VCM Weekly Trading Lessons

Entries on Gap Plays, Part 2 of 2

This is part two of a two part series. Below are the opening comments from last week again.

Many traders have a plan to include gap strategies as part of their trading. Stocks that gap can be attractive because these stocks sometimes make a “week’s worth” of movement within a few minutes. Of course, that can be a bad thing if you are on the wrong side of the trade. The problem is that while they are attractive, most traders lose on gap plays. There are many misconceptions and just plain fallacies about stocks that gap. A weeklong seminar could be given on trading gaps and all the possible gap strategies. This lesson cannot begin to scratch the surface. However, for those learning some of these strategies, we can try to address some of the common questions.

Once some gap strategies are learned, many traders find that they become inconsistent on the proper entry. Every strategy comes with its own entry, but as some strategies blur together, the various entries can offer different risk-reward parameters. Many traders find that they have the right play, but can’t find the right entry.

The previous two paragraphs were in last week’s lesson. Last week we looked at the one extreme where we had a beautiful ‘shock value’ gap, so we were looking for the fastest entry we could find, trusting the gap would do the work for us. This week we will see the reverse, which is a gap that was ‘questionable’ as to its affect, so we want as much intraday ‘confirmation’ as possible.

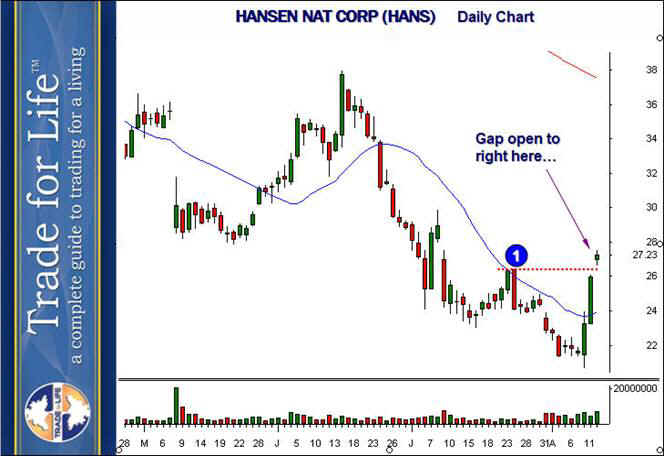

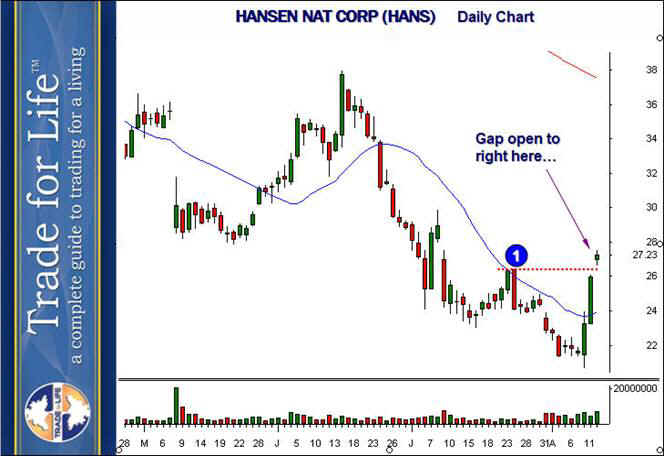

Here is a general rule. The more questionable the gap is, (assuming you even want to play it) the more we want the intraday chart pattern to confirm the move in the direction we believe the bias of the gap is giving. Below is a gap that occurred on HANSEN NAT CORP (HANS) as it looked on the daily chart the morning it gapped up.

As gaps go, this one was not clear. We look at several things to evaluate if gaps should have a bullish or bearish bias, or where they should be played. Obviously this stock had upward momentum from the prior move, and the gap cleared nearby resistance at ‘1’. This is all bullish. However, the gap up after two big green bars has a ‘novice’ look to it, which could make our bias bearish. If this were a bigger gap, we would have a bearish bias. So, the daily chart leaves us uncertain. It is often the case that these set ups might rally off of the gap up for half of the day, then come in the other half as they were just too extended. However, that can also sell off right at open. So that leaves us with the dilemma, how do we enter this trade?

We enter this one when the intraday chart ‘proves’ what direction it wants to go. We have a slight bullish bias, so we look for a sign of strength. There are two possibilities. First, there will be a significant sign of strength if the stock can trade above its five minute high, without being extended at the time. This is what happened at ‘1’. A nice little consolidation occurs, and we pop over the five minute high. It makes for a nice entry, with a reasonable likelihood it will not stop out easily. If that is to aggressive, traders can also let an intraday uptrend develop and play the first buyable pullback. This is what happened at ‘2’, a two minute VCM buy set up. This strategy is ‘safe’ because it is playable even without the gap. The gap will just add potential fuel (buyers) to this two minute play.

By combining the proper analysis of the gap itself, with the proper intraday entry, gaps can be a valuable strategy for any intraday trader.