VCM Weekly Trading Lessons

Four Secrets That Will Change Your Trading Career: Part Three of Four

After a long time of working with many traders, one discovers that there are certain truths that cannot be denied. There are four things that are done so consistently wrong by new traders, that each of these mistakes results in bad trades 90% of the time for most traders. If traders would simply follow these four rules, they would eliminate most of their losing trades. The fourth rule does not really fall into this “90%” category, but is perhaps the most important.

Here is the third rule, and the subject of this lesson. Traders should always follow the power of the market (or an individual stock). Keep your opperations in-synch with the broader market trend. When the market or stock is having a bullish day, the daily bar is green, and the intraday trends are up, buy pullbacks; do not play short. When the market or stock is having a bearish day, the daily bar is red, and the intraday trends are down, short the rallies; do not buy the pullbacks.

This sounds simple, yet this rule actually addresses the number one mistake traders make in selecting plays. Most traders, especially newer traders, try to short strong stocks, or buy weak stocks. They try to ‘short the top’, or ‘buy the bottom’. They may not even realize they have the problem. Most issues like this are not discovered unless the trader takes overt action to find the problem.

Why would so many traders pick up such a bad habit? The answer is simple; it is the same problem that causes so many traders to not trade the way they want to trade. Psychological issues step in and cause the trader to trade improperly. Catching a bottom or a top in a stock makes a trader fell like a ‘hero’ when right. And, if they do get an occasional trade correct, that is all they remember. They forget the dozens of losses it took to get the one winner, and remember only the glory of ‘shorting that one at its high’.

There is a strategy for shorting a strong stock, or buying a weak stock, but it is only used when the stock goes ‘climactic’ (i.e., has run to an unsustainable extreme and must do a trend reversal). Unfortunately, this play seems to be difficult for most traders to recognize, and requires patience, something most new traders do not have. Below is an example. Would you short this pattern as a ‘climactic advanced sell’ (CAS)?

Many traders see patterns like this and feel that it just cannot go any higher. So they short the first red bar, at ‘1’. Unfortunately, the usual result is shown below.

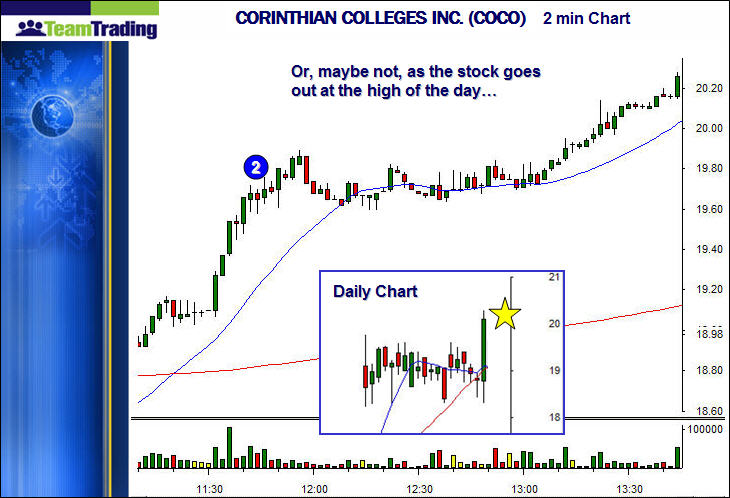

The ‘1’ is the same ‘1’ as on the prior chart. As you may have guessed, traders shorting at ‘1’ were not just off, they were way off. They needed the patience to wait for ‘2’, above. Surely THIS, is a much better place to short; or is it?.

Well, maybe not. The stock did not drop at all, and after a little rest, it is back off to the races.

Look at the yellow stars, and the daily inset. They are highlighting the wide green bar that is present and increasing in size on the daily chart. Bottom line, stay with the easy play. Look at all the money that could be made on the LONG side of this trade, yet so many traders are drawn to finding the top. It is often never found.

The concept illustrated above refers to avoiding playing a stock against its daily bar. It is also applicable to avoid shorting stocks in general, if the market daily bar is green (and the same for not going long on a ‘red bar’ day). While there are certain stocks that will drop on bullish days, they are much harder to find, and as a rule, drop much less.

Bottom line — Keep your operations in-synch with the broader market trend!