Weekly Trading Lessons

The 15 Minute VCM Buy Setup Examined

One of the tactics we teach in our seminars is the VCM buy setup. This play can live on any timeframe. While this strategy is ‘simple’, it is the fine points that give a trader the edge between one that is ‘good’ and one that is ‘great’. We are not going to go over all the requirements for a VCM buy setup (VBS), but we are going to focus on two ‘fine tuning issues. This talk is a little on the ‘advanced’ side, as will be discussed later. Below is a 15 minute chart of QUALCOM INC (QCOM).

We want to examine the 15 minute VBS at ‘3’. First, let’s discuss why this is a ‘bad’ trade. Hopefully, some of you noticed this already. The most important thing is missing. We are not in an established uptrend. Did you notice? First, the setup forms under the 20 period moving average (20ma), and the 20ma is ‘sideways’ at best. Also, notice, from the high at ‘1’, we started a downtrend with three lower highs (LH) and three lower lows (LL). The bounce to ‘2’ set the first higher high, but if we play the pullback to ‘3’ as a buy, we are playing the first higher low. For an uptrend to be established, we need two higher highs and two higher lows. At the very least, we want to be playing the second potential higher low as the buy setup. So all of this begs the question, is it ever acceptable to play the first higher low as a VBS?

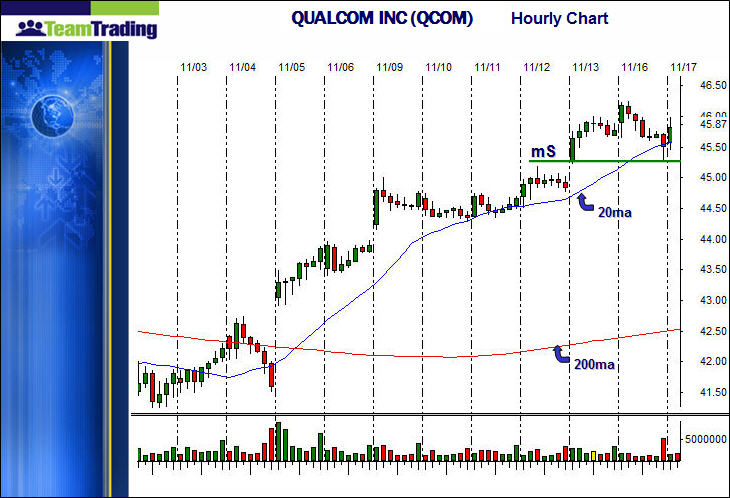

The answer to that question is one of the two points that we wanted to bring out about this play. To make the point, we need one move chart, the hourly chart.

Notice that the hourly chart is in a nice uptrend. The pullback for the hourly VBS comes down to minor support (mS) and at the rising 20 period moving average. The bottom tail (BT) of this hourly buy setup, is the ‘lowest low’ on the 15 minute chart. This means that the 15 minute VBS we are discussing is the first 15 minute VBS in an hourly uptrend. Note, the hourly uptrend is established. It is simply the pullback on the hourly chart, to set up the next hourly buy set up, that has caused the 15 minute downtrend. With the hourly chart in an established uptrend, it is not only acceptable, but preferable, to play the 15 minute chart at the first opportunity, this is the first point of this lesson. This is the exception, there is no need to wait for an established 15 minute uptrend, when the chart shows a nice hourly buy setup. Often times, the first move is the biggest one, so it pays to be aggressive in this case. The second point is simple. Playing the 15 minute uptrend, inside the hourly uptrend will give the best results, whenever you play the fifteen minute chart.