VCM Weekly Trading Lessons

Difficult Bases

The procedure outlined below is actually a good way to play all bases. We have discussed this in prior lessons. As you get to know your bases better, there may be some you trust, like those we discussed last week. There will also be those that you are skeptical of. The base may be wide and sloppy, or have prior attempts to move up, that have failed. Below is the five minute chart of STATE STR CORP (STT).

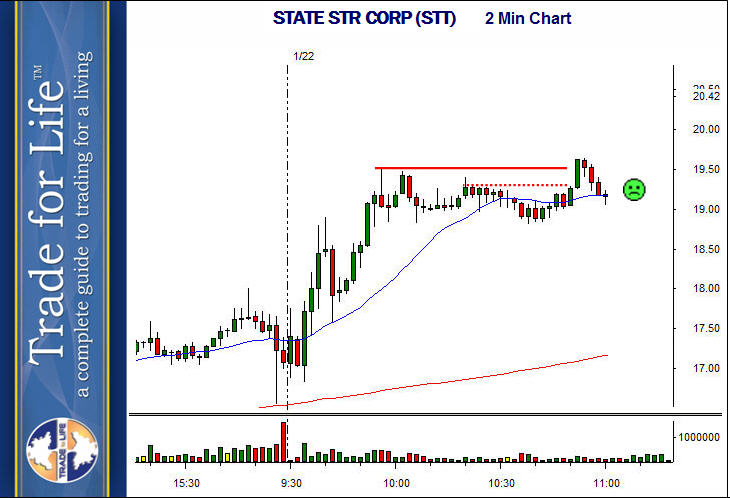

Notice we have a strong consolidation above the rising 20 period moving average. However, notice that we are below the 200 period moving average, and notice the topping tails under the solid red line. These are prior attempts for the stock to break out that failed. So the question is, do you play this green bar (?) as it breaks over the top of the base. Below is the same chart, but ten minutes later, and on a two minute chart to show the detail better.

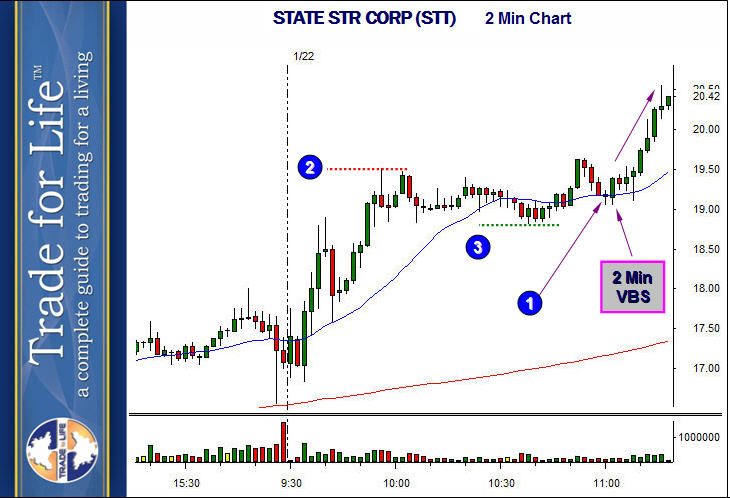

For the first eight minutes of this trade, anyone who played the breakout is not happy. They are under water, and the whole play is threatening to fail. Worse than that, they went long at the high of the day. Has this happened to you more than once? The sad thing is, even if this play does work, there are very few traders that will still be with it because that high of the day entry was just too painful down here near the bottom of the base. How do you avoid this? Have patience, and only play this stock when this pullback becomes a quality VCM buy setup. Below is the same chart, 18 minutes later.

By waiting to play the VCM two minute buy setup, the trader had the following advantages.

Patience is always rewarded in trading, and having the right strategy for the setups you find will pay large dividends in the end. Put this idea in your trader tool belt.