to ‘stay away’ form relative strength at this time. Note also, that had the market continued to drop and formed a climactic decline buy or hit the support from the low on the18th, it may come under consideration again.