Weekly Trading Lessons

Exceptional Base Plays

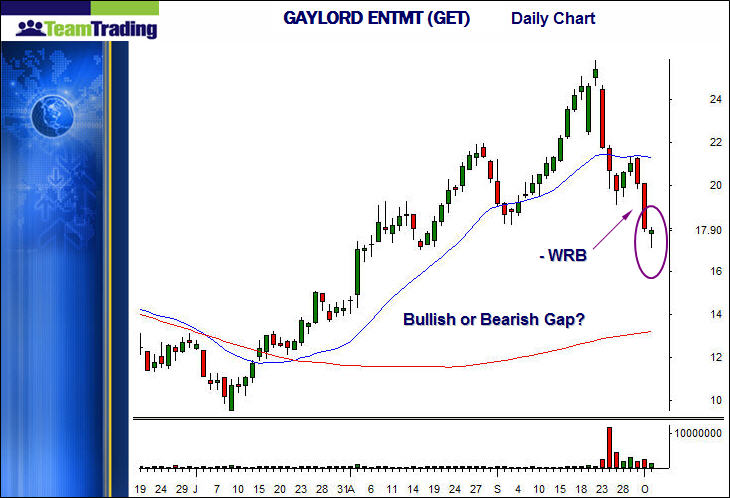

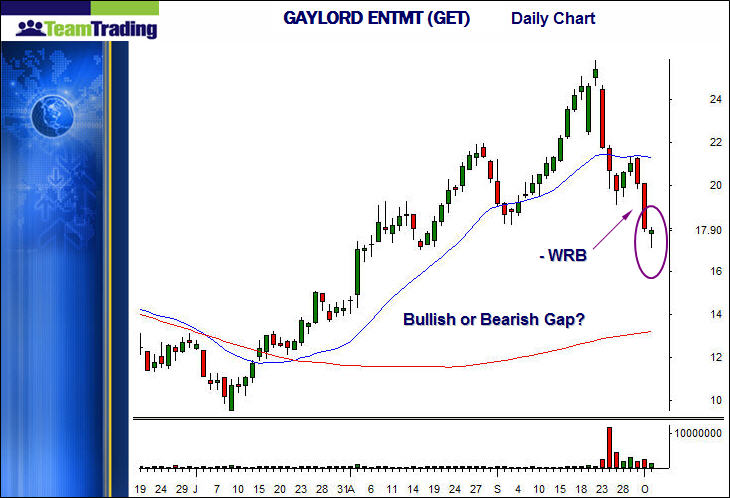

We have discussed various concepts of playing bases in several other lessons. Bases can generate large moves, but they do have a high failure rate. That is why we teach two ways to enter base plays that have higher odds than simply buying the break out with a stop under the low. However, one of the first secrets is to find a really great base. If you do that, the initial chance of success is greater. So, what makes for a great base? There are several unique setups that give us confidence to enter aggressively. One of these is the consolidation after a gap fill. Below is a daily chart of GAYLORD ENTMT (GET).

The day in question, the last day, (circled), the stock gapped down after a bearish wide range bar (-WRB). This is not about analyzing the gap, though you may have found this stock pattern because it was on your gap list. After the gap, note what happened on the five minute chart.

The stock traded lower quickly, and hit its low at the 10:00 reversal time. This is when the ‘unique’ pattern begins. It immediately rallies, over the high of the day, and fills the gap. Now, we are assuming nothing up to this point is a ‘play’. Nothing was predictable up until now. At 10:30, looking back we see what happened was very bullish, but the stock just ran hard to fill the gap, so there is nothing to play. After the gap fill, the ‘expectation’ would be to sell off, as the gap fill is usually resistance, especially after a long run. However, the stock holds. Like a rock. No pullback at all, and consolidates past the 1:30 reversal time.

This is now a ‘special’ base. All strength after an initial bearish move, and holding a tight base right at the gap fill. This stock can be played long, with any of the base entering tactics. If you look at your own charts, you will see that this break out led to a five day rally.