VCM Weekly Trading Lessons

A Breakout Strategy

During our last lesson, we ended the discussion about bases with a little hint of this week’s topic. “There is also a near ‘fool-proof way’ to not get caught buying breakouts or shorting breakdowns that fail. Well, nothing is ‘fool-proof’, of course, but here is an idea that helps eliminate many failures. Simply let the stock clearly breakout or breakdown, then go long after the first pullback on that time frame, or short after the first rally. We will discuss this more in the next lesson.”

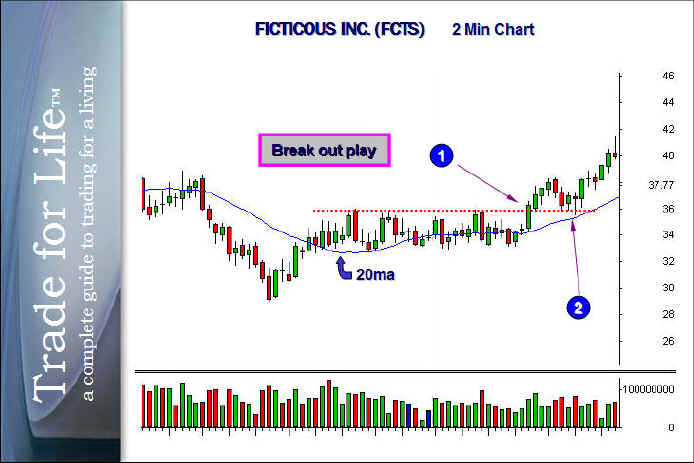

This will be a very simple, yet powerful lesson. It is one you can begin using immediately, once you are aware of its value. You may have heard of this concept, but perhaps you are not aware of the simple power it holds. Most traders are not fully aware that breakout plays come with a high failure rate. That is especially true if you are not aware of the type of base you are playing (see last two lessons). There are three ways to play breakouts. We are going to discuss the ‘safest’ way today. Below is a two minute chart of FCTS.

This is known as a VCM breakout play (BOP). If every play happened exactly like this, there would be no need for this article. However if you trade these on a regular basis, you know that stocks that breakout from consolidations do not always go on a terror to their first target.

At "1", the stock breaks a consolidation. This is the typical point where most traders buy a breakout. There is actually nothing wrong with this, if it is the right type of consolidation. However, it is often difficult to tell what type of consolidation you are looking at and even a good breakout will sometimes fail. If the breakout play works, the entry at "1" is always your best entry. However, you will also be involved in every failure that occurs.

By letting the stock breakout first and then watching for the first pullback, we have the opportunity to avoid the play totally, if the stock pulls back too far and becomes a failure. We want to see this stock find support on or around the top of the base. Once it gets more than halfway to the bottom of the base, it becomes questionable to be able to rally. This is known as playing the first pullback. It is also helpful if the first pullback comes in contact with the rising 20 period moving average as we see in this particular chart. We simply use the VCM buy set up (VBS) to get long the stock. Every concept here works equally as well in the reverse, for shorting a VSS after a base break down.

Another advantage of using the pullback method is that your stop will almost always be tighter than it was on the original play. While you may be entering at a later moment in time, and at a slightly higher price, your reward to risk will usually be better because of the tight stop offered by the buy set up on the pullback.

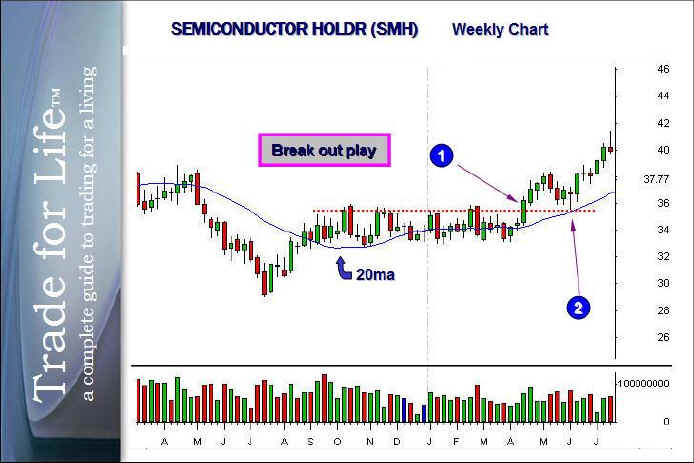

One more thing. You may be wondering if this works on any time frame. Like most all of our strategies, it does. As a matter of fact we played a bit of a trick on you. You may notice the chart above is a chart of "fictitious". That is because there is no such stock, and that time frame above that was captured is not a two minute time frame. This is actually a weekly chart of the Semiconductor index.

Whether you are a core trader on weekly charts or a scalper on the one minute chart, this concept can help you make money starting today.